TomTom 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

may be uncertain. If the final outcome differs from the group's estimates, such differences will impact the current and deferred income tax

assets and liabilities in the period in which such determination is made.

Provisions

For our critical accounting estimates and judgements on provisions, refer to note 26 - Provisions.

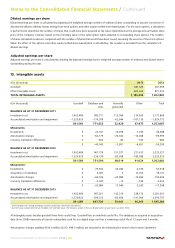

Internally generated technology, databases and tools

Internally generated technology, databases and tools are capitalised in accordance with IAS 38. Assumptions and judgements are made with

regard to assessing the expected future economic benefits, the economic useful life and the level of completion of the databases. At the point

where activities no longer relate to development but to maintenance, capitalisation is discontinued. For additional information, refer to note

13 - Intangible assets.

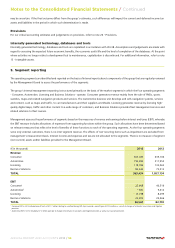

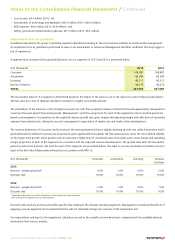

5. Segment reporting

The operating segments are identified and reported on the basis of internal reports about components of the group that are regularly reviewed

by the Management Board to assess the performance of the segments.

The group's internal management reporting is structured primarily on the basis of the market segments in which the four operating segments

- Consumer, Automotive, Licensing and Business Solutions - operate. Consumer generates revenue mainly from the sale of PNDs, sports

watches, maps and related navigation products and services. The Automotive business unit develops and sells navigation systems, services

and content, such as maps and traffic, to car manufacturers and their suppliers worldwide. Licensing generates revenue by licensing high-

quality digital maps, traffic and other content to a wide range of customers, and Business Solutions provides fleet management services and

related solutions to fleet owners.

Management assesses the performance of segments based on the measures of revenue and earnings before interest and taxes (EBIT), whereby

the EBIT measure includes allocations of expenses from supporting functions within the group. Such allocations have been determined based

on relevant measures that reflect the level of benefits of these functions to each of the operating segments. As the four operating segments

serve only external customers, there is no inter-segment revenue. The effects of non-recurring items such as impairment are excluded from

management's measurement basis. Interest income and expenses and tax are not allocated to the segments. There is no measure of segment

(non-current) assets and/or liabilities provided to the Management Board.

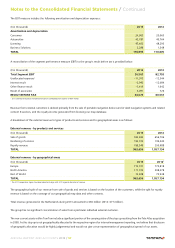

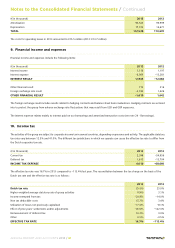

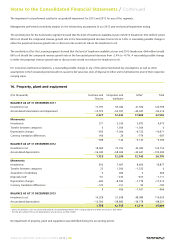

(€ in thousands) 2013 2012

Revenue

Consumer 567,020 639,106

Automotive 192,435 211,952

Licensing 119,369 133,063

Business Solutions 84,630 73,013

TOTAL 963,454 1,057,134

EBIT

Consumer125,668 40,516

Automotive2– 631 9,412

Licensing – 13,298 8,299

Business Solutions 24,822 24,566

TOTAL 36,561 82,793

1Consumer EBIT in 2012 included one-off costs of €11.7 million relating to a malfunctioning GPS chip issue and a one-off gain of €10.5 million as a result of changes of estimates in our claims and litigation

provision.

2Automotive EBIT in 2012 included a €7.2 million gain due to changes of estimates in our claims and litigation provision as well as our warranty provision.

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 56