TomTom 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 73

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

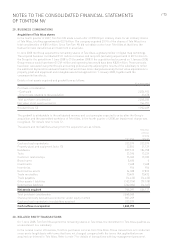

29. BUSINESS COMBINATIONS

Acquisition of Tele Atlas shares

In the fourth quarter of 2007, TomTom NV made a cash offer of €30.00 per ordinary share for all ordinary shares

of Tele Atlas, totalling approximately €2.9 billion. The company acquired 29.9% of the shares of Tele Atlas for a

total consideration of €816 million. Since TomTom NV did not obtain control over Tele Atlas at that time, the

transaction was classified as an investment in associate.

In June 2008 the Group acquired the remaining shares of Tele Atlas, a global provider of digital map technology.

The acquired business contributed €121 million in revenue and net profit (excluding impairment) of €5.9 million to

the Group for the period from 1 June 2008 to 31 December 2008. If the acquisition had occurred on 1 January 2008,

Group revenue would have been €1,749 million and operating loss would have been €820 million. These amounts

have been calculated using the Group’s accounting policies and by adjusting the results of the subsidiary to reflect

the additional depreciation and amortisation that would have been charged assuming the fair value adjustments to

property, plant and equipment and intangible assets had applied from 1 January 2008, together with the

consequential tax effects.

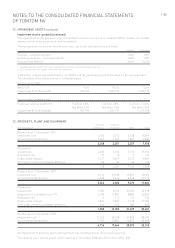

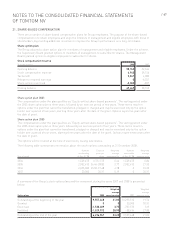

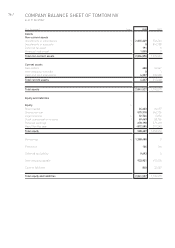

Details of net assets acquired and goodwill are as follows.

(€ in thousands)

Purchase consideration:

– Cash paid 2,834,902

– Direct costs relating to the acquisition 33,678

Total purchase consideration 2,868,580

Fair value of net assets acquired 966,091

Goodwill (note 12) 1,902,489

The goodwill is attributable to the anticipated revenue and cost synergies expected to arise after the Group’s

acquisition and the assembled workforce of Tele Atlas. In the fourth quarter of 2008, an impairment charge was

recognised. For details refer to note 12.

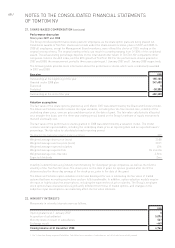

The assets and the liabilities arising from the acquisition are as follows.

Tele Atlas

previous

carrying

Fair value amount

Cash and cash equivalents 233,579 233,579

Property plant and equipment (note 13) 22,852 21,129

Databases 839,519 186,098

Tools 33,390 13,239

Customer relationships 75,000 13,183

Brand name 8,600 0

Investments 7,608 7,608

Inventories 956 956

Deferred tax assets 54,388 17,810

Trade receivables 70,409 70,432

Trade payables (14,422) (14,422)

Other assets / liabilities (103,704) (79,108)

Deferred tax liabilities (262,084) (14,367)

Net assets acquired 966,091 456,137

Total purchase consideration 2,868,580

Shares previously held and accounted for under equity method 801,209

Cash and cash equivalents in subsidiary acquired 233,579

Cash outflow on acquisition 1,833,792

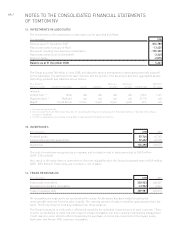

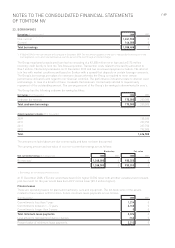

30. RELATED PARTY TRANSACTIONS

On 1 June 2008, TomTom NV acquired the remaining shares in Tele Atlas, the investment in Tele Atlas qualifies as

an investment in a subsidiary.

In the normal course of business, TomTom purchases services from Tele Atlas. These transactions are conducted

on an arm’s length basis with terms that have not changed compared with the terms that applied before we

acquired our interest in Tele Atlas. Refer to note 7 for details of transactions with key management personnel.