Supercuts 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

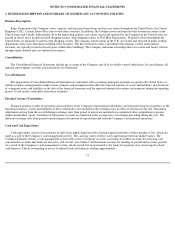

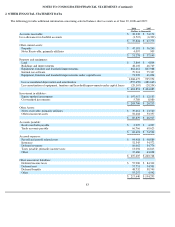

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business Description:

Regis Corporation (the Company) owns, operates and franchises hairstyling and hair care salons throughout the United States, the United

Kingdom (U.K.), Canada, Puerto Rico and several other countries. In addition, the Company owns and operates hair restoration centers in the

United States and Canada. Substantially all of the hairstyling and hair care salons owned and operated by the Company in the United States are

located in leased space in enclosed mall shopping centers, strip shopping centers or Wal-Mart Supercenters. Franchise salons throughout the

United States are primarily located in strip shopping centers. The company-owned salons in the U.K. are owned and operated in malls, leading

department stores, mass merchants and high-street locations. The hair restoration centers, including both company-owned and franchise

locations, are typically located in leased space within office buildings. The Company maintains ownership interest in salons and beauty schools

through equity-method and cost-method investments

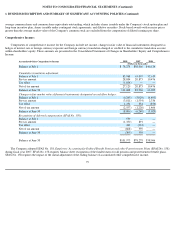

Consolidation:

The Consolidated Financial Statements include the accounts of the Company and all of its wholly-owned subsidiaries. In consolidation, all

material intercompany accounts and transactions are eliminated.

Use of Estimates:

The preparation of Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of

America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

Foreign Currency Translation:

Financial position, results of operations and cash flows of the Company's international subsidiaries are measured using local currency as the

functional currency. Assets and liabilities of these subsidiaries are translated at the exchange rates in effect at each fiscal year end. Translation

adjustments arising from the use of differing exchange rates from period to period are included in accumulated other comprehensive income

within shareholders' equity. Statement of Operations accounts are translated at the average rates of exchange prevailing during the year. The

different exchange rates from period to period impact the amount of reported income from the Company's international operations.

Cash and Cash Equivalents:

Cash equivalents consist of investments in short-term, highly liquid securities having original maturities of three months or less, which are

made as a part of the Company's cash management activity. The carrying values of these assets approximate their fair market values. The

Company primarily utilizes a cash management system with a series of separate accounts consisting of lockbox accounts for receiving cash,

concentration accounts that funds are moved to, and several "zero balance" disbursement accounts for funding of payroll and accounts payable.

As a result of the Company's cash management system, checks issued, but not presented to the banks for payment, may create negative book

cash balances. Checks outstanding in excess of related book cash balances totaling approximately

73