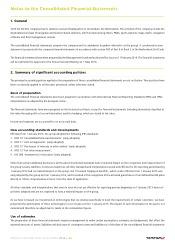

TomTom 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

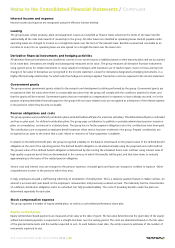

Associates

Associates are all entities over which the group has significant influence but not control, generally accompanying a shareholding of between

20% and 50% of the voting rights, or other evidence of significant influence. Investments in associates are accounted for using the equity

method of accounting, and are initially recognised at cost. The group's investment in associates includes goodwill identified on acquisition,

net of any accumulated impairment loss.

The group's share of its associates' post-acquisition profits or losses is recognised in the income statement, and its share of post-acquisition

movements in 'Other comprehensive income' is recognised in 'Other comprehensive income'. The cumulative post-acquisition movements

are adjusted against the carrying amount of the investment. When the group's share of losses in an associate equals or exceeds its interest

in the associate, including any other unsecured receivables, the group does not recognise further losses, unless it has incurred obligations or

made payments on behalf of the associate. Unrealised gains on transactions between the group and its associates are eliminated to the extent

of the group's interest in the associates. Unrealised losses are also eliminated, unless the transaction provides evidence of an impairment of

the asset transferred. Accounting policies of associates have been changed where necessary to ensure consistency with the policies adopted

by the group.

Revenue recognition

Revenue is measured at the fair value of the consideration received or receivable and represents amounts receivable for products and/or

services delivered in the normal course of business. Revenue is reduced for estimated customer returns, rebates and other similar allowances

whenever applicable based on historical data and expectations of future sales. For further details, refer to note 4 - Critical accounting estimates

and judgements.

Sale of goods

Revenue on the sale of goods is only recognised when the risks and rewards of ownership of goods are transferred to the customers, which

include distributors, retailers, end-users and OEMs. The risks and rewards of ownership are generally transferred at the time the product is

shipped and delivered to the customer and, depending on the delivery conditions, title and risk have passed to the customer and acceptance

of the product, when contractually required, has been obtained. In cases where contractual acceptance is not required, revenue is recognised

when management has established that all aforementioned conditions for revenue recognition have been met.

Royalty revenue

Royalty revenue is generated through licensing of geographic and/or other traffic-/location-based content to customers. Revenue is recognised

on an accrual basis based on the contractual terms and substance of the relevant arrangements with the customers.

Sale of services

Services revenue is generated from the selling of traffic and map update services, content sales, connected navigation and fleet management

services for commercial fleets. The revenue relating to the service element is recognised over the agreed or estimated service period on a

straight-line basis.

Multiple-element arrangements

The group's product and services offerings include arrangements that require the group to deliver equipment (e.g. navigation hardware) and/

or a number of services (e.g. traffic information services) under one agreement, or under a series of agreements that are commercially linked

(referred to as 'multiple-element arrangements'). In such multiple-element arrangements, the consideration received is allocated to each

separately identifiable element, based on the relative fair values of each identifiable element. In the absence of a stand-alone selling price the

fair value of each element is estimated using other methods allowed under IFRS, such as the cost plus reasonable margin or the residual

method.

The amount of revenues allocated to the hardware element is recognised in line with the accounting policy for the sale of goods as described

above. The revenue relating to the service element is recognised over the agreed or estimated service period on a straight-line basis, which

varies on average from 3 months to 48 months (for lifetime services). To the extent that there is a discount on the arrangement, the discount

is allocated between the elements of the contract in such a manner as to reflect the fair value of the elements and the substance of the

transaction.

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 48