TomTom 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

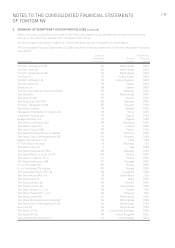

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Intangible assets (continued)

Intangible assets acquired in a business combination (continued)

Other intangible assets

Intangible assets acquired in a business combination are identified and recognised separately from goodwill

where they satisfy the definition of an intangible asset and their fair values can be measured reliably. The cost of

such intangible assets is their fair value at the acquisition date. Subsequent to initial recognition, intangible

assets acquired in a business combination are reported at cost less accumulated amortisation and accumulated

impairment losses, on the same basis as intangible assets acquired separately.

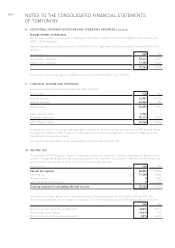

Amortisation is recorded on a straight-line basis over the estimated useful economic lives of the assets as

follows:

Databases and tools 10-20 years

Brand name 20 years

Customer relationships 20-27 years.

Customer relationships include customers for Tele Atlas maps, there is a high cost to change map providers and

historically there is a high customer retention.

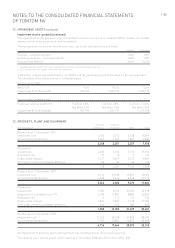

Property, plant and equipment

Property, plant and equipment are stated at historical cost less accumulated depreciation and impairment

charges. Depreciation is recorded on a straight-line basis over the estimated useful lives of the assets as follows:

Furniture and fixtures 4-10 years

Computer equipment and hardware 2-4 years

Vehicles 4 years

Tools and moulds 1-2 years.

The costs of tools and moulds used to manufacture the Group’s products are capitalised within property, plant

and equipment, and depreciated over their estimated useful lives, which is usually less than a year.

The estimated useful lives, residual values and depreciation methods are reviewed at each year end, with the

effect that any changes in estimate are accounted for on a prospective basis.

The gain or loss arising on disposal or retirement of an item of property, plant and equipment is determined as

the difference between the sales proceeds and the carrying amount of the asset and is recognised in profit or

loss.

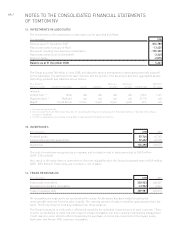

Impairment of tangible and intangible assets

Assets, such as goodwill, that have an indefinite useful life are not subject to amortisation and are tested

annually for impairment. Assets that are subject to amortisation are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is

recognised for the amount by which the asset’s carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset’s fair value, less costs to sell and value in use. In assessing

value in use, the estimated future cash flows are discounted to their present value, using a post-tax discount rate

that reflects current market assessments of the time-value of money and the risks specific to the asset for which

the estimates of future cash flows have not been adjusted.

For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately

identifiable cash flows (cash-generating units).

An impairment loss is recognised immediately in profit or loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a revaluation decrease.

Non-financial assets, other than goodwill that suffered an impairment, are reviewed for possible reversal of the

impairment at each reporting date.

Financial assets

The Group classifies its financial assets in the following categories: at fair value through profit or loss and loans

and receivables. The classification depends on the purpose for which the financial assets were acquired.

Management determines the classification of its financial assets at initial recognition. The fair values and

classification of the financial instruments used by the Group are disclosed in note 32.