United Healthcare 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.risk-based offerings in our public and senior markets businesses and premium rate increases in response to

growth in underlying medical costs, partially offset by a decline in the number of people served in the

commercial market. The effect of 2008 Health Benefits acquisitions also contributed to the increase in premium

revenues during 2009.

Medical Costs

Medical costs for 2009 increased primarily due to growth in public and senior markets risk-based businesses,

elevated medical costs due to the H1N1 influenza virus, unemployment-related benefit continuation programs

due to an increased level of national unemployment, medical cost inflation and increased utilization of medical

services.

For each period, our operating results include the effects of revisions in medical cost estimates related to all prior

periods. Changes in medical cost estimates related to prior periods, resulting from more complete claim

information identified in the current period, are included in total medical costs reported for the current period.

For 2009 and 2008, medical costs included $310 million and $230 million, respectively, of net favorable medical

cost development related to prior fiscal years.

Operating Costs

Operating costs for 2009 decreased due to certain expenses incurred in 2008 as discussed below and disciplined

operating cost management, which were partially offset by increased costs due to acquired and organic business

growth and from an increase in state insurance assessments levied against premiums, a portion of which was in

lieu of state income taxes in one of the states in which we operate.

Operating costs for 2008 included $882 million for settlement of two class action lawsuits related to our

historical stock option practices and related legal costs, $350 million for the settlement of class action litigation

related to reimbursement for out-of-network medical services, $50 million related to estimated costs to conclude

a legal matter and $46 million for employee severance related to operating cost reduction initiatives and other

items, partially offset by a $185 million reduction in operating costs for proceeds from the sale of certain assets

and membership in the individual Medicare Advantage business in Nevada in May 2008.

Income Tax Rate

Our income tax rate for 2009 decreased primarily due to the favorable resolution of various historical state

income tax matters and the change to a premium tax in lieu of an income tax in one of the states in which we

operate, which increased operating costs and decreased income taxes.

Reporting Segments

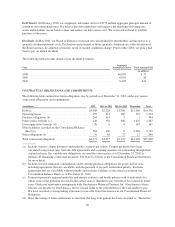

Health Benefits

Revenue growth in Health Benefits for 2009 was primarily due to growth in the number of individuals served by

our public and senior markets businesses and premium rate increases, partially offset by a decline in individuals

served through commercial products and a decrease in investment and other income driven by lower short-term

investment yields. 2009 revenues were $40.8 billion for UnitedHealthcare Employer & Individual; $32.1 billion

for UnitedHealthcare Medicare & Retirement; and $8.4 billion for UnitedHealthcare Community & State. 2008

revenues were $41.8 billion for UnitedHealthcare Employer & Individual; $28.1 billion for UnitedHealthcare

Medicare & Retirement; and $6.0 billion for UnitedHealthcare Community & State.

The decrease in Health Benefits earnings from operations for 2009 was primarily due to a $166 million reduction

in investment and other income and a decrease in commercial business, partially offset by the growth in lower

margin public and senior markets businesses. Health Benefits’ operating margins decreased due to the factors

that decreased earnings from operations.

45