United Healthcare 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

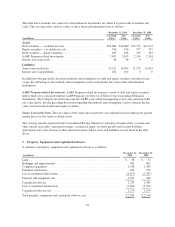

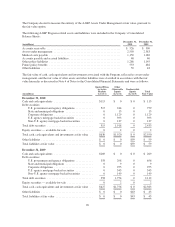

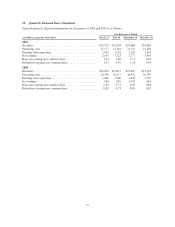

Restricted Shares

Restricted shares generally vest ratably over three to five years. Compensation expense related to restricted

shares is based on the share price on date of grant. Restricted share activity for the year ended December 31,

2010 is summarized in the table below:

(shares in millions) Shares

Weighted-

Average Grant

Date Fair Value

Nonvested at beginning of period ............................................ 11 $32

Granted ................................................................. 6 32

Vested .................................................................. (3) 33

Forfeited ................................................................ (1) 32

Nonvested at end of period ................................................. 13 $31

The weighted-average grant date fair value of restricted shares granted during 2010, 2009 and 2008 was

approximately $32 per share, $29 per share and $34 per share, respectively. The total fair value of restricted

shares vested during 2010, 2009 and 2008 was $99 million, $56 million and $17 million, respectively.

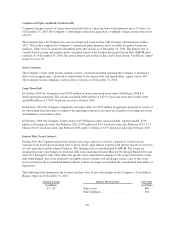

Employee Stock Purchase Plan

The Company’s Employee Stock Purchase Plan (ESPP) is intended to enhance employee commitment to the

goals of the Company, by providing a means of achieving stock ownership at advantageous terms to eligible

employees of the Company. Eligible employees are allowed to purchase the Company’s stock at a discounted

price, which is 85% of the lower market price of the Company’s common stock at the beginning or at the end of

the six-month purchase period. During 2010, 2009 and 2008, 3.8 million shares, 3.7 million shares and

2.9 million shares of common stock, respectively, were purchased under the ESPP. The compensation expense is

included in the compensation expense amounts recognized and discussed below. As of December 31, 2010, there

were 5.6 million shares of common stock available for issuance under the ESPP.

Share-Based Compensation Recognition

The Company recognizes compensation expense for share-based awards, including stock options, SARs and

restricted shares, on a straight-line basis over the related service period (generally the vesting period) of the

award, or to an employee’s eligible retirement date under the award agreement, if earlier. Beginning with share-

based awards granted in 2009, the Company’s equity award program includes a retirement provision that treats

all employees who are age 55 or older with at least ten years of recognized employment with the Company as

retirement-eligible. For 2010, 2009 and 2008, the Company recognized compensation expense related to its

share-based compensation plans of $326 million ($278 million net of tax effects), $334 million ($220 million net

of tax effects) and $305 million ($202 million net of tax effects), respectively. Share-based compensation

expense is recognized in Operating Costs in the Company’s Consolidated Statements of Operations. As of

December 31, 2010, there was $449 million of total unrecognized compensation cost related to share awards that

is expected to be recognized over a weighted-average period of 1.2 years. For 2010, 2009 and 2008, the income

tax benefit realized from share-based award exercises was $78 million, $94 million and $106 million,

respectively.

As further discussed in Note 10 of Notes to the Consolidated Financial Statements, the Company maintains a

share repurchase program. The objectives of the share repurchase program are to optimize the Company’s capital

structure, cost of capital and return to shareholders, as well as to offset the dilutive impact of shares issued for

share-based award exercises.

Other Employee Benefit Plans

The Company also offers a 401(k) plan for all employees. Compensation expense related to this plan was not

significant for the years 2010, 2009 and 2008.

88