Under Armour 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

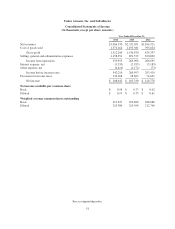

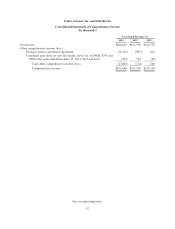

Under Armour, Inc. and Subsidiarie

s

Consolidated Statements of Stockholders’ E

q

uit

y

(

In thousands

)

C

lass A

C

ommon

S

toc

k

C

lass

B

C

onvertibl

e

C

ommon

S

tock

Add

iti

o

n

al

Paid-In

C

ap

i

tal

R

etained

E

arn

i

ngs

A

ccumulate

d

O

the

r

Com

p

rehensiv

e

I

ncome

(

Loss

)

T

o

t

al

S

tockholders’

E

qu

i

t

y

S

hare

s

Amount

S

hares Amount

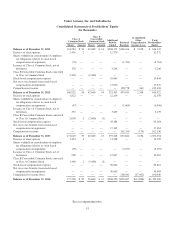

Balance as of December 31

,

201

1

161

,

984 $ 54 45

,

000 $ 14 $268

,

172 $366

,

164 $ 2

,

028 $ 636

,

43

2

Exercise of stock options 2,43

6

2 — — 12,370 — — 12,37

2

S

h

ares w

i

t

hh

e

ld i

n cons

id

erat

i

on o

f

emp

l

oye

e

tax obli

g

ations relative to stock-base

d

compensation arrangements (7

6

) — — — — (1,7

6

1) — (1,7

6

1

)

Issuance of Class A Common Stock

,

net o

f

forfeitures 178 — — — 3,24

6

— — 3,24

6

C

l

ass B Convert

ibl

e Common Stoc

k

converte

d

to Class A Common Stock 2,400 —

(

2,400

)

——— —

—

Stock-based compensation expense — — — — 19,84

5

— — 19,84

5

N

et excess tax benefits from stock-base

d

compensation arrangements — — — — 17,

6

70 — — 17,

6

7

0

Compre

h

ens

i

ve

i

ncome — — — — — 128,778 340 129,11

8

Balance as of December 31

,

201

2

166

,

922 56 42

,

600 14 321

,

303 493

,

181 2

,

368 816

,

92

2

Exercise of stock options 1,822 — — — 12,1

5

9 — — 12,1

59

S

h

ares w

i

t

hh

e

ld i

n cons

id

erat

i

on o

f

emp

l

o

y

e

e

tax obli

g

ations relative to stock-base

d

compensation arrangements (47) — — — — (1,

66

9) — (1,

66

9

)

Issuance of Class A Common Stock

,

net o

f

f

or

f

e

i

tures 332 — — — 3,439 — — 3,43

9

Cl

ass B

C

on

v

ert

ibl

e

C

ommon

S

toc

k

con

v

erte

d

to Class A Common Stock 2,600 1

(

2,600

)(

1

)

—— —

—

Stoc

k

-

b

ase

d

compensat

i

on expense — — — — 43,184 — — 43,184

N

et excess tax benefits from stock-base

d

compensation arrangements — — — — 17,1

6

3 — — 17,1

63

Com

p

rehensive income — — — — — 162,330 (174) 162,1

56

Balance as of December 31

,

201

3

171

,

629 57 40

,

000 13 397

,

248 653

,

842 2

,

194 1

,

053

,

35

4

Exercise of stock options 1,4

5

4 1 — — 11,2

5

8 — — 11,2

59

S

h

ares w

i

t

hh

e

ld i

n cons

id

erat

i

on o

f

emp

l

o

y

e

e

tax obli

g

ations relative to stock-base

d

compensation arrangements (9

5

)— — — — (

5

,197) — (

5

,197

)

Issuance of Class A Common Stock

,

net o

f

forfeitures 908 — — — 12,0

6

7 — — 12,0

67

Cl

ass B

C

on

v

ert

ibl

e

C

ommon

S

toc

k

con

v

erte

d

to Class A Common Stock 3,400 1

(

3,400

)(

1

)

—— —

—

Stock-based compensation expense — — — —

5

0,812 — —

5

0,812

N

et excess tax benefits from stock-base

d

compensation arrangements — — — — 36,96

5

— — 36,96

5

Com

p

re

h

ens

i

ve

i

ncome (

l

oss) — — — — — 208,042 (17,002) 191,04

0

Balance as of December 31

,

201

4

177,296 $ 59 36,600 $ 12 $508,350 $856,687 $

(

14,808

)

$1,350,30

0

See accompany

i

ng notes.

5

3