Under Armour 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3. Ac

q

u

i

s

i

t

i

ons

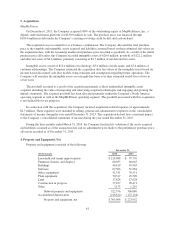

MapMyFitness

On December

6

, 2013, the Compan

y

acquired 100% of the outstandin

g

equit

y

of MapM

y

Fitness, Inc., a

di

g

ital connected fitness platform, for $150.0 million in cash. The purchase price was financed throu

g

h

$

100.0 million in debt under the Compan

y

’s existin

g

revolvin

g

credit facilit

y

and cash on hand

.

T

h

e acqu

i

s

i

t

i

on was accounte

df

or as a

b

us

i

ness com

bi

nat

i

on. T

h

e Compan

y

a

ll

ocate

d

t

h

e tota

l

purc

h

as

e

p

r

i

ce to t

h

e tan

gibl

ean

di

ntan

gibl

e assets acqu

i

re

d

an

dli

a

bili

t

i

es assume

db

ase

d

on t

h

e

i

r est

i

mate

df

a

i

rva

l

ues on

t

h

e acqu

i

s

i

t

i

on

d

ate, w

i

t

h

t

h

e rema

i

n

i

n

g

una

ll

ocate

d

purc

h

ase pr

i

ce recor

d

e

d

as

g

oo

d

w

ill

. As a resu

l

to

f

t

h

e

i

n

i

t

i

a

l

p

urchase price allocation, the Compan

y

recorded intan

g

ible assets of $20.6 million,

g

oodwill of $122.2 million,

and other net assets of $6.6 million, primaril

y

consistin

g

of $4.7 million of net deferred tax assets.

I

ntangible assets consist of

$

12.0 million of technology,

$

5.0 million of trade name, and

$

3.6 million o

f

customer relationships. The Company estimated the acquisition date fair values of the intangible assets based on

income based discounted cash flow models using estimates and assumptions regarding future operations. The

Company will amortize the intangible assets on a straight-line basis over their estimated useful lives of two to

se

v

en

y

ears.

The

g

oodwill recorded as a result of the acquisition primaril

y

reflects unidentified intan

g

ible asset

s

acquired, includin

g

the value of inte

g

ratin

g

and innovatin

g

acquired technolo

g

ies and en

g

a

g

in

g

and

g

rowin

g

the

di

g

ital communit

y

. The acquired

g

oodwill has been allocated primaril

y

within the Compan

y

’s North Americ

a

o

peratin

g

se

g

ment as well as the MapM

y

Fitness operatin

g

se

g

ment. The

g

oodwill associated with this acquisition

is not deductible for tax

p

ur

p

oses

.

I

n connect

i

on w

i

t

h

t

hi

s acqu

i

s

i

t

i

on, t

h

e Compan

yi

ncurre

d

acqu

i

s

i

t

i

on re

l

ate

d

expenses o

f

approx

i

mate

ly

$

2.5 million. These expenses were included in sellin

g

,

g

eneral and administrative expenses on the consolidate

d

statements o

fi

ncome

d

ur

i

n

g

t

h

e

y

ear en

d

e

d

Decem

b

er 31, 2013. T

hi

s acqu

i

s

i

t

i

on

did

not

h

ave a mater

i

a

li

mpac

t

to t

h

e Compan

y

’s conso

lid

ate

d

statements o

fi

ncome

d

ur

i

n

g

t

h

e

y

ear en

d

e

d

Decem

b

er 31, 2013

.

During the three months ended March 31, 2014, the Company finalized its valuation of the assets acquired

and liabilities assumed as of the acquisition date and no adjustments were made to the preliminary purchase pric

e

allocation recorded as of December 31

,

2013

.

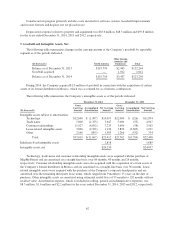

4. Pro

p

ert

y

and E

q

ui

p

ment, Net

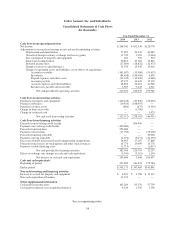

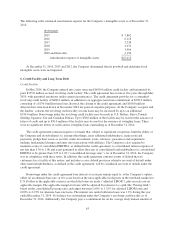

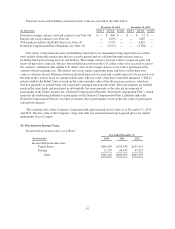

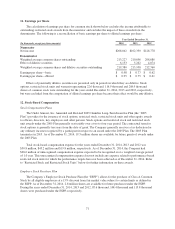

Property and equipment consisted of the following:

December

31,

(

In thousands

)

2014

2013

Leasehold and tenant improvements $ 128,088 $ 97,776

Furniture, fixtures and displa

y

s 80,035 68,045

B

uildin

g

s 46,419 45,90

3

Software 67,506 51,984

Office equipment 51,531 39,551

Plant equipment 70,317 45,509

Land 17,

6

28 17,

6

28

Construction in pro

g

ress 57,677 28,47

1

Other 3,175 1,21

9

S

ubtotal property and equipment

5

22,376 396,086

Accumulated de

p

reciation (216,812) (172,134)

Propert

y

and equipment, net $ 305,564 $ 223,952

61