United Healthcare 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

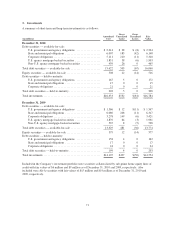

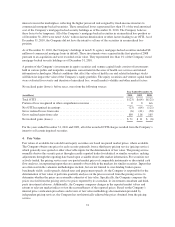

The fair values of the Company’s mortgage-backed securities by credit rating and non-U.S. agency mortgage-

backed securities by origination as of December 31, 2010 were as follows:

(in millions) AAA AA A

Non-Investment

Grade

Total Fair

Value

2010 ................................................. $ 8 $0 $0 $ 0 $ 8

2007 ................................................. 73 0 0 3 76

2006 ................................................. 123 0 0 14 137

2005 ................................................. 140 0 0 3 143

Pre-2005 .............................................. 98 1 1 1 101

U.S. agency mortgage-backed securities ..................... 1,903 0 0 0 1,903

Total ................................................. $2,345 $1 $1 $21 $2,368

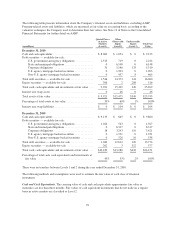

The amortized cost and fair value of available-for-sale debt securities as of December 31, 2010, by contractual

maturity, were as follows:

(in millions)

Amortized

Cost

Fair

Value

Due in one year or less ....................................................... $ 2,251 $ 2,260

Due after one year through five years ........................................... 5,195 5,401

Due after five years through ten years ........................................... 3,860 3,984

Due after ten years .......................................................... 2,026 2,047

U.S. agency mortgage-backed securities ......................................... 1,851 1,903

Non-U.S. agency mortgage-backed securities ..................................... 439 465

Total debt securities — available-for-sale ........................................ $15,622 $16,060

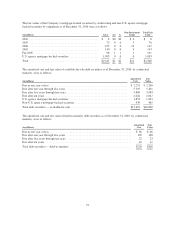

The amortized cost and fair value of held-to-maturity debt securities as of December 31, 2010, by contractual

maturity, were as follows:

(in millions)

Amortized

Cost

Fair

Value

Due in one year or less ......................................................... $ 66 $ 66

Due after one year through five years ............................................. 105 108

Due after five years through ten years ............................................. 22 23

Due after ten years ............................................................ 10 11

Total debt securities — held-to-maturity ........................................... $203 $208

72