TomTom 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

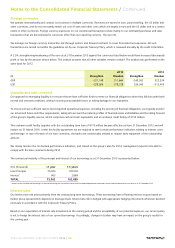

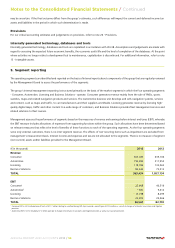

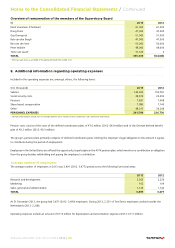

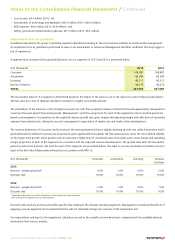

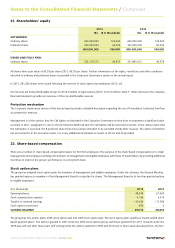

(€ in thousands) 2013 2012

Amortisation 95,523 95,999

Depreciation 17,015 14,671

TOTAL 112,538 110,670

The costs for operating leases in 2013 amounted to €15.5 million (2012: €13.7 million).

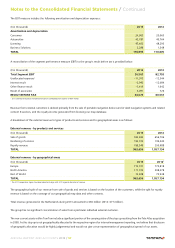

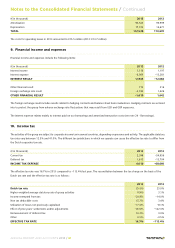

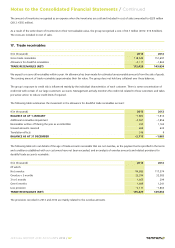

9. Financial income and expenses

Financial income and expenses include the following items:

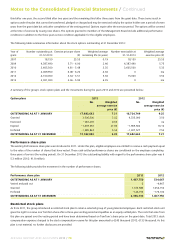

(€ in thousands) 2013 2012

Interest income 1,114 1,197

Interest expense –4,059 –13,281

INTEREST RESULT –2,945 –12,084

Other financial result 714 216

Foreign exchange rate result –2,333 1,426

OTHER FINANCIAL RESULT –1,619 1,642

The foreign exchange result includes results related to hedging contracts and balance sheet item revaluations. Hedging contracts are entered

into to protect the group from adverse exchange rate fluctuations that may result from USD and GBP exposures.

The interest expense relates mainly to interest paid on our borrowings and amortised transaction costs (see note 24 - Borrowings).

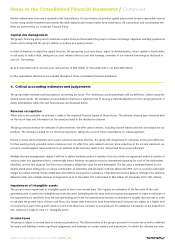

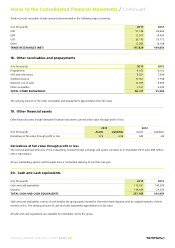

10. Income tax

The activities of the group are subject to corporate income tax in several countries, depending on presence and activity. The applicable statutory

tax rates vary between 12.5% and 41.0%. The different tax jurisdictions in which we operate can cause the effective tax rate to differ from

the Dutch corporate tax rate.

(€ in thousands) 2013 2012

Current tax 2,398 –54,956

Deferred tax 1,612 –13,704

INCOME TAX EXPENSE 4,010 –68,660

The effective tax rate was 16.7% in 2013 compared to –113.4% last year. The reconciliation between the tax charge on the basis of the

Dutch tax rate and the effective tax rate is as follows:

2013 2012

Dutch tax rate 25.0% 25.0%

Higher weighted average statutory rate of group activities 6.9% 3.1%

Income exempted from tax –20.8% –14.0%

Non tax deductible costs 15.7% 3.4%

Utilisation of losses not previously capitalised –17.3% –8.1%

Effect of prior years' settlements and/or adjustments –26.5% –122.3%

Remeasurement of deferred tax 33.2% 0.0%

Other 0.5% –0.5%

EFFECTIVE TAX RATE 16.7% –113.4%

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 61