Supercuts 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QuickLinks -- Click here to rapidly navigate through this document

Exhibit 10(z)

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this " Agreement ") is made and entered into as of January 17, 2008, by and among Regis

Corporation (" Regis "), Trade Secret, Inc., a wholly-owned subsidiary of Regis (" Buyer "), Cameron Capital Investments Inc. (" Seller "),

Cameron Capital Inc. (the " Company "), Stephen Powell (an officer of the Company) (" Powell ") (with respect to Articles II, V.1, VII and IX

and Sections 4.1, 4.7, 4.8 and 8.2(f) only, as provided therein), Mackenzie Limited Partnership (an entity under the control and direction of

Duncan Robinson, an officer of the Company) (" Mackenzie ") (with respect to Articles II, V.2, VII and IX and Sections 4.1, 4.7, 4.8 and 8.2(f)

only, as provided therein), and Cameron Capital Corporation (" CCC ") (with respect to Articles VII and IX and Section 8.2(i) only, as provided

therein).

WHEREAS, Seller owns 14,758 Class A Shares of the issued and outstanding Capital Stock of the Company, and Powell and Mackenzie

each own 500 Class B non-voting Shares of the issued and outstanding Capital Stock of the Company (all of such shares representing all of the

issued and outstanding Capital Stock of the Company, and collectively referred to herein as the " Shares ");

WHEREAS, the Company owns, directly or indirectly, all of the issued and outstanding Capital Stock of Cameron Capital I Inc. (" CC1 ")

(other than Capital Stock of CC1 owned by Buyer), BeautyFirst, Inc. (" BeautyFirst ") (other than the Outside BF Interests (as defined herein))

and PureBeauty, Inc. (" PureBeauty "); and

WHEREAS, on the terms and subject to the conditions set forth in this Agreement, Buyer desires to purchase from Seller, Powell and

Mackenzie, and Seller, Powell and Mackenzie desire to sell to Buyer, all of the Shares; and

WHEREAS, to induce Buyer to enter into this Agreement, the Seller, Powell and Mackenzie are entering into this Agreement and making

their agreements as set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants, agreements and understandings contained herein and intending to be

legally bound, the parties hereto hereby agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

1.1 Definitions . For the purposes of this Agreement, the following terms have the meanings set forth below:

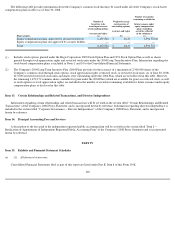

" Accounting Firm " has the meaning set forth in Section 2.4(c) .

" Affiliate " of any particular Person means any other Person controlling, controlled by or under common control with such Person. For

purposes of this definition, " control " (including the terms " controlling ," " controlled by " and " under common control with ") means the

possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the

ownership of voting securities, by contract or otherwise, and such "control" will be presumed if any Person owns 10% or more of the voting

capital stock or other ownership interests, directly or indirectly, of any other Person.

" Affiliated Group " means any affiliated group as defined in Section 1504 of the Code (or any analogous combined, consolidated or unitary

group defined under state, local or foreign income Tax law) of which the Company or any of its Subsidiaries is or has been a member.

" Applicable Rate " means the prime rate of interest as published from time to time in The Wall Street Journal .