Under Armour 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

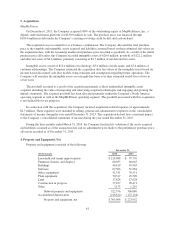

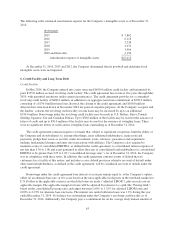

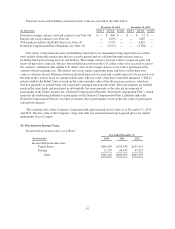

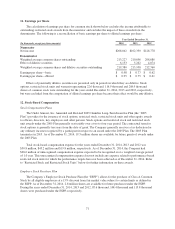

excluding extensions at the Company’s option, and include provisions for rental adjustments. The table belo

w

includes executed lease agreements for brand and factory house stores that the Company did not yet occupy as of

December 31, 2014 and does not include contingent rent the Company may incur at its stores based on future

sales above a specified minimum or payments made for maintenance, insurance and real estate taxes. The

f

ollowing is a schedule of future minimum lease payments for non-cancelable real property operating leases as o

f

December 31, 2014 as well as significant operating lease agreements entered into during the period afte

r

December 31, 2014 through the date of this report:

(

In t

h

ousan

d

s

)

2

015

$

56,452

2

016

5

7,079

2

017

5

2,17

2

2

018 48,34

5

2019 44

,

313

2

020 and thereafter 214,21

4

Total future minimum lease pa

y

ments

$

472,575

I

ncluded in selling, general and administrative expense was rent expense of

$

59.0 million,

$

41.8 million an

d

$

31.1 million for the years ended December 31, 2014, 2013 and 2012, respectively, under non-cancelable

o

perating lease agreements. Included in these amounts was contingent rent expense of

$

11.0 million,

$

7.8 millio

n

and

$

6.2 million for the years ended December 31, 2014, 2013 and 2012, respectively.

S

ponsors

h

ips an

d

Ot

h

er Mar

k

etin

g

Commitments

W

i

t

hi

nt

h

e norma

l

course o

fb

us

i

ness, t

h

e Company enters

i

nto contractua

l

comm

i

tments

i

nor

d

er to

p

romote t

h

e Company’s

b

ran

d

an

d

pro

d

ucts. T

h

ese comm

i

tments

i

nc

l

u

d

e sponsors

hi

p agreements w

i

t

h

teams an

d

at

hl

etes on t

h

eco

ll

eg

i

ate an

d

pro

f

ess

i

ona

ll

eve

l

s, o

ffi

c

i

a

l

supp

li

er agreements, at

hl

et

i

c event sponsors

hi

ps an

d

o

t

h

er mar

k

et

i

ng comm

i

tments. T

h

e

f

o

ll

ow

i

ng

i

sasc

h

e

d

u

l

eo

f

t

h

e Company’s

f

uture m

i

n

i

mum payments un

d

er

i

ts sponsors

hi

pan

d

ot

h

er mar

k

et

i

ng agreements as o

f

Decem

b

er 31, 2014, as we

ll

as s

i

gn

ifi

cant sponsors

hi

pan

d

o

t

h

er mar

k

et

i

ng agreements entere

di

nto

d

ur

i

ng t

h

e per

i

o

d

a

f

ter Decem

b

er 31, 2014 t

h

roug

h

t

h

e

d

ate o

f

t

his

r

eport:

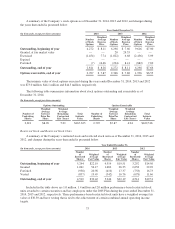

(

In t

h

ousan

d

s

)

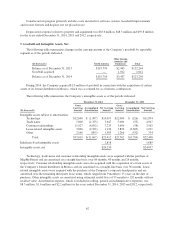

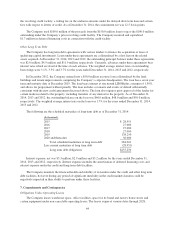

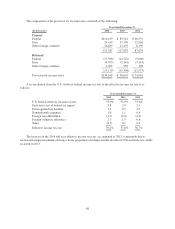

2015

$

90

,

056

201

6

7

1

,

65

4

2017

5

6

,

73

4

2018

44,982

2019

33

,

1

55

2020 and thereafter 96

,

34

5

T

otal future minimum sponsorship and other marketin

g

pa

y

ments $392,926

The amounts listed above are the minimum obli

g

ations required to be paid under the Compan

y

’s

sponsorship and other marketin

g

a

g

reements. The amounts listed above do not include additional performanc

e

incentives and product suppl

y

obli

g

ations provided under certain a

g

reements. It is not possible to determine ho

w

much the Compan

y

will spend on product suppl

y

obli

g

ations on an annual basis as contracts

g

enerall

y

do not

stipulate specific cash amounts to be spent on products. The amount of product provided to the sponsorships

depends on man

y

factors includin

gg

eneral pla

y

in

g

conditions, the number of sportin

g

events in which the

y

p

articipate and the Compan

y

’s decisions re

g

ardin

g

product and marketin

g

initiatives. In addition, the costs t

o

desi

g

n, develop, source and purchase the products furnished to the endorsers are incurred over a period of time

and are not necessaril

y

tracked separatel

y

from similar costs incurred for products sold to customers.

65