United Healthcare 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

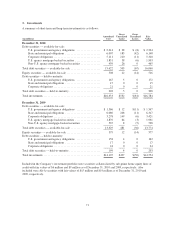

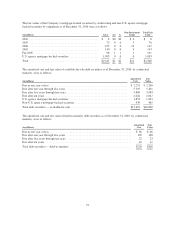

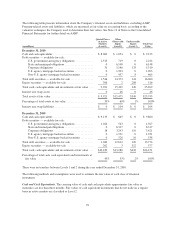

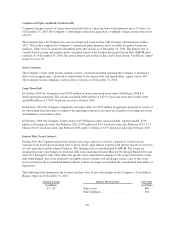

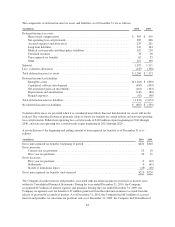

The table below includes fair values for certain financial instruments for which it is practicable to estimate fair

value. The carrying values and fair values of these financial instruments were as follows:

December 31, 2010 December 31, 2009

(in millions)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Assets

Debt securities — available-for-sale ............................ $16,060 $16,060 $13,774 $13,774

Equity securities — available-for-sale .......................... 516 516 577 577

Debt securities — held-to-maturity ............................. 203 208 199 203

AARP Program-related investments ............................ 2,435 2,435 2,114 2,114

Interest rate swap assets ..................................... 46 46 0 0

Liabilities

Senior unsecured notes ...................................... 10,212 10,903 11,173 11,043

Interest rate swap liabilities ................................... 104 104 0 0

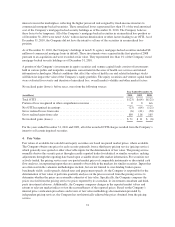

In addition to the previously described methods and assumptions for debt and equity securities and interest rate

swaps, the following are the methods and assumptions used to estimate the fair value of the other financial

instruments:

AARP Program-related Investments. AARP Program-related investments consist of debt and equity securities

held to fund costs associated with the AARP Program (see Note 12 of Notes to the Consolidated Financial

Statements). The Company elected to measure the AARP assets under management at fair value pursuant to the

fair value option. See the preceding discussion regarding the methods and assumptions used to estimate the fair

value of investments in debt and equity securities.

Senior Unsecured Notes. The fair values of the senior unsecured notes are estimated based on third-party quoted

market prices for the same or similar issues.

The carrying amounts reported in the Consolidated Balance Sheets for cash and cash equivalents, accounts and

other current receivables, unearned revenues, commercial paper, accounts payable and accrued liabilities

approximate fair value because of their short-term nature. These assets and liabilities are not listed in the table

above.

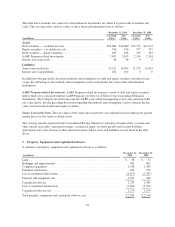

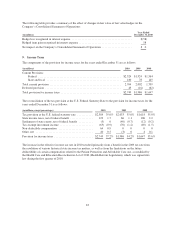

5. Property, Equipment and Capitalized Software

A summary of property, equipment and capitalized software is as follows:

(in millions)

December 31,

2010

December 31,

2009

Land ................................................................ $ 38 $ 32

Buildings and improvements ............................................. 764 662

Computer equipment ................................................... 1,418 1,504

Furniture and fixtures ................................................... 224 235

Less accumulated depreciation ........................................... (1,417) (1,487)

Property and equipment, net ............................................. 1,027 946

Capitalized software .................................................... 2,535 2,445

Less accumulated amortization ........................................... (1,362) (1,251)

Capitalized software, net ................................................ 1,173 1,194

Total property, equipment and capitalized software, net ........................ $2,200 $ 2,140

78