United Healthcare 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

state and municipal obligations that are guaranteed by a number of third parties. We do not have any significant

exposure to any single guarantor (neither indirect through the guarantees, nor direct through investment in the

guarantor). Further, due to the high underlying credit rating of the issuers, the weighted-average credit rating of

these securities both with and without the guarantee is “AA” as of December 31, 2010.

Capital Resources and Uses of Liquidity

In addition to cash flow from operations and cash and cash equivalent balances available for general corporate

use, our capital resources and uses of liquidity are as follows:

Commercial Paper. We maintain a commercial paper program, which facilitates the issuance of senior unsecured

debt through third-party broker-dealers. The commercial paper program is supported by the $2.5 billion bank

credit facility described below. We had $930 million of commercial paper outstanding as of December 31, 2010.

Our issuance of commercial paper in 2010 was to maintain ample liquidity at the holding company level.

Bank Credit Facility.We have a $2.5 billion five-year revolving bank credit facility with 23 banks, which

matures in May 2012. This facility supports our commercial paper program and is available for general corporate

purposes. We had no amounts outstanding under this facility as of December 31, 2010. The interest rate is

variable based on term and amount and is calculated based on LIBOR plus a spread. As of December 31, 2010,

the annual interest rate on this facility, had it been drawn, would have ranged from 0.5% to 0.7%.

Our bank credit facility contains various covenants, including requiring us to maintain a debt-to-total-capital ratio

below 50%. Our debt-to-total-capital ratio, calculated as debt divided by the sum of debt and shareholders’

equity, was 30.1% and 32.1% as of December 31, 2010 and 2009, respectively. We were in compliance with our

debt covenants as of December 31, 2010.

Debt Issuance.In October 2010, we issued $750 million in senior unsecured notes under our February 2008 S-3

shelf registration statement. The issuance included $450 million of 3.875% fixed-rate notes due October 2020

and $300 million of 5.700% fixed-rate notes due October 2040. We intend to use the proceeds for general

corporate purposes.

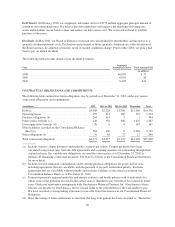

Credit Ratings. Our credit ratings at December 31, 2010 were as follows:

Moody’s Standard & Poor’s Fitch (a) A.M. Best

Ratings Outlook Ratings Outlook Ratings Outlook Ratings Outlook

Senior unsecured debt ........... Baa1 Stable A- Stable A- Negative bbb+ Stable

Commercial paper .............. P-2 n/a A-2 n/a F1 n/a AMB-2 n/a

(a) On January 12, 2011, Fitch updated their ratings outlook on our senior unsecured debt to “stable”.

The availability of financing in the form of debt or equity is influenced by many factors, including our

profitability, operating cash flows, debt levels, credit ratings, debt covenants and other contractual restrictions,

regulatory requirements and economic and market conditions. For example, a significant downgrade in our credit

ratings or conditions in the capital markets may increase the cost of borrowing for us or limit our access to

capital. We have therefore adopted strategies and actions to maintain financial flexibility and mitigate the impact

of such factors on our ability to raise capital.

Share Repurchases. Under our Board of Directors’ authorization, we maintain a common share repurchase

program. Repurchases may be made from time to time at prevailing prices in the open market, subject to certain

preset parameters. In February 2010, the Board renewed and increased our share repurchase program, and

authorized us to repurchase up to 120 million shares of our common stock. In 2010, we repurchased 76 million

shares at an average price of approximately $33 per share and an aggregate cost of $2.5 billion. As of

December 31, 2010, we had Board authorization to purchase up to an additional 48 million shares of our

common stock.

49