Supercuts 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

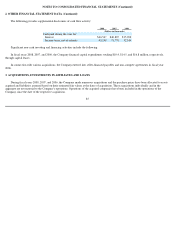

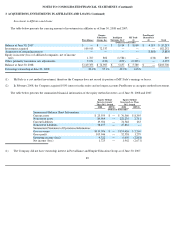

3. ACQUISITIONS, INVESTMENTS IN AFFILIATES AND LOANS (Continued)

Company's effective ownership interest increased to 55.1 percent related to the buyout of EEG's equity interest shareholder. In connection with

the buyout, the Company advanced EEG, an additional $21.4 million. Total outstanding debt was $36.4 million at June 30, 2008. The exposure

to loss related to the Company's involvement with EEG is the carrying value of the investment and the outstanding loans.

The Company will continue to account for the investment in EEG under the equity method of accounting as Empire Beauty School retains

majority voting interest and has full responsibility for managing EEG. During the fiscal year ended June 30, 2008 the Company recorded

$0.9 million of interest income related to the loans and advances. During the fiscal year ended June 30, 2008, the Company recorded

$0.8 million of equity earnings related to its investment in EEG.

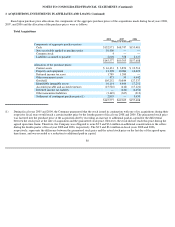

Investment in Intelligent Nutrients, LLC

The Company holds a 49.0 percent interest in Intelligent Nutrients, LLC. The Company's ownership percentage decreased from

50.0 percent to 49.0 percent during the three months ended March 31, 2008 due to the issuance of additional shares by Intelligent Nutrients, LLC

to the other investor. The Company is accounting for this investment under the equity method. Intelligent Nutrients, LLC currently carries a wide

variety of organic, harmonically grown™ products, including dietary supplements, coffees, teas and aromatics. Additionally, a full line of

professional hair care and personal care products is in development and is expected to be available in the fall of calendar year 2008. These

products will be offered at the Company's corporate and franchise salons, and eventually in other independently owned salons. During the fiscal

year ended June 30, 2008 the Company recorded $1.6 million of equity losses related to its investment in Intelligent Nutrients, LLC. The

exposure to loss related to the Company's involvement with Intelligent Nutrients, LLC is the carrying value of the investment. Subsequent to

June 30, 2008, the Company completed $3.0 million of loans to Intelligent Nutrients, LLC.

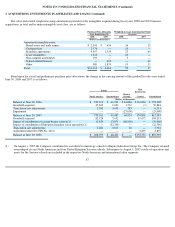

Investment in MY Style

In April 2007, the Company purchased exchangeable notes issued by Yamano Holding Corporation and a loan obligation of a Yamano

Holdings subsidiary, Beauty Plaza Co. Ltd., for an aggregate amount of 1.3 billion JPY ($11.3 million USD). A portion of the notes are

exchangeable for approximately 14.8 percent of the outstanding shares of MY Style, a subsidiary of Yamano Holdings. The exchangeable

portion of the notes is accounted for as a cost method investment. The notes, excluding the exchangeable portion are recorded in the condensed

consolidated balance sheet as current assets and long-term assets of $3.9 and $2.0 million, respectively at June 30, 2008. The notes are due in

May of fiscal years 2009 through 2013. The Company recorded $0.2 million in interest income related to the exchangeable notes and loan

obligation during the fiscal year ended June 30, 2008. In connection with the purchase of the exchangeable notes and loan obligation, the parties

also entered into an agreement with respect to their joint pursuit of opportunities relating to retail hair salons in Asia. The Company did not

estimate the fair value of MY Style as of June 30, 2008 as there were no identified events or changes in circumstances that the Company was

aware of that would have had a significant adverse affect on the fair value of MY Style.

91