TomTom 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share premium

The share premium represents the amount by which the fair value of the consideration received exceeds the nominal value of shares issued.

Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax, from the proceeds.

Provisions

Provisions are recognised when:

• The group has a present obligation as a result of a past event;

• It is probable that the group will be required to settle that obligation; and

• The amount can be reliably estimated.

Provisions are measured at management’s best estimate of the expenditure required to settle the obligation at the balance sheet date, and

are discounted to present value where the effect is material.

Provisions for warranty costs are recognised at the date of sale of the relevant products, at management's best estimate of the expenditure

required to settle the group's obligation. Warranty costs are recorded within cost of sales.

Other provisions include legal claims, pension liabilities and tax risks for which it is probable that an outflow of resources will be required to

settle the obligation.

Borrowings

Borrowings are recognised initially at fair value, net of transaction costs incurred. Subsequently, amounts are stated at amortised cost with

the difference being recognised in the income statement over the period of the borrowings using the effective interest rate method.

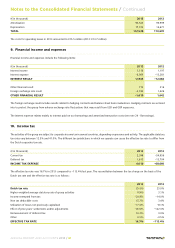

3. Financial risk management

Financial risk factors

The group's activities result in exposure to a variety of financial risks: including credit, foreign currencies, liquidity and interest rate risk.

Management policies have been established to identify, analyse and monitor these risks, and to set appropriate risk limits and controls. Financial

risk management is carried out in accordance with our Corporate Treasury Policy. The written principles and policies are reviewed periodically

to reflect changes in market conditions, the activities of the business and laws and regulations affecting our business.

Credit

Credit risk arises primarily from cash and cash equivalents held at financial institutions, and, to a certain extent, from trade receivables relating

to our wholesale customers.

Cash balances are held with counterparties that have a credit risk rating of at least A-, as rated by an acknowledged rating agency. Moreover,

to avoid significant concentration of our exposure to particular financial institutions, we ensure that transactions and businesses are properly

spread among different counterparties.

Our exposure to wholesale customers is managed through establishing proper credit limits and continuous credit risk assessments for each

individual customer.

Our procedures include aligning our credit and trading terms and conditions with our assessment of the individual characteristics and risk

profile of each customer. This assessment is made based on our past experiences and independent ratings from external rating agencies

whenever available.

As at 31 December 2013, our total bad debt provision represented approximately 0.3% of our group revenue (2012: 0.2%).

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 53