Supercuts 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

includes rent and interest expenses) may not drop below 1.50 on a rolling four quarter basis. We were in compliance with all covenants and other

requirements of our credit agreement and senior notes as of June 30, 2008. Additionally, the credit agreements do not include rating triggers or

subjective clauses that would accelerate maturity dates.

Fiscal Year 2007

During fiscal year 2007, we neither entered into new borrowing arrangements, nor were any significant amendments made to existing

agreements. Under the terms of the April 7, 2005 amended and restated revolving credit agreement, our ratio of earnings before interest, taxes,

depreciation, amortization and rent expense (EBITDAR) to fixed charges (which includes rent and interest expenses) may not drop below 1.65

on a rolling four quarter basis. We were in compliance with all covenants and other requirements of our credit agreements and senior notes

during fiscal year 2007.

Fiscal Year 2006

During fiscal year 2006, we neither entered into new borrowing arrangements, nor were any significant amendments made to existing

agreements. Under the terms of the April 7, 2005 amended and restated revolving credit agreement, our ratio of earnings before interest, taxes,

depreciation, amortization and rent expense (EBITDAR) to fixed charges (which includes rent and interest expense) may not drop below 1.65 on

a rolling four quarter basis. We were in compliance with all covenants and other requirements of our credit agreements and senior notes during

fiscal year 2006.

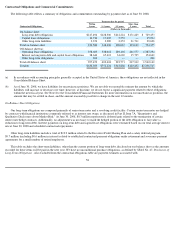

Other Financing Arrangements

Private Shelf Agreement

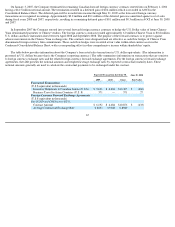

At June 30, 2008 and 2007, we had $255.2 and $189.7 million, respectively, in unsecured, fixed rate, senior term notes outstanding under a

Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from July 2008 through December 2017. The

interest rates on the notes range from 4.65 to 8.39 percent as of June 30, 2008 and 2007. In fiscal 2008, we borrowed $125.0 million, and

amended the fixed charge coverage ratio under Private Shelf Agreement.

The Private Shelf Agreement includes financial covenants including debt to earnings before interest, taxes, depreciation and amortization

(EBITDA) ratios, fixed charge coverage ratios and minimum net equity tests (as defined within the Private Shelf Agreement), as well as other

customary terms and conditions. The maturity date for the debt may be accelerated upon the occurrence of various Events of Default, including

breaches of the agreement, certain cross-default situations, certain bankruptcy related situations, and other customary events of default.

As a result of the fair value hedging activities discussed in Note 5 of Part II, Item 8 of this Form 10-K, an adjustment of approximately $0.3

and $0.9 million was made to increase the carrying value of the Company's long-term fixed rate debt at June 30, 2008 and 2007, respectively.

Acquisitions

Acquisitions are discussed throughout Management's Discussion and Analysis in this Item 7, as well as in Note 3 to the Consolidated

Financial Statements in Part II, Item 8 of this Form 10-K. The most significant of these acquisitions relates to the purchase of the hair restoration

centers; refer to Note 3 of the Consolidated Financial Statements for related pro forma information. The remainder of the acquisitions,

individually and in the aggregate, was not material to our operations. The acquisitions were funded primarily from operating cash flow, debt and

the issuance of common stock.

57