Ubisoft 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Report

2013

10

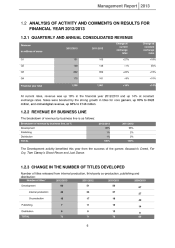

CASH AND CAPITAL 1.3

CHANGES IN EQUITY 1.3.1

The video game business line calls for investments in development of around 35% of revenue. This

capital expenditure takes place over average periods of between 24 and 36 months, which publishers

must be able to finance out of their own resources. Furthermore, publishers are required to launch

new releases on a regular basis, and their level of success cannot be guaranteed.

For these reasons, significant capitalization is essential to guarantee the continuous financing of

capital expenditure and to deal with contingencies stemming from the success or failure of a particular

title without endangering the future of the Company.

With equity of €838 million, up €75 million, Ubisoft easily finances its capital investments in games,

which amount to €375 million.

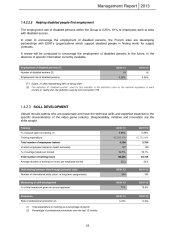

CASH FLOW 1.3.2

Video game publishers have two kinds of cash flows:

- Cash flows for financing development costs are spread evenly over a period of 24 to 36

months, given that each project progressively scales up but that teams work on a number

of projects. They represented €459 million in 2012/2013;

- Cash flows linked to the marketing of games, which are highly seasonal in nature

(25% of revenue is made in the first half of the year and 75% in the second half), and the

lag between manufacturing costs and the cash recovery of sales. This is because the

Company must first finance product manufacturing, which accounts for 28% of revenue

and is payable at 30 days on average, and also finance marketing costs (around 18% of

revenue) before cash flows in at an average of 48 days after the games hit the shelves.

For this reason, the Company must finance significant cash peaks around Christmas time

before seeing its cash climb back up during February and March. This timing may be

different if Q4 of the financial year is very strong, because in this case, working capital

requirements may be higher.

Accordingly, in the financial year 2012/2013, the Company’s net cash varied between €85 million and

€105 million, with debt peaking from October to December.

BORROWING TERMS AND FINANCING STRUCTURE 1.3.3

In 2012/2013, most of the financing used came from a syndicated loan of €214.5 million signed in July

2012 (maturing in July 2017), bilateral credit lines of €45 million (maturing in April and September

2013) and a loan of €3 million (maturing in September 2019); in addition, in December 2012 the

Company placed a bond loan of €20 million (maturing in December 2018).

The average cost of borrowing was around 2% for the financial year 2012/2013.