TomTom 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

1. GENERAL

TomTom NV (the “company”) has its statutory seat and headquarters in Amsterdam, the Netherlands. The

activities of the company include the development and sale of navigation solutions and digital maps. The primary

focus of these activities is on personal navigation.

The consolidated Financial Statements of the company for the year ended 31 December 2008 comprise the

company and its subsidiaries (together referred to as “the Group”).

The Financial Statements have been prepared by the Board of Management and authorised for issue on

23 February 2009. They will be submitted for approval to the Annual General Meeting of Shareholders

on 28 April 2009.

In accordance with section 402 of Part 9 of Book 2 of the Netherlands Civil Code, a condensed income statement

is included in the company Financial Statements.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these consolidated Financial Statements are set

out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

Basis of preparation

The consolidated Financial Statements have been prepared in accordance with International Financial Reporting

Standards as adopted by the EU.

The Financial Statements have been prepared on the historical cost basis, except for derivatives and financial

instruments classified as held for trading or available for sale, which are stated at fair value.

Unless otherwise indicated, assets and liabilities are carried at their nominal value. Income and expenses are

accounted for on an accrual basis.

Use of estimates

The preparation of these Financial Statements requires that the Group makes assumptions, estimates and

judgements that affect the reported amounts of assets, liabilities and disclosure of contingent assets and

liabilities as of the date of the consolidated Financial Statements and the reported amounts of revenues and

expenses during the reporting period. Actual results may differ from those estimates. Estimates are used when

accounting for items and matters such as revenue recognition, allowances for uncollectible accounts receivable,

inventory obsolescence, product warranty costs, depreciation and amortisation, asset valuations, impairment

assessments, taxes, earn-out provisions, other provisions, stock-based compensation and contingencies. The

estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are

recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of

revision and the future periods if the revision affects both current and future periods. The principal accounting

policies adopted are set out below.

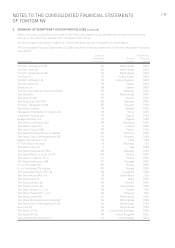

Adoption of new and revised standards

Standards and Interpretations effective in the current period that have been adopted by the Group:

• IFRIC 14 “ The limit on a defined benefit asset”

• IFRIC 11 “Group and Treasury share transactions”

• IAS 39 & IFRS 7 “Amendments to IAS 39 & IFRS 7”

All other Standards and Interpretations that were in issue but not yet effective for reporting periods beginning on

1 January 2008 have not yet been adopted. The Group anticipates that the adoption of these Standards and

Interpretations will have no material impact on the Financial Statements of the Group in future periods.

Basis of consolidation

The consolidated Financial Statements incorporate the Financial Statements of the company and entities

controlled by the company (its subsidiaries). Control is achieved where the company has the power to govern the

financial and operating policies of an entity so as to obtain benefits from its activities.

The results of subsidiaries acquired during the year are included in the Consolidated Income Statement from the

effective date of acquisition.