United Healthcare 2010 Annual Report Download - page 87

Download and view the complete annual report

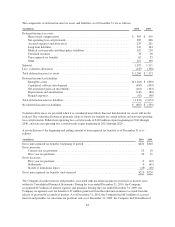

Please find page 87 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accrued interest. These amounts are not included in the reconciliation above. As of December 31, 2010, the total

amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate, was $128 million.

The Company currently files income tax returns in the U.S. federal jurisdiction, various states and foreign

jurisdictions. The U.S. Internal Revenue Service (IRS) has completed exams on the consolidated income tax

returns for fiscal years 2009 and prior. The Company’s 2010 tax returns are under advance review by the IRS

under its Compliance Assurance Program. With the exception of a few states, the Company is no longer subject

to income tax examinations prior to 2004. The Company does not believe any adjustments that may result from

these examinations will be significant.

The Company believes it is reasonably possible that its liability for unrecognized tax benefits will decrease in the

next twelve months by $118 million as a result of audit settlements and the expiration of statutes of limitations in

certain major jurisdictions.

10. Shareholders’ Equity

Regulatory Capital and Dividend Restrictions

The Company’s regulated subsidiaries are subject to regulations and standards in their respective states of

domicile. Most of these regulations and standards conform to those established by the National Association of

Insurance Commissioners. These standards, among other things, require these subsidiaries to maintain specified

levels of statutory capital, as defined by each state, and restrict the timing and amount of dividends and other

distributions that may be paid to their parent companies. Except in the case of extraordinary dividends, these

standards generally permit dividends to be paid from statutory unassigned surplus of the regulated subsidiary and

are limited based on the regulated subsidiary’s level of statutory net income and statutory capital and surplus.

These dividends are referred to as “ordinary dividends” and generally can be paid without prior regulatory

approval. If the dividend, together with other dividends paid within the preceding twelve months, exceeds a

specified statutory limit or is paid from sources other than earned surplus, it is generally considered an

“extraordinary dividend” and must receive prior regulatory approval.

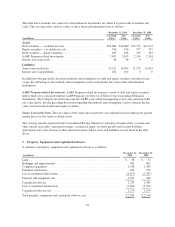

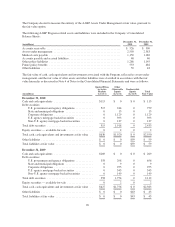

In 2010, based on the 2009 statutory net income and statutory capital and surplus levels, the maximum amount of

ordinary dividends that could be paid was $3.2 billion. For the year ended December 31, 2010, the Company’s

regulated subsidiaries paid their parent companies dividends of $3.2 billion, including $686 million of

extraordinary dividends. For the year ended December 31, 2009, the Company’s regulated subsidiaries paid their

parent companies dividends of $4.2 billion, including $2.5 billion of extraordinary dividends. The total dividends

received in both 2010 and 2009 included all of the ordinary dividend capacity of $3.2 billion and $3.1 billion,

respectively. In some cases, ordinary dividends were classified as extraordinary dividends due to their increased

size and/or accelerated timing. As of December 31, 2010, $974 million of the Company’s $25.9 billion of cash

and investments was held by non-regulated entities.

The Company’s regulated subsidiaries had aggregate statutory capital and surplus of approximately $11 billion as

of December 31, 2010; regulated entity statutory capital exceeded state minimum capital requirements.

OptumHealth Bank must meet minimum requirements for Tier 1 leverage capital, Tier 1 risk-based capital, and

Total risk-based capital of the Federal Deposit Insurance Corporation (FDIC) to be considered “Well

Capitalized” under the capital adequacy rules to which it is subject. At December 31, 2010, the Company

believes that OptumHealth Bank met the FDIC requirements to be considered “Well Capitalized”.

Dividends

In May 2010, the Company’s Board of Directors increased the Company’s cash dividend to shareholders and

moved the Company to a quarterly dividend payment cycle. Declaration and payment of future quarterly

dividends is at the discretion of the Board and may be adjusted as business needs or market conditions change.

Prior to May 2010, the Company’s policy had been to pay an annual dividend.

85