United Healthcare 2010 Annual Report Download - page 68

Download and view the complete annual report

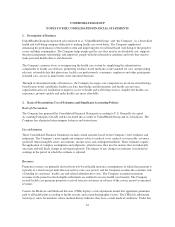

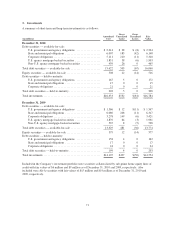

Please find page 68 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Current Receivables

Other current receivables include amounts due from pharmacy rebates, CMS for Medicare Part D, reinsurance

and other miscellaneous amounts due to the Company.

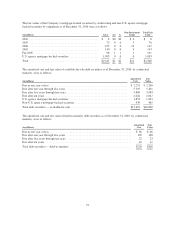

The Company’s PBM businesses contract with pharmaceutical manufacturers, some of whom provide rebates

based on use of the manufacturers’ products by its PBM businesses’ affiliated and non-affiliated clients. The

Company accrues rebates as they are earned by its clients on a monthly basis based on the terms of the applicable

contracts, historical data and current estimates. The PBM businesses bill these rebates to the manufacturers on a

monthly or quarterly basis depending on the contractual terms. The PBM businesses record rebates attributable to

affiliated clients as a reduction to medical costs. Rebates attributable to non-affiliated clients are accrued as

rebates receivable and a reduction of cost of products sold with a corresponding payable for the amounts of the

rebates to be remitted to non-affiliated clients in accordance with their contracts and recorded in the Consolidated

Statements of Operations as a reduction of Product Revenue. The Company generally receives rebates between

two to five months after billing.

For details on the Company’s Medicare Part D receivables see “Medicare Part D Pharmacy Benefits Contract”

below.

For details on the Company’s reinsurance receivable see “Future Policy Benefits and Reinsurance Receivables”

below.

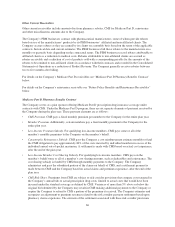

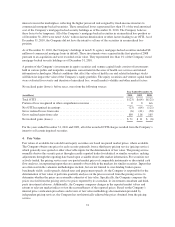

Medicare Part D Pharmacy Benefits Contract

The Company serves as a plan sponsor offering Medicare Part D prescription drug insurance coverage under

contracts with CMS. Under the Medicare Part D program, there are six separate elements of payment received by

the Company during the plan year. These payment elements are as follows:

•CMS Premium. CMS pays a fixed monthly premium per member to the Company for the entire plan year.

•Member Premium. Additionally, certain members pay a fixed monthly premium to the Company for the

entire plan year.

•Low-Income Premium Subsidy. For qualifying low-income members, CMS pays some or all of the

member’s monthly premiums to the Company on the member’s behalf.

•Catastrophic Reinsurance Subsidy. CMS pays the Company a cost reimbursement estimate monthly to fund

the CMS obligation to pay approximately 80% of the costs incurred by individual members in excess of the

individual annual out-of-pocket maximum. A settlement is made with CMS based on actual cost experience,

after the end of the plan year.

•Low-Income Member Cost Sharing Subsidy. For qualifying low-income members, CMS pays on the

member’s behalf some or all of a member’s cost sharing amounts, such as deductibles and coinsurance. The

cost sharing subsidy is funded by CMS through monthly payments to the Company. The Company

administers and pays the subsidized portion of the claims on behalf of CMS, and a settlement payment is

made between CMS and the Company based on actual claims and premium experience, after the end of the

plan year.

•CMS Risk-Share. Premiums from CMS are subject to risk corridor provisions that compare costs targeted in

the Company’s annual bids to actual prescription drug costs, limited to actual costs that would have been

incurred under the standard coverage as defined by CMS. Variances of more than 5% above or below the

original bid submitted by the Company may result in CMS making additional payments to the Company or

require the Company to refund to CMS a portion of the premiums it received. The Company estimates and

recognizes an adjustment to premium revenues related to the risk corridor payment settlement based upon

pharmacy claims experience. The estimate of the settlement associated with these risk corridor provisions

66