Under Armour 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

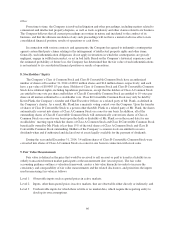

the revolving credit facility, a ticking fee on the undrawn amounts under the delayed draw term loan and certai

n

f

ees with res

p

ect to letters of credit. As of December 31, 2014, the commitment fee was 12.

5

basis

p

oints

.

The Company used

$

100.0 million of the proceeds from the

$

150.0 million loan to repay the

$

100.0 million

o

utstanding under the Company’s prior revolving credit facility. The Company incurred and capitalized

$

1.7 million in deferred financing costs in connection with the credit facility.

Ot

h

er Lon

g

Term De

b

t

T

h

e Compan

yh

as

l

on

g

term

d

e

b

ta

g

reements w

i

t

h

var

i

ous

l

en

d

ers to

fi

nance t

h

e acqu

i

s

i

t

i

on or

l

ease o

f

qua

lifyi

n

g

cap

i

ta

li

nvestments. Loans un

d

er t

h

ese a

g

reements are co

ll

atera

li

ze

dby

a

fi

rst

li

en on t

h

ere

l

ate

d

assets acqu

i

re

d

. At Decem

b

er 31, 2014, 2013 an

d

2012, t

h

e outstan

di

n

g

pr

i

nc

i

pa

lb

a

l

ance un

d

er t

h

ese a

g

reements

was $2.0 million, $4.9 million and $11.9 million, respectivel

y

. Currentl

y

, advances under these a

g

reements bea

r

i

nterest rates w

hi

c

h

are

fi

xe

d

at t

h

et

i

me o

f

eac

h

a

d

vance. T

h

ewe

igh

te

d

avera

g

e

i

nterest rates on outstan

di

n

g

b

orrow

i

n

g

s were 3.1%, 3.3% an

d

3.7%

f

or t

h

e

y

ears en

d

e

d

Decem

b

er 31, 2014, 2013 an

d

2012, respect

i

ve

ly

.

I

n December 2012, the Compan

y

entered into a $50.0 million recourse loan collateralized b

y

the land,

b

u

ildi

n

g

san

d

tenant

i

mprovements compr

i

s

i

n

g

t

h

e Compan

y

’s corporate

h

ea

d

quarters. T

h

e

l

oan

h

as a seven

y

ear

term and maturit

y

date of December 2019. The loan bears interest at one month LIBOR plus a mar

g

in of 1.50%,

an

d

a

ll

ows

f

or prepa

y

ment w

i

t

h

out pena

l

t

y

.T

h

e

l

oan

i

nc

l

u

d

es covenants an

d

events o

fd

e

f

au

l

tsu

b

stant

i

a

lly

cons

i

stent w

i

t

h

t

h

e new cre

di

ta

g

reement

di

scusse

d

a

b

ove. T

h

e

l

oan a

l

so requ

i

res pr

i

or approva

l

o

f

t

h

e

l

en

d

er

f

or

certa

i

n matters re

l

ate

d

to t

h

e propert

y

,

i

nc

l

u

di

n

g

trans

f

ers o

f

an

yi

nterest

i

nt

h

e propert

y

.Aso

f

Decem

b

er 31

,

2014, 2013 and 2012, the outstandin

g

balance on the loan was $46.0 million, $48.0 million and $50.0 million,

r

espect

i

ve

ly

.T

h

ewe

igh

te

d

avera

g

e

i

nterest rate on t

h

e

l

oan was 1.7%

f

or t

h

e

y

ears en

d

e

d

Decem

b

er 31, 2014

,

2

0

1

3

an

d

2

0

12.

T

h

e

f

o

ll

ow

i

n

g

are t

h

esc

h

e

d

u

l

e

d

matur

i

t

i

es o

fl

on

g

term

d

e

b

taso

f

Decem

b

er 31, 2014:

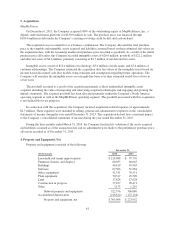

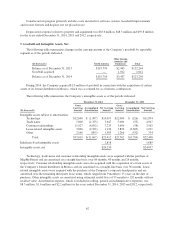

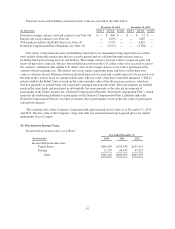

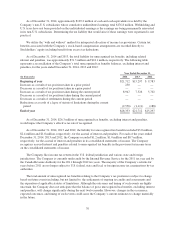

(

In t

h

ousan

d

s

)

2

015

$

28,95

1

2

01

6

27,00

0

201

7

2

7

,000

2018 2

7,

000

2

019 138,25

0

2

020 and thereafter 36

,

000

Tota

l

sc

h

e

d

u

l

e

d

matur

i

t

i

es o

fl

ong term

d

e

b

t 284,201

L

ess current maturities of long term debt (28,9

5

1)

Long term debt obligations

$

255,250

I

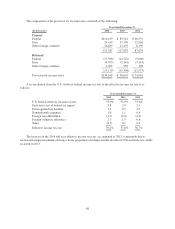

nterest expense, net was

$

5.3 million,

$

2.9 million and

$

5.2 million for the years ended December 31,

2014, 2013 and 2012, respectively. Interest expense includes the amortization of deferred financing costs an

d

interest expense under the credit and long term debt facilities.

The Company monitors the financial health and stability of its lenders under the credit and other long term

debt facilities, however during any period of significant instability in the credit markets lenders could be

negatively impacted in their ability to perform under these facilities.

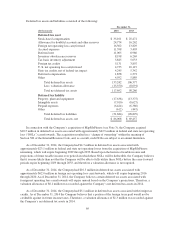

7

. Commitments and Contin

g

encie

s

O

bl

i

g

ations Un

d

er Operatin

g

Lease

s

The Company leases warehouse space, office facilities, space for its brand and factory house stores and

certain equipment under non-cancelable operating leases. The leases expire at various dates through 2028

,

64