TomTom 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

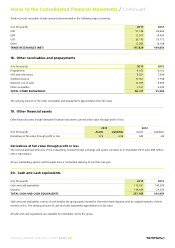

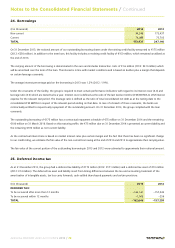

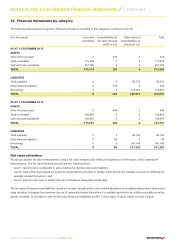

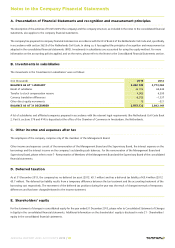

33. Financial instruments by category

The following table presents the group's financial instruments according to the categories as defined in IAS 39:

(€ in thousands) Loans and

receivables

Assets/liabilities at

fair value through

profit or loss

Other financial

assets/liabilities at

amortised cost

Total

AS AT 31 DECEMBER 2013

ASSETS

Other financial assets 0 376 0 376

Trade receivables 115,429 0 0 115,429

Cash and cash equivalents 257,785 0 0 257,785

TOTAL 373,214 376 0 373,590

LIABILITIES

Trade payables 0 0 82,337 82,337

Other financial liabilities 0 236 0 236

Borrowings 0 0 173,437 173,437

TOTAL 0 236 255,774 256,010

AS AT 31 DECEMBER 2012

ASSETS

Other financial assets 0 444 0 444

Trade receivables 149,834 0 0 149,834

Cash and cash equivalents 164,459 0 0 164,459

TOTAL 314,293 444 0 314,737

LIABILITIES

Trade payables 0 0 84,162 84,162

Other financial liabilities 0 85 0 85

Borrowings 0 0 247,140 247,140

TOTAL 0 85 331,302 331,387

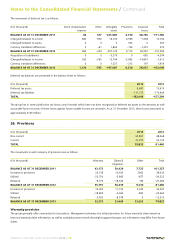

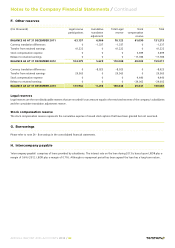

Fair value estimation

The group classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in making the

measurements. The fair value hierarchy should have the following levels:

• Level 1: quoted prices (unadjusted) in active markets for identical assets and liabilities;

• Level 2: inputs other than quoted prices that are observable for the asset or liability, either directly (for example, as prices) or indirectly (for

example, derived from prices); and

• Level 3: inputs for the asset or liability that are not based on observable market data.

The fair value of financial assets/liabilities carried at fair value through profit or loss and the derivatives in a hedging relationship is determined

using valuation techniques that maximise the use of observable market data where it is available and which rely as little as possible on entity-

specific estimates. In accordance with the fair value hierarchy established by IFRS 7, these types of inputs classify as Level 2 inputs.

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 78