Supercuts 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

Hedge of Net Investments in Foreign Operations:

The Company has investments in foreign subsidiaries, and the net assets of these subsidiaries are exposed to exchange rate volatility. The

Company frequently evaluates its foreign currency exchange risk by monitoring market data and external factors that may influence exchange

rate fluctuations. As a result, the Company may engage in transactions involving various derivative instruments to hedge assets, liabilities and

purchases denominated in foreign currencies.

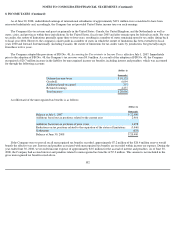

During September 2006, the Company's cross-currency swap (which had a notional amount of $21.3 million and hedged a portion of the

Company's net investment in its foreign operations) was settled, resulting in a cash outlay of $8.9 million. This cash outlay was recorded within

investing activities within the Consolidated Statement of Cash Flows. The related cumulative tax-effected net loss of $7.9 million was recorded

in accumulated other comprehensive income (AOCI) in fiscal year 2007. This amount will remain deferred within AOCI indefinitely, as the

event which would trigger its release from AOCI and recognition in earnings is the complete sale or liquidation of the Company's international

operations that the cross-

currency swap hedged. The Company currently has no intent to sell or liquidate its interest in this portion of its business

operations.

The Company's cross-currency swap was recorded at fair value within other noncurrent liabilities in the Consolidated Balance Sheet at

June 30, 2006 when the Company's net investment in this derivative financial instrument was in a $9.4 million loss position based on its

estimated fair value. The corresponding tax-effected offset was charged to the cumulative translation adjustment account, which is a component

of AOCI set forth under the caption shareholders' equity in the Consolidated Balance Sheet. The cumulative tax-effected net loss recorded in

AOCI related to the cross-currency swap was $8.1 million at June 30, 2006. For the year ended June 30, 2006, $1.2 million of tax-effected loss

related to this derivative was charged to the cumulative translation adjustment account.

6. COMMITMENTS AND CONTINGENCIES:

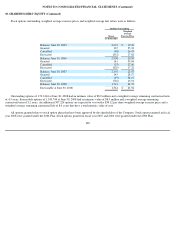

Operating Leases:

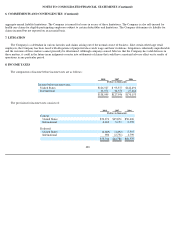

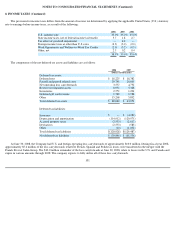

The Company is committed under long-term operating leases for the rental of most of its company-owned salon and hair restoration center

locations. The original terms of the leases range from one to 20 years, with many leases renewable for an additional five to ten year term at the

option of the Company, and certain leases include escalation provisions. For certain leases, the Company is required to pay additional rent based

on a percent of sales in excess of a predetermined amount and, in most cases, real estate taxes and other expenses. Rent expense for the

Company's international department store salons is based primarily on a percent of sales.

The Company also leases the premises in which the majority of its franchisees operate and has entered into corresponding sublease

arrangements with the franchisees. These leases, generally with terms of approximately five years, are expected to be renewed on expiration. All

additional lease costs are passed through to the franchisees.

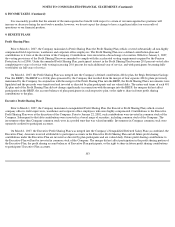

During fiscal year 2005, the Company entered into a lease agreement for a 102,448 square foot building, located in Edina, Minnesota. The

Company began to recognize rent expense related to this property during the three months ended September 30, 2005, which was the date that it

obtained the legal right to use and control the property. The original lease term ends in 2016 and the aggregate amount of lease payments to be

made over the remaining original lease term are approximately

98