United Healthcare 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Depreciation expense for property and equipment for 2010, 2009 and 2008 was $398 million, $436 million and

$439 million, respectively. Amortization expense for capitalized software for 2010, 2009 and 2008 was $349

million, $314 million and $290 million, respectively.

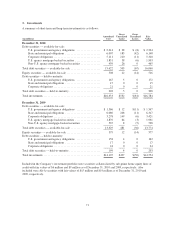

6. Goodwill and Other Intangible Assets

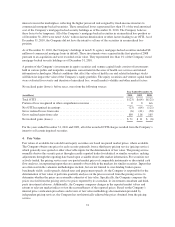

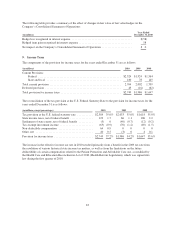

Changes in the carrying amount of goodwill, by reporting segment, were as follows:

(in millions)

Health

Benefits OptumHealth Ingenix

Prescription

Solutions Consolidated

Balance at January 1, 2009 .................... $17,044 $1,152 $1,052 $840 $20,088

Acquisitions ................................ 161 40 415 0 616

Subsequent payments and adjustments, net ....... 61 (34) (4) 0 23

Balance at December 31, 2009 ................. 17,266 1,158 1,463 840 20,727

Acquisitions ................................ 0 187 2,022 0 2,209

Impairment ................................ 0 0 (172) 0 (172)

Subsequent payments and adjustments, net ....... (14) 0 (5) 0 (19)

Balance at December 31, 2010 ................. $17,252 $1,345 $3,308 $840 $22,745

In 2010, there was a decline in the economic environment and competitive landscape for the clinical trial support

businesses within one of the Ingenix reporting units. These businesses experienced unexpected declines in new

business authorizations from historical levels including continued delays in and lengthening of the selling cycle.

During this time the Company began evaluating strategic options with respect to the clinical trial support

businesses. In December 2010, as part of the annual goodwill impairment analysis, the Company considered the

aforementioned market conditions and operating results as well as indications of interest the Company began to

receive on the clinical trial support businesses as the fair value of the reporting unit was evaluated. As a result of

that analysis, the Company determined that the implied fair value of the reporting unit was less than its carrying

value and an impairment charge of $172 million was recorded. The implied fair value of the reporting unit was

determined by a combination of valuation techniques, including discounting future expected cash flows and

expected sale proceeds.

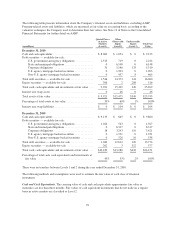

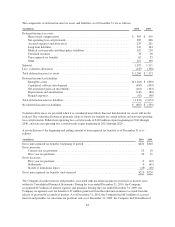

The gross carrying value, accumulated amortization and net carrying value of other intangible assets were as

follows:

December 31, 2010 December 31, 2009

(in millions)

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Customer contracts and membership lists . . $3,623 $(1,038) $2,585 $2,864 $ (796) $2,068

Patents, trademarks and technology ....... 505 (246) 259 437 (187) 250

Other ............................... 132 (66) 66 118 (55) 63

Total ............................... $4,260 $(1,350) $2,910 $3,419 $(1,038) $2,381

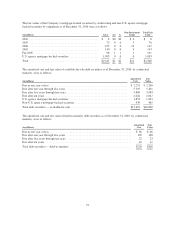

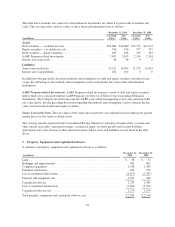

The acquisition date fair values and weighted-average useful lives assigned to finite-lived intangible assets

acquired in business combinations consisted of the following by year of acquisition:

2010 2009

(in millions, except years)

Fair

Value

Weighted-

Average

Useful Life

Fair

Value

Weighted-

Average

Useful Life

Customer contracts and membership lists ........................... $786 14 years $239 12 years

Patents, trademarks, and technology ............................... 94 8years 41 9 years

Other ....................................................... 14 9years 1 2 years

Total acquired finite-lived intangible assets ......................... $894 13 years $281 12 years

79