TomTom 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 67

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

21. SHARE-BASED COMPENSATION

There are a number of share-based compensation plans for Group employees. The purpose of the share-based

compensation is to retain employees and align the interests of management and eligible employees with those of

shareholders, by providing additional incentives to improve the Group’s performance on a long-term basis.

Share option plan

The Group adopted a share option plan for members of management and eligible employees. Under the scheme,

the Supervisory Board granted options to members of management to subscribe for shares. The Management

Board granted options to eligible employees to subscribe for shares.

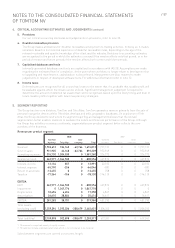

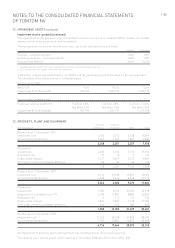

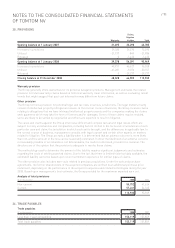

Stock compensation reserve

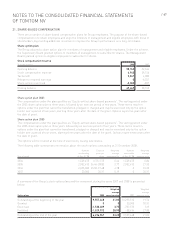

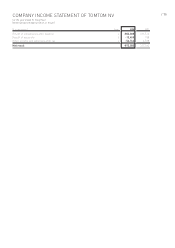

(€ in thousands) 2008 2007

Opening balance 58,765 32,364

Stock compensation expense 6,940 29,156

Tax benefit 5,847 4,083

Release to retained earnings 0-6,031

Share options exercised -2,083 -807

Closing balance 69,469 58,765

Share option plan 2003

The compensation under the plan qualifies as “Equity-settled share-based payments”. The vesting period under

the 2003 share option plan is three years, followed by an exercise period of two years. These terms result in

options under the plan that cannot be transferred, pledged or charged and may be exercised only by the option

holder over a period of two years, starting three years after the date of the grant. Options expire five years after

the date of grant.

Share option plan 2005

The compensation under the plan qualifies as “Equity-settled share-based payments”. The vesting period under

the 2005 share option plan is three years followed by an exercise period of four years. These terms result in

options under the plan that cannot be transferred, pledged or charged and may be exercised only by the option

holder over a period of four years, starting three years after the date of the grant. Options expire seven years after

the date of grant.

The options will be covered at the time of exercise by issuing new shares.

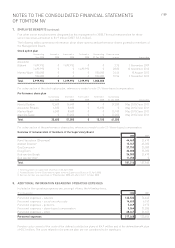

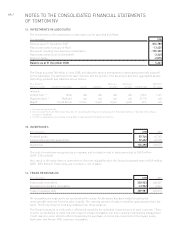

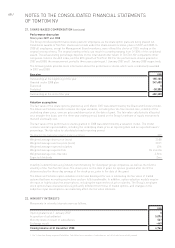

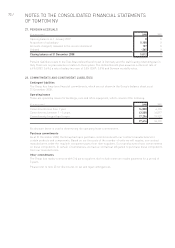

The following table summarises information about the stock options outstanding at 31 December 2008.

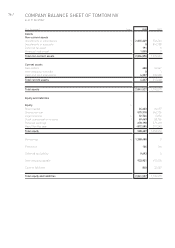

Number Exercise Weighted Number Weighted

outstanding price per average exercisable average

Year of grant at Dec 31 ‘08 share remaining life at Dec 31 ‘08 exercise price

2004 1,529,475 0.75-3.75 0.44 1,529,475 0.84

2005 2,902,492 26.44-28.82 3.77 2,902,492 27.92

2006 2,035,000 25.50-37.68 4.78 0 33.30

2007 30,000 30.91 5.19 0 30.91

A summary of the Group’s stock option plans and the movement during the years 2007 and 2008 is presented

below.

Weighted Weighted

average average

Option plans 2008 exercise price 2007 exercise price

Outstanding at the beginning of the year 9,557,648 21.02 10,293,512 19.74

Granted 0030,000 30.91

Exercised -1,530,689 3.75 -707,370 1.29

Forfeited -1,529,992 28.90 -58,494 27.85

Outstanding at the end of the year 6,496,967 23.23 9,557,648 21.02