Supercuts 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

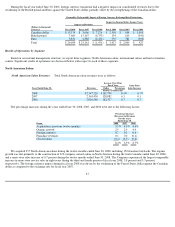

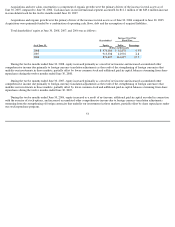

We acquired 338 North American salons during the twelve months ended June 30, 2007, including 93 franchise buybacks. The organic

growth was due primarily to the construction of 395 company-owned salons in North America during the twelve months ended June 30, 2007,

partially offset by a lower same-store sales increase of 0.1 percent during the twelve months ended June 30, 2007 as compared to 0.7 percent

during the twelve months ended June 30, 2006. The foreign currency impact during fiscal year 2007 was driven by the weakening of the United

States dollar against the Canadian dollar as compared to the exchange rate for fiscal year 2006.

We acquired 278 North American salons during the twelve months ended June 30, 2006, including 140 franchise buybacks. The organic

growth stemmed primarily from the construction of 498 company-owned salons in North America during the twelve months ended June 30,

2006. The foreign currency impact during fiscal year 2006 was driven by the weakening of the United States dollar against the Canadian dollar

as compared to the exchange rate for fiscal year 2005.

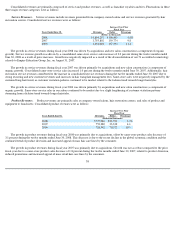

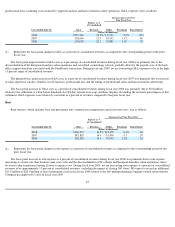

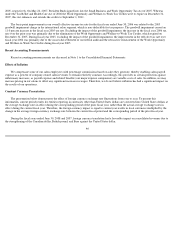

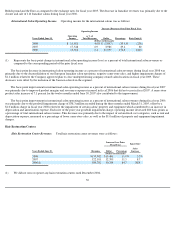

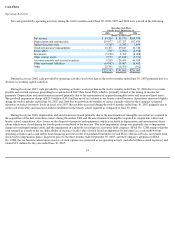

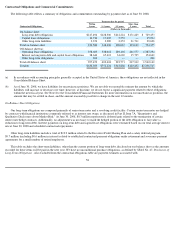

North American Salon Operating Income. Operating income for the North American salons was as follows:

(1)

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Operating

Income

Operating Income as

% of Total Revenues

Dollar

Percentage

Basis Point(1)

(Dollars in thousands)

2008

$

286,812

12.2

%

$

4,314

1.5

%

(80

)

2007

282,498

13.0

25,937

10.1

40

2006

256,561

12.6

8,481

3.4

(60

)

Represents the basis point change in North American salon operating income as a percent of total North American salon revenues as

compared to the corresponding period of the prior fiscal year.

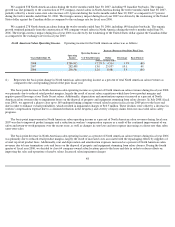

The basis point decrease in North American salon operating income as a percent of North American salon revenues during fiscal year 2008

was primarily due to reduced retail product margins, largely the result of recent salon acquisitions which have lower product margins and

negative payroll leverage at our Trade Secret salons. Additionally, depreciation and amortization expenses increased as a percent of North

American salon revenues due to impairment losses on the disposal of property and equipment stemming from salon closures. In July 2008 (fiscal

year 2009), we approved a plan to close up to 160 underperforming company

-owned salon locations in fiscal year 2009 prior to the lease end

date in order to enhance overall profitability, which resulted in impairment charges of $10.5 million. These declines were offset by a decrease in

workers' compensation expense due to a continued reduction in the frequency and severity of injury claims from our successful salon safety

programs.

The basis point improvement in North American salon operating income as a percent of North American salon revenues during fiscal year

2007 was due to improved product margins and a reduction in workers' compensation expense as a result of the continued improvement of our

safety and return-to-work programs over the recent years, as well as changes in state laws and rent expense increasing at a faster rate than salon

same-store sales.

The basis point decrease in North American salon operating income as a percent of North American salon revenues during fiscal year 2006

was primarily due to reduced retail product margins, largely the result of increased costs associated with the repackaging efforts by suppliers of

several top retail product lines. Additionally, rent and depreciation and amortization expenses increased as a percent of North American salon

revenues due to lease termination costs and losses on the disposal of property and equipment stemming from salon closures. During the fourth

quarter of fiscal year 2006, we decided to close 64 company-owned salon locations prior to the lease end date in order to refocus efforts on

improving the sales and operations of nearby salons. Increased salon impairment charges

48