TomTom 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 61

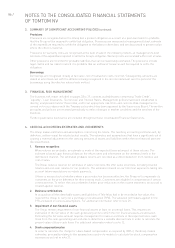

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

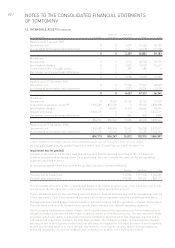

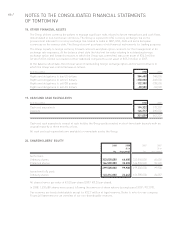

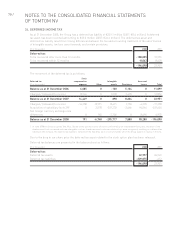

10. INCOME TAX (continued)

2008 2007

Dutch tax rate 25.5% 25.5%

Higher weighted average statutory rate on group activities 0.9% 1.1%

Permanent differences -4.5% 0.0%

Non tax deductible share options 5.7% 0.0%

Non tax deductible result associates 1.5% 0.0%

Other 1.7% -0.1%

Effective tax rate (excluding impairment) 30.8% 26.5%

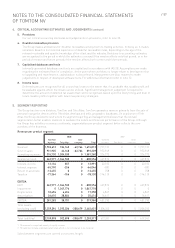

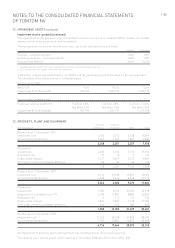

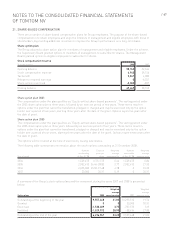

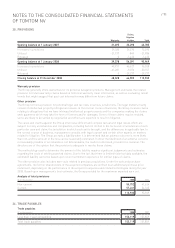

11. EARNINGS PER SHARE

The calculation of basic and diluted earnings per share is based on the following data.

2008 2007

Earnings (€ in thousands)

Earnings (net result attributable to equity holders) -872,585 317,242

Number of shares

Weighted average number of ordinary shares for basic earnings per share 122,467,193 113,759,244

Effect of dilutive potential ordinary shares

Share options 998,223 5,476,417

Weighted average number of ordinary shares for diluted earnings per share 123,465,416 119,235,661

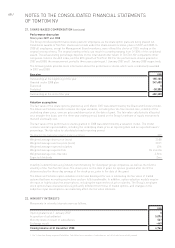

Basic earnings per share

Basic earnings per share is calculated by dividing the profit attributable to equity holders of the company by the

weighted average number of ordinary shares outstanding during the year.

Diluted earnings per share

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares

outstanding to assume conversion of all potential dilutive ordinary shares. The company has one category of

potential dilutive ordinary shares: share options. For these share options, a calculation is performed to determine

the number of shares that could have been acquired at fair value (determined as the average annual market

share price of the company’s shares), based on the monetary value of the subscription rights attached to

outstanding share options. The number of shares calculated as above is compared with the number of shares

that would have been issued, assuming the exercise of the share options. Given the company incurred losses in

2008, this results in the calculation being anti-dilutive and hence, the same number of shares and net loss per

share is presented for Basic and Diluted earnings per share.

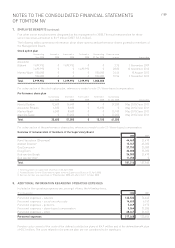

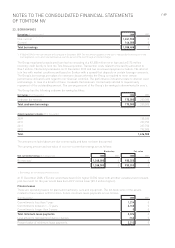

12. INTANGIBLE ASSETS

(€ in thousands) 2008 2007

Goodwill 854,713 0

Other intangible assets 1,011,194 56,344

Total intangible assets 1,865,907 56,344