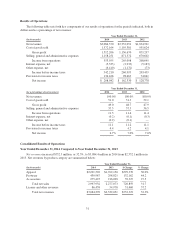

Under Armour 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

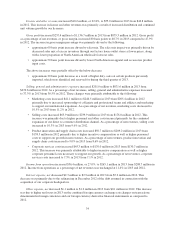

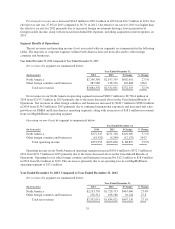

N

et revenues in our North American operating segment increased

$

467.0 million to

$

2,193.7 million i

n

2013 from

$

1,726.7 million in 2012 primarily due to the items discussed above in the Consolidated Results o

f

Operations. Net revenues in other foreign countries and businesses increased by

$

30.1 million to

$

138.3 million

in 2013 from

$

108.2 million in 2012 primarily due to unit sales growth in our EMEA and Asia operating

segments and to distributors in our Latin American operating segment

.

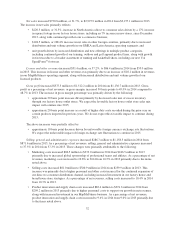

O

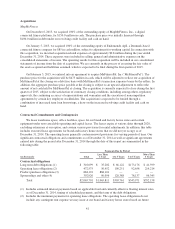

perating income (loss) by segment is summarized below:

Y

ear Ended December 31

,

(

In t

h

ousan

d

s

)

201

3

2

0

1

2

$

Change % Chang

e

N

orth America

$

271,338

$

200,084

$

71,254 35.6%

Other foreign countries and businesses (6,240) 8,611 (14,8

5

1) (172.

5

)

T

otal operatin

g

income

$

265,098

$

208,695

$

56,403 27.0

%

Operatin

g

income in our North American operatin

g

se

g

ment increased

$

71.2 million to

$

271.3 million in

2013 from

$

200.1 million in 2012 primarily due to the items discussed above in the Consolidated Results o

f

Operations. Operating income (loss) in other foreign countries and businesses decreased by

$

14.8 million to

$

(6.2) million in 2013 from

$

8.6 million in 2012 primarily due to our continued investment to support our

i

nternat

i

ona

l

expans

i

on

i

n our EMEA, As

i

aan

d

Lat

i

n Amer

i

can operat

i

ng segments. Investments

i

n 2013

p

r

i

mar

il

y

i

nc

l

u

d

et

h

e open

i

ng o

fb

ran

d

an

df

actory

h

ouse stores

i

nC

hi

na an

d

o

ffi

ces an

ddi

str

ib

ut

i

on

f

ac

ili

t

i

es

i

n

B

raz

il

an

d

C

hil

e, a

l

ong w

i

t

hhi

g

h

er personne

l

costs an

di

ncent

i

ve compensat

i

on

.

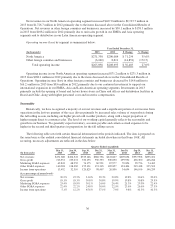

S

easonality

H

i

stor

i

ca

ll

y, we

h

ave recogn

i

ze

d

ama

j

or

i

ty o

f

our net revenues an

d

as

i

gn

ifi

cant port

i

on o

f

our

i

ncome

f

rom

o

perat

i

ons

i

nt

h

e

l

ast two quarters o

f

t

h

e year,

d

r

i

ven pr

i

mar

il

y

b

y

i

ncrease

d

sa

l

es vo

l

ume o

f

our pro

d

ucts

d

ur

i

n

g

t

h

e

f

a

ll

se

lli

ng season,

i

nc

l

u

di

ng our

hi

g

h

er pr

i

ce

d

co

ld

weat

h

er pro

d

ucts, a

l

ong w

i

t

h

a

l

arger proport

i

on o

f

hi

g

h

er marg

i

n

di

rect to consumer sa

l

es. T

h

e

l

eve

l

o

f

our wor

ki

ng cap

i

ta

l

genera

ll

yre

fl

ects t

h

e seasona

li

ty an

d

growt

hi

n our

b

us

i

ness. We genera

ll

y expect

i

nventory, accounts paya

bl

ean

d

certa

i

n accrue

d

expenses to

be

hi

g

h

er

i

nt

h

e secon

d

an

d

t

hi

r

d

quarters

i

n preparat

i

on

f

or t

h

e

f

a

ll

se

lli

ng season

.

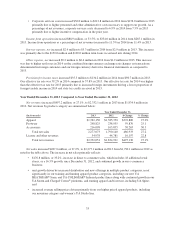

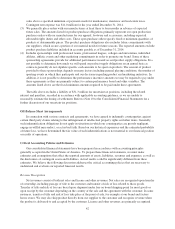

T

h

e

f

o

ll

ow

i

ng ta

bl

e sets

f

ort

h

certa

i

n

fi

nanc

i

a

li

n

f

ormat

i

on

f

or t

h

e per

i

o

d

s

i

n

di

cate

d

.T

h

e

d

ata

i

s prepare

d

o

n

t

h

e same

b

as

i

sast

h

eau

di

te

d

conso

lid

ate

dfi

nanc

i

a

l

statements

i

nc

l

u

d

e

d

e

l

sew

h

ere

i

nt

hi

s Form 10-K. A

ll

r

ecurr

i

ng, necessary a

dj

ustments are re

fl

ecte

di

nt

h

e

d

ata

b

e

l

ow

.

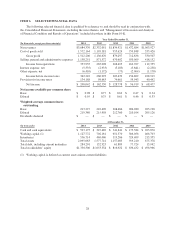

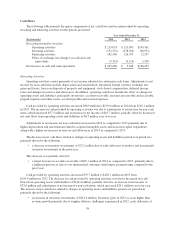

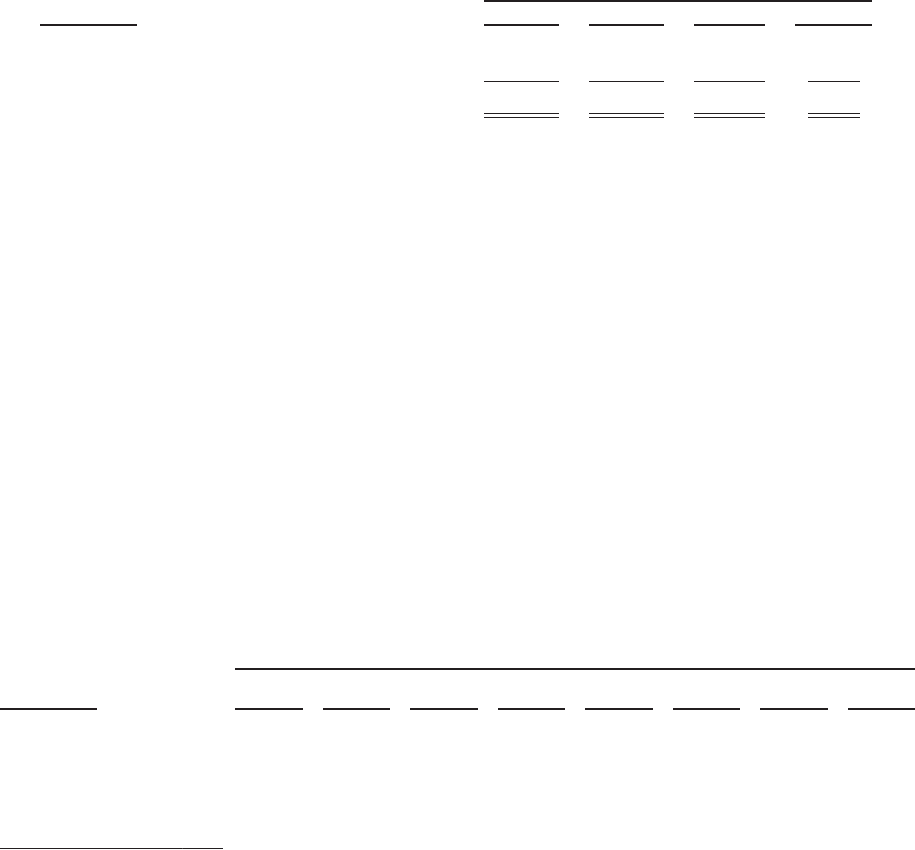

Q

uarter Ended (unaudited)

(

In t

h

ousan

d

s

)

Mar 31

,

2013

Jun 30,

2

01

3

S

ep 30,

2013

D

ec 31,

201

3

M

ar 31,

20

1

4

Jun 30

,

2

0

1

4

S

ep 30

,

2

0

14

Dec 31

,

20

1

4

Net revenues

$

471,608

$

454,541

$

723,146

$

682,756

$

641,607

$

609,654

$

937,908

$

895,201

Gross

p

rofit 216,551 219,631 350,135 350,353 300,690 299,952 465,300 446,264

Marketin

g

SG&A expenses 62,841 48,952 74,175 60,521 87,977 70,854 99,756 74,462

Other SG&A ex

p

enses 140,218 138,369 155,131 191,365 185,857 194,404 219,438 225,50

3

Income from o

p

erations 13,492 32,310 120,829 98,467 26,856 34,694 146,106 146,299

(

As a

p

ercentage o

f

annua

l

tota

l

s)

Net revenues 20.2% 19.5% 31.0% 29.3% 20.8% 19.8% 30.4% 29.0%

Gross

p

rofit 19.1% 19.3% 30.8% 30.8% 19.9% 19.8% 30.8% 29.5%

Marketin

g

SG&A expenses 25.4% 19.9% 30.1% 24.6% 26.4% 21.3% 29.9% 22.4%

Other SG&A ex

p

enses 22.4% 22.2% 24.8% 30.6% 22.5% 23.6% 26.6% 27.3

%

Income from o

p

erations 5.1% 12.2% 45.6% 37.1% 7.6% 9.8% 41.3% 41.3%

36