TomTom 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

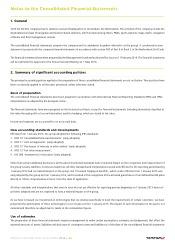

Interest income and expense

Interest income and expense are recognised using the effective interest method.

Leasing

The group leases certain property, plant and equipment. Leases are classified as finance leases whenever the terms of the lease transfer

substantially all the risks and rewards of ownership to the group. All other leases are classified as operating leases. Rentals payable under

operating leases are charged to income on a straight-line basis over the term of the relevant lease. Benefits received and receivable as an

incentive to enter into an operating lease are also spread on a straight-line basis over the lease term.

Derivative financial instruments and hedging activities

All derivative financial instruments are classified as current or non-current assets or liabilities based on their maturity dates and are accounted

for at trade date. Derivatives are initially and subsequently measured at fair value. The group measures all derivative financial instruments

using quoted prices for similar instruments or using valuation techniques with maximum use of market inputs. Gains or losses arising from

changes in fair value of derivatives are recognised in the income statement, except for derivatives designated as hedging instruments, in a

highly effective hedge relationship, for which cash flow hedge accounting is applied. Transaction costs are expensed in the income statement.

Government grants

The group receives government grants related to the research and development activities performed by the group. Government grants are

recognised at their fair value when there is a reasonable assurance that the group will comply with the conditions attached to them, and

that the grants will be received. Government grants that are receivable as compensation for expenses or losses already incurred, or for the

purpose of giving immediate financial support to the group with no future related costs, are recognised as a deduction of the related expense

in the period in which they become receivable.

Pension obligations and costs

The group operates various defined contribution plans and a defined benefit plan for a German subsidiary. This defined benefit plan is unfunded

and has no plan asset. For defined contribution plans, the group pays contributions to publicly or privately administered pension insurance

plans on a mandatory, contractual or voluntary basis. The group has no further payment obligations once the contributions have been paid.

The contributions are recognised as employee benefit expenses when service has been rendered to the group. Prepaid contributions are

recognised as an asset to the extent that a cash refund or reduction of future payments is available.

In relation to the defined benefit plan, the group recognised a liability on the balance sheet based on the present value of the defined benefit

obligation at the end of the reporting period. The defined benefit obligation is calculated annually using the projected unit credit method.

The present value of the defined benefit obligation is determined by discounting the estimated future cash outflows using interest rates of

high-quality corporate bonds that are denominated in the currency in which the benefits will be paid, and that have terms to maturity

approximating to the terms of the related pension obligation.

Service costs and interest costs are charged to the pension expenses. Actuarial gains and losses are charged or credited to equity in 'Other

comprehensive income' in the period in which they arise.

In Italy, employees are paid a staff leaving indemnity on termination of employment. This is a statutory payment based on Italian civil law. An

amount is accrued each year based on the employee's remuneration and previously revalued accruals. The indemnity has the characteristics

of a defined contribution obligation and is an unfunded, but fully provided liability. The costs of providing benefits under the plans are

determined separately for each plan.

Stock compensation expense

The group operates a number of equity-settled plans, as well as a cash-settled performance share plan.

Equity-settled plans

Equity-settled share-based payments are measured at fair value at the date of grant. The fair value determined at the grant date of the equity-

settled share-based payments is expensed on a straight-line basis over the vesting period. The costs are determined based on the fair value

of the granted instruments and the number expected to vest. At each balance sheet date, the entity revises its estimates of the number of

instruments expected to vest.

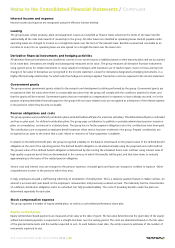

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 49