United Healthcare 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

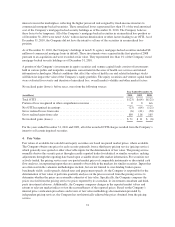

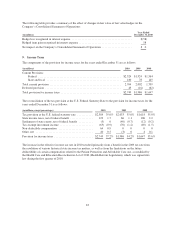

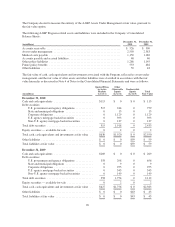

The components of deferred income tax assets and liabilities as of December 31 are as follows:

(in millions) 2010 2009

Deferred income tax assets:

Share-based compensation ................................................. $ 385 $ 419

Net operating loss carryforwards ............................................ 285 206

Accrued expenses and allowances ........................................... 233 201

Long term liabilities ...................................................... 147 164

Medical costs payable and other policy liabilities ............................... 102 218

Unearned revenues ....................................................... 78 58

Unrecognized tax benefits ................................................. 62 55

Other .................................................................. 215 190

Subtotal .................................................................... 1,507 1,511

Less: valuation allowances ..................................................... (247) (198)

Total deferred income tax assets ................................................ $1,260 $ 1,313

Deferred income tax liabilities:

Intangible assets ......................................................... $(1,104) $ (890)

Capitalized software development ........................................... (450) (449)

Net unrealized gains on investments ......................................... (161) (163)

Depreciation and amortization .............................................. (140) (80)

Prepaid expenses ......................................................... (92) (90)

Total deferred income tax liabilities .............................................. (1,947) (1,672)

Net deferred income tax liabilities ............................................... $ (687) $ (359)

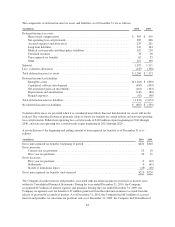

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will not be

realized. The valuation allowances primarily relate to future tax benefits on certain federal and state net operating

loss carryforwards. Federal net operating loss carryforwards of $149 million expire beginning in 2011 through

2030, and state net operating loss carryforwards expire beginning in 2011 through 2029.

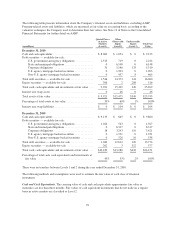

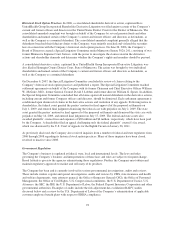

A reconciliation of the beginning and ending amount of unrecognized tax benefits as of December 31 is as

follows:

(in millions) 2010 2009

Gross unrecognized tax benefits, beginning of period .................................... $220 $340

Gross increases:

Current year tax positions ...................................................... 13 10

Prior year tax positions ........................................................ 30 11

Gross decreases:

Prior year tax positions ........................................................ 0 (62)

Settlements ................................................................. 0 (61)

Statute of limitations lapses .................................................... (43) (18)

Gross unrecognized tax benefits, end of period ......................................... $220 $220

The Company classifies interest and penalties associated with uncertain income tax positions as income taxes

within its Consolidated Financial Statements. During the year ended December 31, 2010, the Company

recognized $15 million of interest expense and penalties. During the year ended December 31, 2009, the

Company recognized a net tax benefit of $7 million generated from the reduction in interest accrued from the

release of previously accrued tax matters. As of December 31, 2010, the Company had $63 million of accrued

interest and penalties for uncertain tax positions and, as of December 31, 2009, the Company had $44 million of

84