Supercuts 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

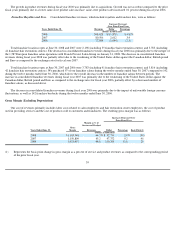

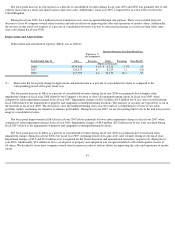

respectively. The residual goodwill generated by fiscal year 2008, 2007, and 2006 acquisitions totaled $16.1, $50.8, and $127.3 million,

respectively.

Self-insurance Accruals

We use a combination of third party insurance and self-insurance for a number of risks including workers' compensation, health insurance,

employment practice liability and general liability claims. The liability reflected on our Consolidated Balance Sheet represents an estimate of the

undiscounted ultimate cost of uninsured claims incurred as of the balance sheet date. In estimating this liability, loss development factors utilize

historical data to project the future development of incurred losses. Loss estimates are adjusted based upon actual claims settlements and

reported claims. Although we do not expect the amounts ultimately paid to differ significantly from the estimates, self-insurance accruals could

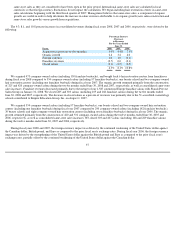

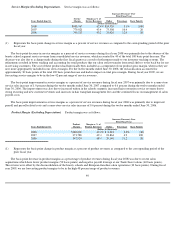

be affected if future claims experience differs significantly from the historical trends and actuarial assumptions. We recorded a positive

adjustment to our self-insurance accruals of $7.1 million ($4.3 million net of tax) and $10.2 million ($6.7 million net of tax) during fiscal years

2008 and 2007, respectively. The reserve reduction relates primarily to an actuarial change in estimate in prior years workers' compensation

claims reserves as a result of continued improvement of our new safety and return-to-work programs over the recent years as well as changes in

state laws. In fiscal 2006 we increased self-insurance accruals related to prior year's claims by $1.0 million. During fiscal years 2008, 2007, and

2006, our insurance costs were $46.8, $45.2 and $52.5 million, respectively.

Income Taxes

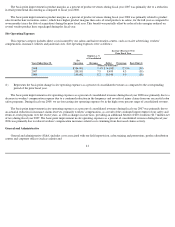

In determining income for financial statement purposes, management must make certain estimates and judgments. These estimates and

judgments occur in the calculation of certain tax liabilities and in the determination of the recoverability of certain deferred tax assets, which

arise from temporary differences between the tax and financial statement recognition of revenue and expense.

Management must assess the likelihood that deferred tax assets will be recovered. If recovery is not likely, we must increase our provision

for taxes by recording a reserve, in the form of a valuation allowance, for the deferred tax assets that will not be ultimately recoverable. Should

there be a change in our ability to recover our deferred tax assets, our tax provision would increase in the period in which it is determined that

the recovery is not more likely than not.

In addition, the calculation of tax liabilities involves dealing with uncertainties in the application of complex tax regulations. Management

recognizes potential liabilities for anticipated tax audit issues in the United States and other tax jurisdictions based on our estimate of whether

and the extent to which additional taxes will be due. If payment of these amounts ultimately proves to be unnecessary, the reversal of the

liabilities would result in tax benefits being recognized in the period when we determine the liabilities are no longer necessary. If our estimate of

tax liabilities proves to be less than the ultimate assessment, a further charge to expense would result. In the United States, fiscal years 2005 and

after remain open for federal tax audit. For state tax audits, the statute of limitations generally spans three to four years, resulting in a number of

states remaining open for tax audits dating back to fiscal year 2004. However, the company is under audit in a number of states in which the

statute of limitations has been extended to fiscal years 2000 and forward. Internationally (including Canada), the statute of limitations for tax

audits varies by jurisdiction, but generally ranges from three to five years.

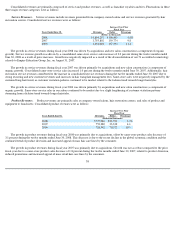

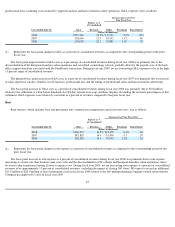

We adopted the provisions of FASB Interpretation ("FIN") No. 48, Accounting for Uncertainty in Income Taxes—an Interpretation of

FASB Statement No. 109

, effective July 1, 2007. FIN No. 48 provides guidance regarding the recognition, measurement, presentation, and

disclosure in the financial statements of tax positions taken or expected to be taken on a tax return, including the decision whether to file or not

to file in a particular jurisdiction. As a result of the adoption of FIN No. 48, effective July 1, 2007, the Company recognized a $20.7 million

increase in the liability for unrecognized

33