TomTom 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38 / BUSINESS RISKS (CONTINUED)

Supply chain

Our supply chain and distribution model is outsourced.

This increases our ability to scale up or down the supply

chain, while limiting capital expenditure risks. We

depend on a limited number of third parties and in

certain instances sole suppliers, for component supply

and manufacturing. Any disruption to, or termination of

our relationships with third party manufacturers,

suppliers or distributors, or reduction in their ability to

meet our needs, could have a material adverse effect on

our business.

We continually evaluate the risks associated with

outsourcing our supply chain. Our engineering and

quality assurance departments perform regular audits

and ongoing reviews of our manufacturing partners and

component suppliers.

The supply disruption risk for our highest volume

products is mitigated by dual-sourcing production from

two different manufacturing partners. In order to limit

component supply risks, we perform de-risking of

hardware design by evaluating component supply at the

earliest possible stage of the design process. We

mitigate supply disruption risks through actively

minimising the number of single source components. We

have taken out insurance for our lost market opportunity

in the event that a natural catastrophe significantly

impairs our manufacturing capabilities.

FINANCIAL RISKS

Trade credit

Trade receivables relate mostly to our wholesale

customers. Our exposure to credit risk is influenced

mainly by the individual characteristics of each customer.

There is some concentration of credit risk with respect

to trade receivables, but this is actively monitored by

management. For our PND business, most of our

exposure to credit risk in Europe, US, Asia, Australia and

Africa is further mitigated by the purchase of credit

insurance.

We have established a credit policy under which each

new customer is analysed individually for

creditworthiness before our standard payment and

delivery terms and conditions are offered. We take into

account the view of external rating agencies when

determining creditworthiness.

Credit limits are established for each customer and then

reviewed on a quarterly basis, or more frequently if

required. In monitoring customer credit risk, customers

are grouped according to their credit characteristics.

Customers who are graded “high risk”, or who otherwise

fail to meet our benchmark creditworthiness, are placed

on a restricted customer list and we only do business

with these on a pre-payment basis.

Total bad debts currently represent 0.8% of sales

revenue.

Certain financial assets, such as trade receivables, are

individually assessed for impairment. When assets are

considered not to be individually impaired, these assets

are subsequently assessed for impairment on a

collective basis. Evidence of impairment could include

our past experience of debt collecting and/or changes in

economic conditions that have an effect on receivables.

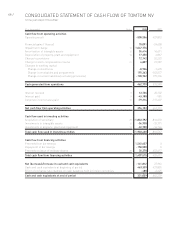

Liquidity

Our approach to managing liquidity is to ensure, as far

as possible, that we will always have sufficient liquidity to

meet our liabilities when they fall due, under both

normal and stressed conditions, without incurring

unacceptable losses or risking damage to our reputation.

We consistently monitor future cash flow requirements

to ensure we have sufficient cash on demand to meet

expected operational expenses, including the servicing of

financial obligations.

Management monitors rolling forecasts of the Group’s

liquidity reserve which comprises cash and cash

equivalents (note 19) and an undrawn credit facility of

€175 million. An adequate liquidity position is

maintained via continuously monitoring forecasted and

actual cash flows, and matching the maturity profiles of

financial assets and liabilities. The potential impact of

extreme circumstances that cannot reasonably be

predicted, such as natural disasters, have been

excluded. The contractual maturity of our trade and

other liabilities is less than one year. Our outstanding

borrowings amount to €1,427 million, of which 10% is

due within 12 months (note 23).

Loan covenants

TomTom Group incurred an acquisition debt of €1,585

million on 10 June 2008. The facility terminates on

31 December 2012 and has an annual repayment

schedule. The first repayment, of 10% of the Principal,

was made on 31 December 2008 and further repayments

are scheduled, each year on 31 December, of 10%,15%,

15% and 50% of the Principal respectively. The Group’s

borrowings are subject to covenant clauses whereby the

Group is required to meet certain performance indicators

with regard to our financial condition. The performance

indicators relate to interest cover and leverage. In case of

a breach of these covenants the banks are contractually

entitled to request early repayment of the outstanding

amount (€1,427 million as at 31 December 2008).

Based upon the Group’s plans for 2009, management

expects to comply with the loan covenants. However,

given the uncertainties in the wider macro economic

environment and their knock on effect on consumer

spending, scenarios can be envisaged where the loan

covenants could be breached. The company continues

to evaluate options aimed at remaining within its loan

covenants under a variety of scenarios, which could

include renegotiating the terms of the facility in isolation

or in combination with other actions.