Supercuts 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

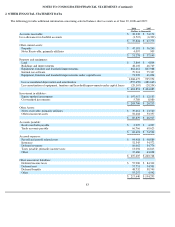

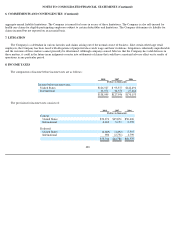

3. ACQUISITIONS, INVESTMENTS IN AFFILIATES AND LOANS (Continued)

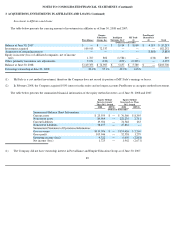

As of June 30, 2006, the Company did not maintain an interest in any equity method investees.

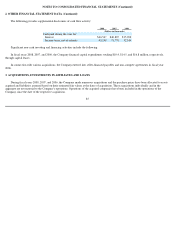

Investment in Provalliance

On January 31, 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost

Salon Group in exchange for a 30.0 percent equity interest in the newly formed Provalliance entity (Provalliance). The merger with the

operations of the Franck Provost Salon Group which are also located in continental Europe, created Europe's largest salon operator with

approximately 2,300 company-owned and franchise salons as of June 30, 2008.

The carrying value of the contributed European franchise salon operations approximated the estimated fair value of the Company's interest

in Provalliance. The Company's net asset value in its European franchise salon operations as of January 31, 2008 was recorded as an investment

in Provalliance and no gain or loss was recognized on the date of the merger.

The merger agreement contains a right (Equity Put) to require the Company to purchase additional ownership interest in Provalliance

between specified dates in 2010 to 2018. The acquisition price is determined based on the earnings before interest, taxes, depreciation and

amortization of Provalliance for a trailing twelve month period which is intended to approximate fair value. The estimated fair value of this

Equity Put has been included as a component of the Company's investment in Provalliance with a corresponding liability for the same amount.

The merger agreement also contains an option (Equity Call) whereby the Company can acquire additional ownership interest in Provalliance

between specific dates in 2018 to 2020 at an acquisition price determined consistent with the Equity Put. Any changes in the fair value of the

Equity Put in future periods thereafter, will be recorded in the Company's consolidated statement of operations.

The Company's investment in Provalliance is accounted for under the equity method of accounting. During the period from the date of the

merger on January 31, 2008 to June 30, 2008, the Company recorded $1.8 million of equity in income related to its investment in Provalliance.

The exposure to loss related to the Company's involvement with Provalliance is the carrying value of the investment and future changes in fair

value of the Equity Put. As of June 30, 2008, the identifiable intangible assets of Provalliance resulting from the merger are based on preliminary

estimates of fair value which are expected to be finalized by Provalliance during the Company's 2009 fiscal year.

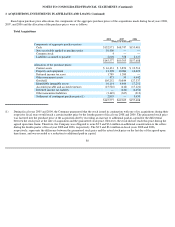

Investment in Empire Education Group, Inc.

On August 1, 2007, the Company contributed its 51 wholly-owned accredited cosmetology schools to Empire Education Group, Inc. (EEG)

in exchange for a 49.0 percent equity interest in EEG. This transaction leverages EEG's management expertise, while enabling the Company to

maintain a vested interest in the beauty school industry. Once the integration of the Regis schools is complete, the Company expects to share in

significant synergies and operating improvements. EEG operates 87 accredited cosmetology schools.

The carrying value of the contributed schools approximated the estimated fair value of the Company's interest in EEG, resulting in no gain

or loss on the date of contribution. The $40.5 million difference between the carrying amount and the Company's underlying equity in net assets

of EEG is related to the indefinite lived license and accreditation intangible assets and goodwill. The Company's investment in EEG is accounted

for under the equity method of accounting. Subsequent to August 1, 2007, the Company completed $25.0 million of loans and advances to EEG.

In January 2008, the

90