TomTom 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

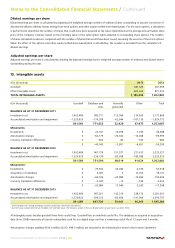

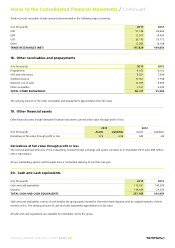

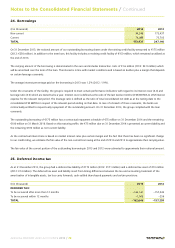

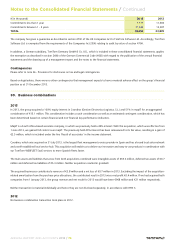

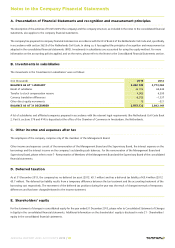

The movement of deferred tax is as follows:

(€ in thousands) Stock compensation

expense

Other Intangible

assets

Provisions Assessed

losses

Total

BALANCE AS AT 31 DECEMBER 2011 82 337 –225,089 4,150 48,740 –171,780

(Charged)/released to income 882 –606 16,100 4,596 –7,268 13,704

(Charged)/released to equity 0 0 0 503 0 503

Currency translation differences 0 –61 1,860 –134 –1,391 274

BALANCE AS AT 31 DECEMBER 2012 964 –330 –207,129 9,115 40,081 –157,299

Acquisition of subsidiaries 0 0 –5,279 0 685 –4,594

(Charged)/released to income 362 –265 15,794 –2,662 –14,841 –1,612

Currency translation differences 0 0 1,527 –215 147 1,459

BALANCE AS AT 31 DECEMBER 2013 1,326 –595 –195,087 6,238 26,072 –162,046

Deferred tax balances are presented in the balance sheet as follows:

(€ in thousands) 2013 2012

Deferred tax assets 9,681 13,610

Deferred tax liabilities –171,727 –170,909

TOTAL –162,046 –157,299

The group has in some jurisdictions tax losses carry forwards which have not been recognised as deferred tax assets as the amounts as well

as possible future recovery of these losses against future taxable income are uncertain. As at 31 December 2013, these losses amounted to

approximately €100 million.

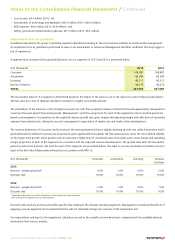

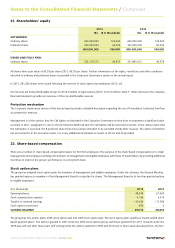

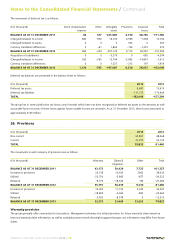

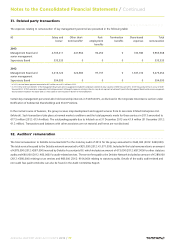

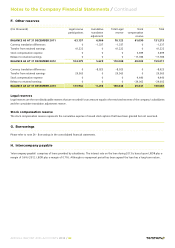

26. Provisions

(€ in thousands) 2013 2012

Non-current 55,857 48,268

Current 23,975 33,192

TOTAL 79,832 81,460

The movements in each category of provisions are as follows:

(€ in thousands) Warranty Claims &

litigations

Other Total

BALANCE AS AT 31 DECEMBER 2011 43,173 50,429 7,725 101,327

Increases in provisions 25,138 10,435 2462 38,035

Utilised –23,750 –5,895 –877 –30,522

Released –8,770 –18,530 –80 –27,380

BALANCE AS AT 31 DECEMBER 2012 35,791 36,439 9,230 81,460

Increases in provisions 19,022 11,105 5,320 35,447

Utilised –18,805 –5,362 –895 –25,062

Released –3,435 –8,578 0 –12,013

BALANCE AS AT 31 DECEMBER 2013 32,573 33,604 13,655 79,832

Warranty provision

The group generally offers warranties for its products. Management estimates the related provision for future warranty claims based on

historical warranty claim information, as well as evaluating recent trends that might suggest that past cost information may differ from future

claims.

Notes to the Consolidated Financial Statements / Continued

ANNUAL REPORT AND ACCOUNTS 2013 / 73