Under Armour 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ac

q

u

i

s

i

t

i

on

s

MapMyF

i

tness

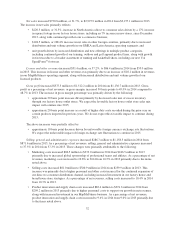

On December

6

, 2013, we acquired 100% of the outstanding equity of MapMyFitness, Inc., a digital

connected fitness platform, for

$

150.0 million in cash. The purchase price was initially financed throug

h

$

100.0 million in debt under our revolving credit facility and cash on hand

.

On January

5

, 201

5

, we acquired 100% of the outstanding equity of Endomondo ApS, a Denmark-based

connected fitness company for

$

85 in cash million, subject to adjustment for working capital. In connection wit

h

this acquisition, we incurred acquisition related expenses of approximately

$

0.8 million during the year ended

December 31, 2014. These expenses were included in selling, general and administrative expenses on th

e

consolidated statements of income. The operating results for this acquisition will be included in our consolidated

statements of income from the date of acquisition. We are currently in the process of assessing the fair value o

f

the assets acquired and liabilities assumed, which is expected to be final during the first quarter of 201

5

.

On February 3, 201

5

, we entered into an agreement to acquire MyFitnessPal, Inc (“MyFitnessPal”). The

p

urchase price for the acquisition will be

$

475 million in cash, which will be adjusted to reflect our acquisition o

f

MyFitnessPal at the closing on a debt free basis with MyFitnessPal’s transaction expenses borne by the sellers. In

addition, the aggregate purchase price payable at the closing is subject to an upward adjustment to reflect the

amount of net cash held by MyFitnessPal at closing. The acquisition is currently expected to close during the firs

t

quarter of 201

5

, subject to the satisfaction of customary closing conditions, including among others, regulatory

approvals, the continuing accuracy of representations and warranties and the execution of noncompetition

agreements by certain key employee stockholders. The acquisition is expected to be funded through a

combination of increased term loan borrowings, a draw on the increased revolving credit facility and cash o

n

hand

.

C

ontractual

C

omm

i

tments and

C

ont

i

ngenc

i

es

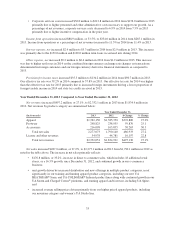

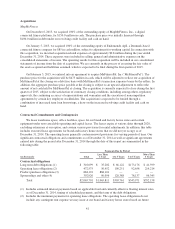

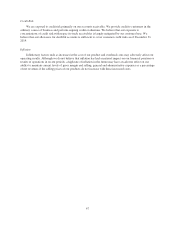

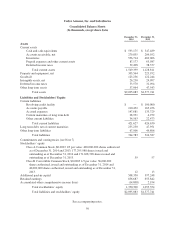

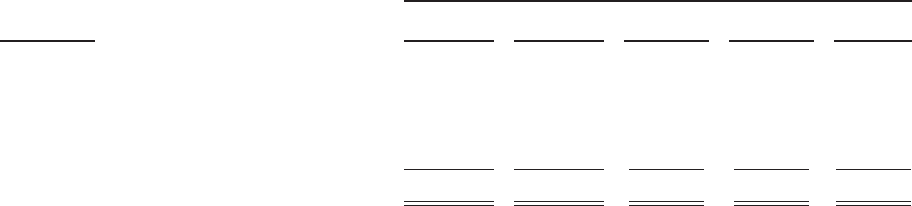

We lease warehouse space, office facilities, space for our brand and factory house stores and certai

n

equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2028

,

excluding extensions at our option, and contain various provisions for rental adjustments. In addition, this table

includes executed lease agreements for brand and factory house stores that we did not yet occupy as o

f

December 31, 2014. The operating leases generally contain renewal provisions for varying periods of time. Ou

r

significant contractual obligations and commitments as of December 31, 2014 as well as significant agreement

s

entered into during the period after December 31, 2014 through the date of this report are summarized in th

e

f

ollowing table:

P

a

y

ments Due b

y

Perio

d

(

in thousands

)

T

ota

l

L

ess Tha

n

1

Yea

r

1

to

3

Year

s

3

to 5 Year

s

M

ore Than

5Y

ears

Contractual obli

g

ations

Lon

g

term debt obli

g

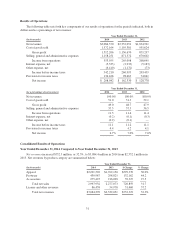

ations (1) $ 316,099 $ 35,202 $ 66,122 $173,176 $ 41,599

Operatin

g

lease obli

g

ations (2) 472,575 56,452 109,251 92,658 214,214

Product purchase obli

g

ations (3) 884,101 884,101 — —

—

S

p

onsorshi

p

s and other (4) 392,926 90,056 128,388 78,137 96,34

5

Total

$

2,065,701

$

1,065,811

$

303,761

$

343,971

$

352,15

8

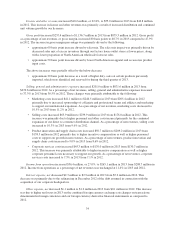

(1) Includes estimated interest payments based on applicable fixed and currently effective floating interest rates

as of December 31, 2014, timing of scheduled payments, and the term of the debt obligations.

(2) Includes the minimum payments for operating lease obligations. The operating lease obligations do no

t

include any contingent rent expense we may incur at our brand and factory house stores based on future

41