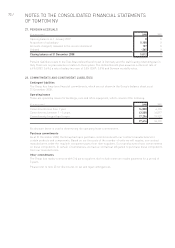

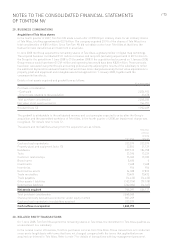

TomTom 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

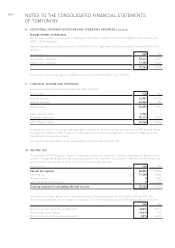

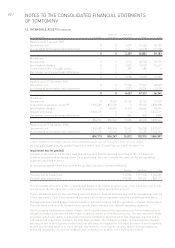

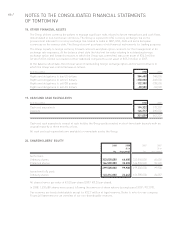

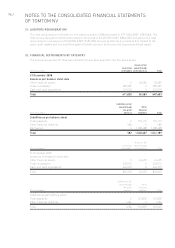

18. OTHER FINANCIAL ASSETS

The Group utilises currency derivatives to manage significant risks related to future transactions and cash flows

denominated in non-functional currencies. The Group is exposed to USD currency exchange risk on the

procurement side and to currency exchange risk related to sales in GBP, USD, AUD and some European

currencies on the revenue side. The Group does not purchase or hold financial instruments for trading purposes.

The Group is party to foreign currency forward contracts and plain option contracts for the management of its

exchange rate exposures. At the balance sheet date the total net fair value relating to outstanding foreign

exchange option and forward contracts to which the Group was committed, was a net asset of €36.0 million

(of which €0.6 million is included in other liabilities) compared to a net asset of €25.0 million in 2007.

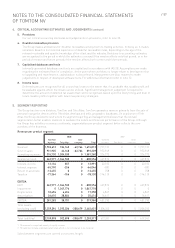

At the balance sheet date, the notional value of outstanding foreign exchange option and forward contracts to

which the Group was committed was as follows.

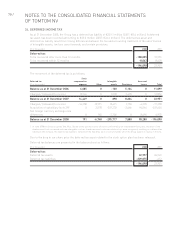

(€ in thousands) 2008 2007

Rights and obligations to buy US dollars 384,400 748,000

Rights and obligations to sell US dollars -350,000 -348,000

Rights and obligations to sell GB pounds -132,900 -138,500

Rights and obligations to sell AU dollars -38,500 -96,500

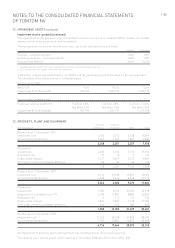

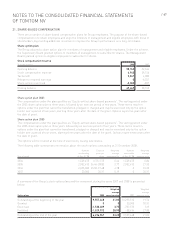

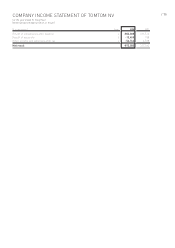

19. CASH AND CASH EQUIVALENTS

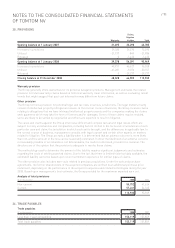

(€ in thousands) 2008 2007

Cash and equivalents 194,322 173,337

Deposits 126,717 290,002

321,039 463,339

Cash and cash equivalents consist of cash held by the Group partly invested in short-term bank deposits with an

original maturity of three months or less.

All cash and cash equivalents are available for immediate use by the Group.

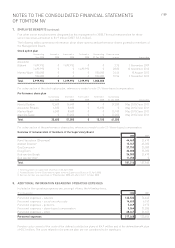

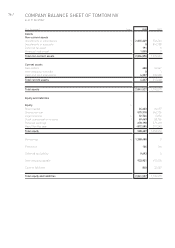

20. SHAREHOLDERS’ EQUITY

2008 2008 2007 2007

(€ in (€ in

No. thousands) No. thousands)

Authorised:

Ordinary shares 333,000,000 66,600 333,000,000 66,600

Preferred shares 166,500,000 33,300 166,500,000 33,300

499,500,000 99,900 499,500,000 99,900

Issued and fully paid:

Ordinary shares 123,316,000 24,663 121,785,000 24,357

All shares have a par value of €0.20 per share (2007: €0.20 per share).

In 2008, 1,530,689 shares were issued following the exercise of share options by employees (2007: 707,370).

Our reserves are freely distributable except for €32.7 million of legal reserves. Refer to note 6 in our company

Financial Statements for an overview of our non-distributable reserves.