Under Armour 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

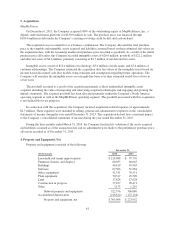

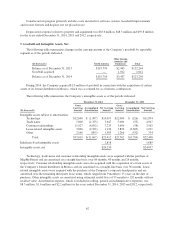

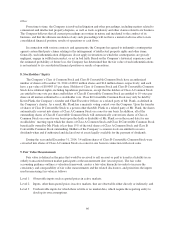

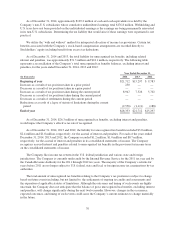

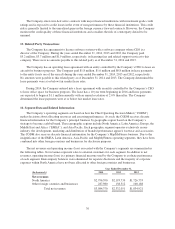

The components of the provision for income taxes consisted of the following

:

Y

ear Ended December 31

,

(

In t

h

ousan

d

s

)

2

0

14 201

3

2

0

1

2

C

urren

t

Federal

$

110,439

$

85,542

$

66,533

State 24,419 19,130 12,9

62

O

ther foreign countries 16,489 13,29

5

8,139

151

,

347 117

,

967 87

,

63

4

De

f

e

rr

ed

Federal (15,368) (14,722) (9,606)

State (4,073) (5,541) (3,563)

O

ther forei

g

n countries 2,262 959 196

(1

7,

1

7

9) (19

,

304) (12

,

9

7

3)

P

rovision for income taxes

$

134

,

168

$

98

,

663

$

74

,

661

A

reconc

ili

at

i

on

f

rom t

h

e U.S. statutory

f

e

d

era

li

ncome tax rate to t

h

ee

ff

ect

i

ve

i

ncome tax rate

i

sa

s

f

o

ll

ows:

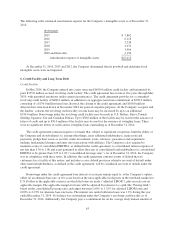

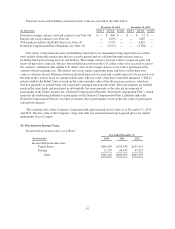

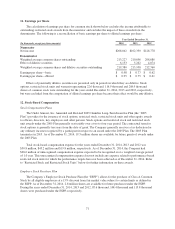

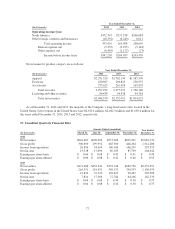

Year Ended December 31,

2

014

2

01

3

201

2

U

.S. federal statutory income tax rate 3

5

.0% 3

5

.0% 3

5

.0%

State taxes, net o

ff

e

d

era

l

tax

i

mpact 3.8 2.4 2.

1

U

nrecognized tax benefits 1.9 2.

5

2.7

Nondeductible expenses 1.0 1.1 0.6

Foreign rate differential (4.

5

) (4.8) (4.9

)

Foreign valuation allowance 2.

5

1.

5

0.8

O

ther

(

0.

5)

0.1 0.

4

Effective income tax rate 3

9

.2% 37.8% 3

6

.7%

T

h

e

i

ncrease

i

nt

h

e 2014

f

u

ll y

ear e

ff

ect

i

ve

i

ncome tax rate, as compare

d

to 2013,

i

spr

i

mar

ily d

ue t

o

i

ncrease

df

ore

ig

n

i

nvestments

d

r

i

v

i

n

g

a

l

ower proport

i

on o

ff

ore

ig

n taxa

bl

e

i

ncome

i

n 2014 an

d

state tax cre

di

t

s

r

ece

iv

e

di

n2

0

1

3.

68