Supercuts 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

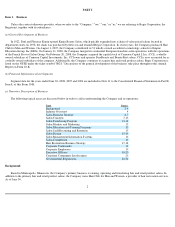

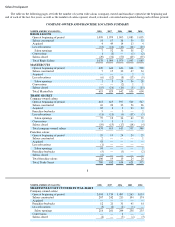

2008, the Company owned, franchised or held ownership interests in over 13,550 worldwide locations. The Company's locations consisted of

10,745 company-owned and franchise salons, 92 hair restoration centers, and 2,714 locations in which the Company maintains an ownership

interest of less than 100 percent. Each of the Company's salon concepts offer similar salon products and services and serve the mass market

consumer marketplace. The Company's hair restoration centers offer three hair restoration solutions; hair systems, hair transplants and hair

therapy, which are targeted at the mass market consumer.

The Company is organized to manage its operations based on significant lines of business—salons and hair restoration centers. Salon

operations are managed based on geographical location—

North America and international. The Company's North American salon operations are

comprised of 8,110 company-owned salons and 2,163 franchise salons operating in the United States, Canada and Puerto Rico. The Company's

international operations are comprised of 472 company-owned salons. The Company's worldwide salon locations operate primarily under the

trade names of Regis Salons, MasterCuts, Trade Secret, SmartStyle, Supercuts, Cost Cutters, and Sassoon. The Company's hair restoration

centers are located in the United States and Canada. During fiscal year 2008, the number of customer visits at the Company's company-owned

salons approximated 111 million. The Company had approximately 65,000 corporate employees worldwide during fiscal year 2008.

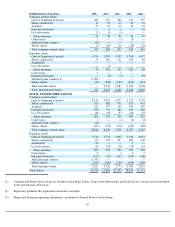

On August 1, 2007, the Company contributed 51 of its wholly-owned accredited cosmetology schools to EEG in exchange for a

49.0 percent equity interest in EEG. The investment is accounted for under the equity method. The Company recorded an impairment charge

related to this transaction of $23.0 million ($19.6 million net of tax) during the three months ended March 31, 2007.

The Company realized that in order to maximize the potential of the beauty school division, it would be necessary to invest heavily in

information technology platforms and management. The Company believes that contributing the beauty schools to EEG is the most efficient and

accretive way to achieve its goals. This transaction leverages EEG's management expertise, while enabling the Company to maintain a vested

interest in the beauty school industry. EEG is the largest beauty school operator in North America with 86 accredited cosmetology schools with

revenues of approximately $130 million annually and is overseen by the Empire Beauty School management team.

Once the integration of the Regis schools is complete, the Company expects to share in significant synergies and operating improvements.

Long-term, the Company expects this transaction to be very accretive and to add significantly more shareholder value than the $23.0 million

($19.6 million net of tax) impairment charge. In January 2008, the Company's effective ownership interest increased to 55.1 percent related to

the buyout of EEG's equity interest shareholder. The Company will continue to account for the investment in EEG under the equity method of

accounting as Empire Beauty School retains majority voting interest and has full responsibility for managing EEG. Refer to Note 3 to the

Consolidated Financial Statements for additional information.

On January 31, 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost

Salon Group in exchange for a 30.0 percent equity interest in the newly formed Provalliance entity (Provalliance). The merger with the

operations of the Franck Provost Salon Group which are also located in continental Europe, created Europe's largest salon operator with

approximately 2,300 company-owned and franchise salons as of June 30, 2008.

The Company contributed to Provalliance the shares of each of its European operating subsidiaries, other than the Company's operating

subsidiaries in the United Kingdom and Germany. The contributed subsidiaries operate retail hair salons in France, Spain, Switzerland and

several other European countries primarily under the Jean Louis David™ and Saint Algue™ brands. This transaction is expected to create

significant growth opportunities for Europe's salon brands. The Franck Provost Salon Group management structure has a proven platform to

build and acquire company-owned stores as well as a strong franchise operating group that is positioned for expansion.

3