Under Armour 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1

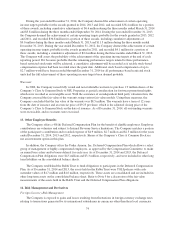

8. Subse

q

uent Events

Acquisitions

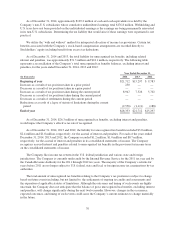

On January

5

, 201

5

, the Company acquired 100% of the outstanding equity of Endomondo ApS, a

Denmark-based connected fitness company for

$

85 million, subject to adjustment for working capital. I

n

connection with this acquisition, the Company incurred acquisition related expenses of approximatel

y

$

0.8 million during the year ended December 31, 2014. These expenses were included in selling, general and

administrative expenses on the consolidated statements of income. The operating results for this acquisition wil

l

be included in the Company’s consolidated statements of income from the date of acquisition. The Company i

s

currently in the process of assessing the fair value of the assets acquired and liabilities assumed, which i

s

expected to be final during the first quarter of 201

5

.

On February 3, 201

5

, the Company entered into an agreement to acquire MyFitnessPal, Inc.

(“MyFitnessPal”). The purchase price for the acquisition will be

$

475 million in cash, which will be adjusted to

r

eflect that the acquisition of MyFitnessPal by the Company at the closing on a debt free basis wit

h

MyFitnessPal’s transaction expenses borne by the sellers. In addition, the aggregate purchase price payable at th

e

closing is subject to an upward adjustment to reflect the amount of net cash held by MyFitnessPal at closing. Th

e

acquisition is currently expected to close during the first quarter of 201

5

, subject to the satisfaction of customar

y

closing conditions, including among others, regulatory approvals, the continuing accuracy of representations and

warranties and the execution of noncompetition agreements by certain key employee stockholders. Th

e

acquisition is expected to be funded through a combination of increased term loan borrowings, a draw on the

increased revolving credit facility and cash on hand

.

7

8