Under Armour 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

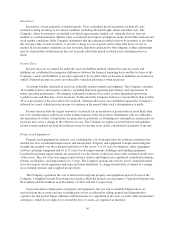

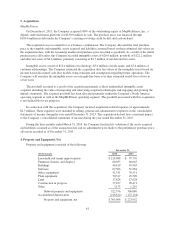

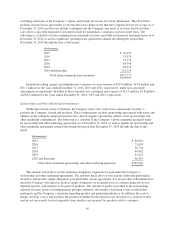

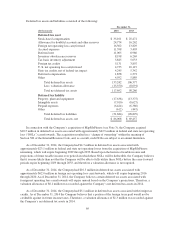

T

he following is the estimated amortization expense for the Company’s intangible assets as of December 31

,

2014

:

(

In t

h

ousan

d

s

)

2

015

$

7,86

2

2

01

66

,118

2

017 3,23

6

2018 2

,

0

7

4

2

019 1,9

66

2

020 and thereafter 2,1

5

6

Amortization expense of intan

g

ible assets

$

23,412

A

t Decem

b

er 31, 2014, 2013 an

d

2012, t

h

e Compan

yd

eterm

i

ne

d

t

h

at

i

ts

g

oo

d

w

ill

an

di

n

d

e

fi

n

i

te-

li

ve

d

i

ntan

gibl

e assets were not

i

mpa

i

re

d

.

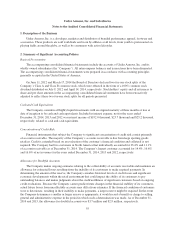

6.

C

red

i

t Fac

i

l

i

ty and Long Term Deb

t

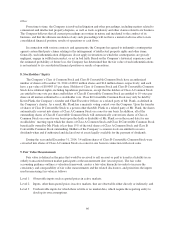

Cre

d

it Faci

l

ity

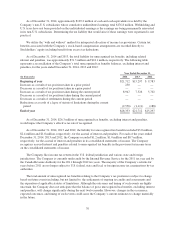

I

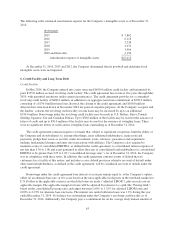

n May 2014, the Company entered into a new unsecured

$

650.0 million credit facility and terminated it

s

p

rior

$

325.0 million secured revolving credit facility. The credit agreement has a term of five years through Ma

y

2019, w

i

t

h

perm

i

tte

d

extens

i

ons un

d

er certa

i

nc

i

rcumstances. T

h

e cre

di

t agreement prov

id

es

f

or a comm

i

tte

d

r

evolving credit facility of

$

400.0 million, in addition to an aggregate term loan commitment of

$

250.0 million,

consisting of a

$

150.0 million term loan, drawn at the closing of the credit agreement, and

$

100.0 millio

n

d

e

l

aye

dd

raw term

l

oan

d

rawn

i

n Novem

b

er 2014

f

or genera

l

corporate purposes. At t

h

e Company’s request an

d

t

h

e

l

en

d

ers’ consent, t

h

e revo

l

v

i

ng cre

di

t

f

ac

ili

ty or term

l

oans may

b

e

i

ncrease

db

yuptoana

ddi

t

i

ona

l

$

150.0 million. Borrowings under the revolving credit facility may be made in U.S. Dollars, Euros, Pounds

Sterling, Japanese Yen and Canadian Dollars. Up to

$

50.0 million of the facility may be used for the issuance of

letters of credit and up to

$

50.0 million of the facility may be used for the issuance of swingline loans. There

were no s

i

gn

ifi

cant

l

etters o

f

cre

di

tan

d

no sw

i

ng

li

ne

l

oans outstan

di

ng as o

f

Decem

b

er 31, 2014.

T

h

e cre

di

t agreement conta

i

ns negat

i

ve covenants t

h

at, su

bj

ect to s

i

gn

ifi

cant except

i

ons,

li

m

i

tt

h

ea

bili

ty o

f

t

h

e Company an

di

ts su

b

s

idi

ar

i

es to, among ot

h

er t

hi

ngs,

i

ncur a

ddi

t

i

ona

li

n

d

e

b

te

d

ness, ma

k

e restr

i

cte

d

p

ayments, p

l

e

d

ge t

h

e

i

r assets as secur

i

ty, ma

k

e

i

nvestments,

l

oans, a

d

vances, guarantees an

d

acqu

i

s

i

t

i

ons

,

un

d

ergo

f

un

d

amenta

l

c

h

anges an

d

enter

i

nto transact

i

ons w

i

t

h

a

ffili

ates. T

h

e Company

i

sa

l

so requ

i

re

d

to

ma

i

nta

i

n a rat

i

oo

f

conso

lid

ate

d

EBITDA, as

d

e

fi

ne

di

nt

h

e cre

di

t agreement, to conso

lid

ate

di

nterest expense o

f

not less than 3.50 to 1.00 and is not permitted to allow the ratio of consolidated total indebtedness to consolidated

EBITDA to be greater than 3.25 to 1.00 (“consolidated leverage ratio”). As of December 31, 2014, the Company

was

i

n comp

li

ance w

i

t

h

t

h

ese rat

i

os. In a

ddi

t

i

on, t

h

e cre

di

t agreement conta

i

ns events o

fd

e

f

au

l

tt

h

at are

customary

f

or a

f

ac

ili

ty o

f

t

hi

s nature, an

di

nc

l

u

d

es a cross

d

e

f

au

l

t prov

i

s

i

on w

h

ere

b

y an event o

fd

e

f

au

l

tun

d

er

o

t

h

er mater

i

a

li

n

d

e

b

te

d

ness, as

d

e

fi

ne

di

nt

h

e cre

di

t agreement, w

ill b

e cons

id

ere

d

an event o

fd

e

f

au

l

tun

d

er t

h

e

cre

di

t agreement.

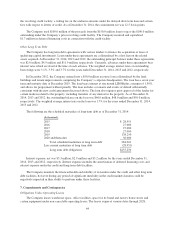

Borrow

i

ngs un

d

er t

h

e cre

di

t agreement

b

ear

i

nterest at a rate per annum equa

l

to, at t

h

e Company’s opt

i

on,

e

i

t

h

er (a) an a

l

ternate

b

ase rate, or (

b

) a rate

b

ase

d

on t

h

e rates app

li

ca

bl

e

f

or

d

epos

i

ts

i

nt

h

e

i

nter

b

an

k

mar

k

et

f

o

r

U

.S. Do

ll

ars or t

h

e app

li

ca

bl

e currency

i

nw

hi

c

h

t

h

e

l

oans are ma

d

e (“a

dj

uste

d

LIBOR”), p

l

us

i

n eac

h

case a

n

app

li

ca

bl

e marg

i

n. T

h

e app

li

ca

bl

e marg

i

n

f

or

l

oans w

ill b

ea

dj

uste

db

yre

f

erence to a gr

id

(t

h

e “Pr

i

c

i

ng Gr

id

”

)

based on the consolidated levera

g

e ratio and ran

g

es between 1.00% to 1.25% for ad

j

usted LIBOR loans and

0.00% to 0.25% for alternate base rate loans. The interest rate under both term loans was 1.2% durin

g

the

y

ear

en

d

e

d

Decem

b

er 31, 2014. No

b

a

l

ance was outstan

di

n

g

un

d

er t

h

e Compan

y

’s revo

l

v

i

n

g

cre

di

t

f

ac

ili

t

y

as o

f

Decem

b

er 31, 2014. A

ddi

t

i

ona

lly

,t

h

e Compan

y

pa

y

s a comm

i

tment

f

ee on t

h

e avera

g

e

d

a

ily

unuse

d

amount o

f

6

3