Supercuts 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 08/29/08 for the Period Ending 06/30/08

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 08/29/08 for the Period Ending 06/30/08 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

... SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2008 OR 3 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from Commission file number 1-12725 to Regis Corporation (Exact name of Registrant as specified in its... -

Page 3

... the Registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes 3 No 1 The aggregate market value of the voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the Registrant's most recently... -

Page 4

...Concepts Salon Franchising Program Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Hair Restoration Business Strategy Corporate Trademarks Corporate Employees Executive Officers... -

Page 5

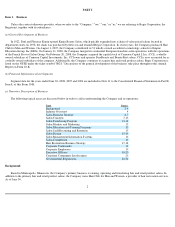

... of business-salons and hair restoration centers. Salon operations are managed based on geographical location-North America and international. The Company's North American salon operations are comprised of 8,110 company-owned salons and 2,163 franchise salons operating in the United States, Canada... -

Page 6

... of accounting. During fiscal year 2008, the Company transformed nine Trade Secret locations to PureBeauty locations. Future transformations will depend on the success of initial transformations. Industry Overview: Management estimates that annual revenues of the hair care industry are approximately... -

Page 7

... strategy is the acquisition of salons. With an estimated two percent worldwide market share, management believes the opportunity to continue to make selective acquisitions exists. Over the past 14 years, the Company has acquired 7,926 locations, expanding in both North America and internationally... -

Page 8

... delivered from the salons' point of sale system. This information is used to reconcile cash on a daily basis. Consistent, Quality Service. The Company is committed to meeting its customers' hair care needs by providing competitively priced services and products with professional and knowledgeable... -

Page 9

... and affordable hair care products and services in the United States, Canada and Puerto Rico. The Company's international salon operations consist of 472 hair care salons located in Europe, primarily in the United Kingdom. Under the table below, the number of new salons expected to be opened within... -

Page 10

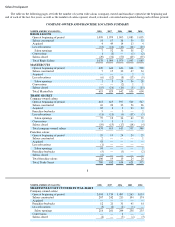

... as the number of salons opened, closed, relocated, converted and acquired during each of these periods. COMPANY-OWNED AND FRANCHISE LOCATION SUMMARY NORTH AMERICAN SALONS: 2008 2007 2006 2005 2004 REGIS SALONS Open at beginning of period Salons constructed Acquired Less relocations Salon openings... -

Page 11

... Salons closed Total franchise salons Total, SmartStyle/Cost Cutters in Wal-Mart STRIP CENTERS Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open... -

Page 12

...franchise salons Total, International Salons TOTAL SYSTEM WIDE SALONS Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Affiliated joint ventures Salons closed Total company-owned salons Franchise salons: Open... -

Page 13

... Maxx Hair Studios, Hair by Stewarts and Heidi's. The average initial capital investment required for a new Regis Salon is approximately $212,000, excluding average opening inventory costs of approximately $17,500. Average annual salon revenues in a Regis Salon which has been open five years or more... -

Page 14

... Salons are comprised of company-owned and franchise salons operating in strip centers across North America under the following concepts: Supercuts. The Supercuts concept provides consistent, high quality hair care services and professional products to its customers at convenient times and locations... -

Page 15

... service hair salon. Salons are usually located on prominent high-street locations and offer a full range of custom hairstyling, cutting, coloring and waving, as well as professional hair care products. The initial capital investment required is approximately £450,000. Average annual salon revenues... -

Page 16

..., inventory, payroll costs and certain other items, including initial working capital. Additional information regarding each of the major franchisee brands is listed below: Supercuts (North America) The majority of existing Supercuts franchise agreements have a perpetual term, subject to termination... -

Page 17

... benefit from the Company's high-traffic locations and receive a steady source of new business from walk-in customers. In addition, the Company offers a career path with the opportunity to move into managerial and training positions within the Company. Salon Design: The Company's salons are designed... -

Page 18

... real estate staff focus on visual appeal, efficient use of space, cost and rapid completion times. Salon Management Information Systems: At all of its company-owned salons, the Company utilizes a point-of-sale (POS) information system to collect daily sales information. Salon employees deposit cash... -

Page 19

... and hair care products and services, Hair Club offers a solution for anyone experiencing or anticipating hair loss. The Company's operations consist of 92 locations (35 franchise) in the United States and Canada. The domestic hair restoration market is estimated to generate over $4 billion annually... -

Page 20

... the procedure. Currently, a total of 34 hair restoration centers offer this service to their customers. The Company plans to add the capability to conduct hair transplants to more centers in future periods. Company-owned-and franchise hair restoration centers are located in markets representing 75... -

Page 21

... any unauthorized use, the Company's success and continuing growth are the result of the quality of its salon location selections and real estate strategies. Corporate Employees: During fiscal year 2008, the Company had approximately 65,000 full- and part-time employees worldwide, of which... -

Page 22

... was also elected Director and Audit Committee Chair of Dress Barn, Inc., which operates a chain of women's apparel specialty stores. Kris Bergly has served as Executive Vice President of Regis Salons, Promenade Salon Concepts, Supercuts, Inc. and MasterCuts and Corporate Chief Operating Officer. He... -

Page 23

... compensation. The Company believes that the current trend is for government regulation of franchising to increase over time. However, such laws have not had, and the Company does not expect such laws to have, a significant effect on the Company's operations. In Canada, the Company's franchise... -

Page 24

... raise prices, our ability to grow same-store sales and increase our revenue and earnings may be impaired. If our joint ventures are unsuccessful our financial results may be affected. We have entered into joint venture arrangements with other companies in the hair salon and beauty school businesses... -

Page 25

... the revenue earned from product sales. We may not be able to achieve the anticipated costs savings related to our approved plan to close up to 160 stores in fiscal year 2009. In July of 2008, the Company approved a plan to close up to 160 underperforming company-owned salons in fiscal year 2009... -

Page 26

.... The Company operates all of its salon locations and hair replacement centers under leases or license agreements. Substantially all of its North American locations in regional malls are operating under leases with an original term of at least ten years. Salons operating within strip centers and Wal... -

Page 27

...Matters; Performance Graph Regis common stock is listed and traded on the New York Stock Exchange under the symbol "RGS." The accompanying table sets forth the high and low closing bid quotations for each quarter during fiscal years 2008 and 2007 as reported by the New York Stock Exchange (under the... -

Page 28

... in the Company's Common Stock, the S&P 500 Index, the Peer Group, the S&P 400 Midcap Index and the Dow Jones Consumer Services Index on June 30, 2003 and those dividends, if any, were reinvested. Comparison of 5 Year Cumulative Total Return Assumes Initial Investment of $100 June 2008 2003 2004... -

Page 29

... derived from the Company's Consolidated Financial Statements in Part II, Item 8. 2008 2007 2006 2005 2004 Revenues(a) $2,738,865 Operating income(b)(c) 174,297 Net income(b)(c)(d) 85,204 Net income per diluted share(b)(c)(d) 1.95 Total assets 2,235,871 Long-term debt, including current portion 764... -

Page 30

... (revised 2004), Share-Based Payment (SFAS No. 123R), using the modified prospective method of application. Total compensation cost for stock-based payment arrangements totaled $6.8, $4.9, $4.9, $1.2 and $0.2 million ($4.2, $3.2, $3.2, $0.8 and $0.1 million after tax) during fiscal years 2008, 2007... -

Page 31

..., Supercuts and Cost Cutters. Our international salon operations include 472 salons located in Europe, primarily in the United Kingdom. Hair Club for Men and Women includes 92 North American locations, including 35 franchise locations. During fiscal year 2008, we had approximately 65,000 corporate... -

Page 32

... number of new locations in untapped markets domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for salon expansion. In an effort to provide confidentiality for our customers, hair restoration centers operate... -

Page 33

... at least semi-annually and the monthly monitoring of factors that could impact our usage rates estimates. These factors include mix of service sales, discounting and special promotions. Cost of product sold to salon customers is determined based on the weighted average cost of product to the... -

Page 34

... of our European franchise business approximated their fair value. The fiscal year 2006 analysis indicated that the net book value of our beauty school business approximated their fair value. The fair value of our North American salons and hair restoration centers exceeded their carrying amounts... -

Page 35

... improvement of our new safety and return-to-work programs over the recent years as well as changes in state laws. In fiscal 2006 we increased self-insurance accruals related to prior year's claims by $1.0 million. During fiscal years 2008, 2007, and 2006, our insurance costs were $46.8, $45... -

Page 36

... same-store sales of 0.5 percent. The revenue increase was partially offset by deconsolidation of accredited cosmetology schools and European franchise salon operations. The Company expects fiscal year 2009 same-store sales growth to be 0.5 to 2.5 percent. A long-lived asset impairment charge of... -

Page 37

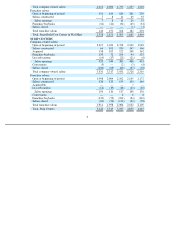

...Revenues For the Years Ended June 30, 2008 2007 2006 Service revenues Product revenues Royalties and fees Operating expenses: Cost of service(1) Cost of product(2) Site operating expenses General and administrative Rent Depreciation and amortization Goodwill impairment Terminated acquisition income... -

Page 38

...) 2008 North American salons: Regis MasterCuts Trade Secret(1) SmartStyle Strip Center(1) Other(3) Total North American Salons International salons(1)(2) Beauty schools(3) Hair restoration centers(1) Consolidated revenues Percent change from prior year Salon same-store sales increase(4) $ 513... -

Page 39

...in closed salons as a percent of revenues was primarily due to the 51 accredited cosmetology schools contributed to Empire Education Group, Inc. on August 1, 2007. We acquired 354 company-owned salons (including 97 franchise buybacks), one beauty school and two company-owned hair restoration centers... -

Page 40

... composed of service and product revenues, as well as franchise royalties and fees. Fluctuations in these three major revenue categories were as follows: Service Revenues. Service revenues include revenues generated from company-owned salons and service revenues generated by hair restoration centers... -

Page 41

...same-store product sales increase; same-store product sales increased 0.1 percent during fiscal year 2006. Franchise Royalties and Fees. Consolidated franchise revenues, which include royalties and franchise fees, were as follows: Increase (Decrease) Over Prior Fiscal Year Revenues Dollar Percentage... -

Page 42

...due to increased tuition in the schools segment, increased hair restoration service revenues due to strong recurring and new customer revenues and increases in hair transplant management fees and the continued focus on management of salon payroll costs. The basis point improvement in service margins... -

Page 43

..., workers' compensation, insurance, utilities and janitorial costs. Site operating expenses were as follows: Increase (Decrease) Over Prior Fiscal Year Expense as % of Consolidated Years Ended June 30, Site Operating Dollar Percentage Revenues (Dollars in thousands) Basis Point(1) 2008 2007 2006... -

Page 44

... fiscal year. The basis point increase in rent expense as a percent of consolidated revenues during fiscal year 2008 was primarily due to rent expense increasing at a faster rate than location same-store sales and the deconsolidation of the schools and European franchise salon operations, offset... -

Page 45

... to close 64 company-owned salon locations and refocus efforts on improving the sales and operations of nearby salons. Additionally, the increase in this fixed-cost expense as a percent of consolidated revenues was due to salon rent increasing at a faster rate than salon samestore sales during... -

Page 46

... to our beauty school business. No impairment charges were recorded during fiscal years 2008 and 2006. Terminated Acquisition Income, net Terminated acquisition income, net was as follows: Increase (Decrease) Over Prior Fiscal Year Terminated Acquisition Years Ended June 30, Income, net Expense as... -

Page 47

... due to increased debt levels due to the Company's repurchase of $79.7 million of our outstanding common stock, acquisitions and the timing of income tax payments during the fiscal year. The basis point increase in interest expense as a percent of consolidated revenues during fiscal year 2006 was... -

Page 48

... of company-owned salon revenues to remain relatively constant. Accordingly, this provides us certain protection against inflationary increases, as payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may increase pricing in our salons to... -

Page 49

... of 310 company-owned salons in North America during the twelve months ended June 30, 2008, and a same-store sales increase of 0.7 percent during the twelve months ended June 30, 2008. The Company experienced the largest comparable increase in same-store service sales in eight years during the... -

Page 50

...and rent expense increasing at a faster rate than salon same-store sales. The basis point decrease in North American salon operating income as a percent of North American salon revenues during fiscal year 2006 was primarily due to reduced retail product margins, largely the result of increased costs... -

Page 51

... dollar against the British Pound and Euro as compared to the exchange rates for fiscal year 2007. Franchise revenues decreased primarily due to the merger of our continental Europe franchise salon operations with Franck Provost Salon Group on January 31, 2008. We acquired 16 international salons... -

Page 52

... the Company approved plan to close underperforming company-owned salon locations in fiscal year 2009. These decreases were offset by the inclusion of the Sassoon schools in the segment. The basis point improvement in international salon operating income as a percent of international salon revenues... -

Page 53

... franchise centers during the twelve months ended June 30, 2008. The basis point improvement in hair restoration operating income as a percent of hair restoration revenues during fiscal year 2007 was due to strong recurring and new customer revenues and increases in hair transplant management fees... -

Page 54

... on-going cash requirements are to finance construction of new stores, remodel certain existing stores, acquire salons and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital requirements. The basis point improvement in... -

Page 55

... investments in those markets, partially offset by lower common stock and additional paid-in capital balances stemming from share repurchases during the twelve months ended June 30, 2008. During the twelve months ended June 30, 2007, equity increased primarily as a result of net income and increased... -

Page 56

... timing of income tax payments. Depreciation and amortization increased primarily due to the amortization of acquired intangible assets and increased fixed assets. The goodwill impairment charge of $23.0 million ($19.6 million net of tax) related to our beauty school business. Inventories increased... -

Page 57

...portion of the Company's net investment in its foreign operations). We constructed 531 company-owned salons, two beauty schools and one hair restoration center and acquired 290 company-owned salons (142 of which were franchise buybacks), 30 beauty schools and eight hair restoration centers (seven of... -

Page 58

...excluding franchise buybacks) consisted of the following number of locations in each concept: Years Ended June 30, 2007 Constructed Acquired 2008 Constructed Acquired 2006 Constructed Acquired Regis MasterCuts Trade Secret SmartStyle Promenade International Beauty schools Hair restoration centers... -

Page 59

... year 2006. Other Financing Arrangements Private Shelf Agreement At June 30, 2008 and 2007, we had $255.2 and $189.7 million, respectively, in unsecured, fixed rate, senior term notes outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range... -

Page 60

... long-term debt). Interest payments on long-term debt and capital lease obligations were estimated based on our total average interest rate at June 30, 2008 and scheduled contractual repayments. Other long-term liabilities include a total of $19.9 million related to the Executive Profit Sharing Plan... -

Page 61

...ordinary course of business. These contracts primarily relate to our commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services, and agreements to indemnify officers, directors and employees in the performance of their work. While our... -

Page 62

... years 2008, 2007 and 2006. On August 25, 2008, the Board of Directors of the Company declared a $0.04 per share quarterly dividend payable September 17, 2008 to shareholders of record on September 3, 2008. Share Repurchase Program In May 2000, the Company's Board of Directors (BOD) approved a stock... -

Page 63

... its franchisees to obtain suitable locations and financing for new salon development; governmental initiatives such as minimum wage rates, taxes and possible franchise legislation; the ability of the Company to successfully identify, acquire and integrate salons that support its growth objectives... -

Page 64

...-month LIBOR rate plus a credit spread) and receives fixed rates of interest on an aggregate $5.0 and $14.0 million notional amount at June 30, 2008 and 2007, respectively, with a maturation date of July 2008. These swaps were designated as hedges of a portion of the Company's senior term notes and... -

Page 65

... expected cost of borrowing for outstanding derivative balances as of June 30, 2008. Foreign Currency Exchange Risk: The majority of the Company's revenue, expense and capital purchasing activities are transacted in United States dollars. However, because a portion of the Company's operations... -

Page 66

... related to fluctuations in the Canadian dollar relative to the U.S. dollar. The exposure to Canadian dollar exchange rates on the Company's fiscal year 2008 cash flows primarily includes payments in Canadian dollars from the Company's Canadian salon operations for retail inventory exported from the... -

Page 67

... provides information about the Company's forecasted sales transactions in U.S. dollar equivalents. (The information is presented in U.S. dollars because that is the Company's reporting currency.) The table summarizes information on transactions that are sensitive to foreign currency exchange rates... -

Page 68

... 2007 Consolidated Statement of Operations for each of the three years in the period ended June 30, 2008 Consolidated Statements of Changes in Shareholders' Equity and Comprehensive Income for each of the three years in the period ended June 30, 2008 Consolidated Statement of Cash Flows for each of... -

Page 69

...to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management has assessed the Company's internal control over financial reporting as of June 30, 2008, based... -

Page 70

... and comprehensive income and of cash flows present fairly, in all material respects, the financial position of Regis Corporation and its subsidiaries at June 30, 2008 and June 30, 2007, and the results of their operations and their cash flows for each of the three years in the period ended June... -

Page 71

... expenses Total current liabilities Long-term debt and capital lease obligations Other noncurrent liabilities Total liabilities Commitments and contingencies (Note 6) Shareholders' equity: Common stock, $0.05 par value; issued and outstanding, 43,070,927 and 44,164,645 common shares at June 30, 2008... -

Page 72

... per share data) Years Ended June 30, 2007 2008 2006 Revenues: Service Product Royalties and fees $1,894,257 775,980 68,628 2,738,865 $1,793,802 752,280 80,506 2,626,588 $1,634,028 718,942 77,894 2,430,864 Operating expenses: Cost of service 1,090,710 1,014,781 928,515 Cost of product 395... -

Page 73

... in fair market value of financial instruments designated as cash flow hedges, net of taxes Stock repurchase plan Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program Payment for contingent consideration in salon acquisitions (Note... -

Page 74

...16,463 Net cash provided by operating activities 222,383 241,860 281,685 Cash flows from investing activities: Capital expenditures (85,799) (90,079) (119,914) Proceeds from sale of assets 47 97 730 Purchases of salon, school and hair restoration center net assets, net of cash acquired (132,971) (68... -

Page 75

... POLICIES Business Description: Regis Corporation (the Company) owns, operates and franchises hairstyling and hair care salons throughout the United States, the United Kingdom (U.K.), Canada, Puerto Rico and several other countries. In addition, the Company owns and operates hair restoration centers... -

Page 76

... least semi-annually and the monthly monitoring of factors that could impact the Company's usage rates estimates. These factors include mix of service sales, discounting and special promotions. Cost of product sold to salon customers is determined based on the weighted average cost of product to the... -

Page 77

... for under the cost method. The impairment charge was included in Other, net (other non-operating expense) in the Consolidated Statement of Operations and reduced the Company's investment balance to zero. Goodwill: Goodwill is tested for impairment annually or at the time of a triggering event... -

Page 78

... Deferred Rent and Rent Expense: The Company leases most salon and hair restoration center locations under operating leases. Accounting principles generally accepted in the United States of America require rent expense to be recognized on a straight-line basis over the lease term. Tenant improvement... -

Page 79

... royalties, initial franchise fees and net rental income (see Note 6). Royalties are recognized as revenue in the month in which franchisee services are rendered or products are sold to franchisees. The Company recognizes revenue from initial franchise fees at the time franchise locations are opened... -

Page 80

... such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as incurred. Sales Taxes: Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company's Consolidated Statement of Operations. Income Taxes: Deferred... -

Page 81

... and long-term incentive plan, shares issuable under contingent stock agreements, and dilutive securities. Stock-based awards with exercise prices greater than the average market value of the Company's common stock are excluded from the computation of diluted earnings per share. Comprehensive Income... -

Page 82

...an option-pricing model to estimate the fair value of options at their grant date. The Company generally recognizes compensation expense for its stock-based compensation awards on a straight-line basis over the five-year vesting period. Awards granted do not contain acceleration of vesting terms for... -

Page 83

...compensation cost for stock-based payment arrangements totaled $6.8, $4.9 and $4.9 million ($4.2 and $3.2 and $3.2 million after tax) for the fiscal years ended June 30, 2008, 2007 and 2006, respectively. SFAS No. 123R requires that the cash retained as a result of the tax deductibility of increases... -

Page 84

...an entity's financial position, financial performance, and cash flows. SFAS No. 161 is effective for fiscal years and interim periods beginning after November 15, 2008 (i.e. the Company's third quarter of fiscal year 2009). The Company intends to comply with the disclosure requirements upon adoption... -

Page 85

... following provides additional information concerning selected balance sheet accounts as of June 30, 2008 and 2007: 2008 2007 (Dollars in thousands) Accounts receivable Less allowance for doubtful accounts Other current assets: Prepaids Notes Receivable, primarily affiliates Property and equipment... -

Page 86

...-line basis over the number of years that approximate their expected period of benefit (ranging from one to 40 years). The cost of intangible assets is amortized to earnings in proportion to the amount of economic benefits obtained by the Company in that reporting period. The weighted average... -

Page 87

...(Dollars in thousands) Cash paid during the year for: Interest Income taxes, net of refunds $46,547 49,148 $40,805 71,770 $35,098 32,544 Significant non-cash investing and financing activities include the following: In fiscal years 2008, 2007, and 2006, the Company financed capital expenditures... -

Page 88

...: Total Acquisitions 2008 2007 2006 (Dollars in thousands) Components of aggregate purchase prices: Cash Note receivable applied to purchase price Common stock Liabilities assumed or payable Allocation of the purchase prices: Current assets Property and equipment Deferred income tax asset Other... -

Page 89

... amount of the goodwill for the years ended June 30, 2008 and 2007 is as follows: Salons North America Hair Restoration Consolidated Beauty International Schools Centers (Dollars in thousands) Balance at June 30, 2006 Goodwill acquired Translation rate adjustments Impairment Balance at June 30... -

Page 90

... further represents the Company's opportunity to strategically combine the acquired business with the Company's existing structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons and hair restoration centers, the residual goodwill... -

Page 91

... 50% Owned 2008 2007(1) 2008 2007(1) (Dollars in thousands) Summarized Balance Sheet Information: Current assets Noncurrent assets Current liabilities Noncurrent liabilities Summarized Statement of Operations Information: Gross revenue Gross profit Operating income (loss) Net income (loss) $ 23... -

Page 92

...in the newly formed Provalliance entity (Provalliance). The merger with the operations of the Franck Provost Salon Group which are also located in continental Europe, created Europe's largest salon operator with approximately 2,300 company-owned and franchise salons as of June 30, 2008. The carrying... -

Page 93

... line of professional hair care and personal care products is in development and is expected to be available in the fall of calendar year 2008. These products will be offered at the Company's corporate and franchise salons, and eventually in other independently owned salons. During the fiscal year... -

Page 94

... a credit agreement with the majority corporate investor in this privately held entity. The long-term notes receivable were incorporated as part of the purchase price of the acquisition. Investment in Cool Cuts 4 Kids, Inc. The Company holds an interest of less than 20 percent in the preferred stock... -

Page 95

... fixed rate, senior term notes outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from July 2008 through December 2017. The interest rates on the notes range from 4.65 to 8.39 percent as of June 30, 2008 and 2007. In fiscal year 2008, we... -

Page 96

... covenants in the new Master Note Purchase Agreement. Revolving Credit Facility The Company has an unsecured $350.0 million revolving credit facility with rates tied to LIBOR plus 60.0 basis points. The revolving credit facility requires a quarterly facility fee on the average daily amount of... -

Page 97

...of speculation. The Company has established an interest rate management policy that attempts to minimize its overall cost of debt, while taking into consideration the earnings implications associated with the volatility of short-term interest rates. As part of this policy, the Company has elected to... -

Page 98

... party by the salon and, therefore, impacts cost of goods sold in the Company's Consolidated Statement of Operations, amounts are transferred out of AOCI to earnings. The Company uses an inventory turnover ratio (based on historical results) to estimate the timing of sales to an external third... -

Page 99

... in fair value of cash flow hedges (2,400) (1,030) 1,416 $(2,557) $(1,220) $1,466 As of June 30, 2008, the Company estimates, based on current interest rates, that less than $0.6 million of tax-effected charges will be recorded in the Consolidated Statement of Operations during the next twelve... -

Page 100

... and hair restoration center locations. The original terms of the leases range from one to 20 years, with many leases renewable for an additional five to ten year term at the option of the Company, and certain leases include escalation provisions. For certain leases, the Company is required to pay... -

Page 101

...) $8.7 million. The lease agreement includes an option to purchase the property or extend the original term for two successive periods of five years. Rent expense in the Consolidated Statement of Operations excludes $29.9, $27.4 and $28.9 million in fiscal years 2008, 2007 and 2006, respectively... -

Page 102

... could have a material adverse effect on its results of operations in any particular period. 8. INCOME TAXES The components of income before income taxes are as follows: 2008 2007 2006 (Dollars in thousands) Income before income taxes: United States International $126,527 11,572 $138,099 $ 93,377... -

Page 103

... to earnings before income taxes, as a result of the following: 2008 2007 2006 U.S. statutory rate State income taxes, net of federal income tax benefit Tax effect of goodwill impairment Foreign income taxes at other than U.S. rates Work Opportunity and Welfare-to-Work Tax Credits Other, net 35... -

Page 104

...) Deferred income taxes Goodwill Additional paid-in capital Retained earnings Total increase A rollforward of the unrecognized tax benefits is as follows: $ 10,128 6,094 237 4,237 $ 20,696 (Dollars in thousands) Balance at July 1, 2007 Additions based on tax positions related to the current year... -

Page 105

... of operations or our financial position. 9. BENEFIT PLANS Profit Sharing Plan: Prior to March 1, 2007, the Company maintained a Profit Sharing Plan (the Profit Sharing Plan) which covered substantially all non-highly compensated field supervisors, warehouse and corporate office employees. The... -

Page 106

...deferred compensation contracts. Compensation associated with these agreements is charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement of Operations totaled $2.4, $4.0, and $2.4 million for fiscal years 2008, 2007... -

Page 107

... that during the period in which payments are made, as provided in the agreement, he will not engage in any business competitive with the business conducted by the Company. Additionally, the Company has a survivor benefit plan for the Vice Chairman's spouse, payable upon his death, at a rate of one... -

Page 108

... Stock-based Compensation Award Plans: In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received shareholder approval at the annual shareholders' meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock... -

Page 109

... price and on disposition of any shares acquired through exercise of the options. Stock options are granted at not less than fair market value on the date of grant. The Board of Directors determines the 2000 Plan participants and establishes the terms and conditions of each option. The Company... -

Page 110

... at June 30, 2008 had an intrinsic value of $8.9 million and a weighted average remaining contractual term of 3.2 years. An additional 347,224 options are expected to vest with a $34.12 per share weighted average exercise price and a weighted average remaining contractual life of 8.6 years that have... -

Page 111

... weighted average period over which such cost is expected to be recognized was approximately 3.7 years as of June 30, 2008. The total intrinsic value of all stock-based compensation (the amount by which the stock exceeded the exercise or grant date price) that was exercised during fiscal years 2008... -

Page 112

... of the strike price at the time of the grant. The Company uses historical data to estimate pre-vesting forfeiture rates. Compensation expense included in income before income taxes related to stock-based compensation was $6.8, $4.9 and $4.9 million for the three years ended June 30, 2008, 2007, and... -

Page 113

... States, Canada and Puerto Rico), 472 international salons, 92 hair restoration centers, and 2,714 locations in which the Company maintains an ownership interest through its investments in affiliates. The Company operates its North American salon operations through six primary concepts: Regis Salons... -

Page 114

...Company's reportable operating segments is shown in the following table as of June 30, 2008, 2007, and 2006: For the Year Ended June 30, 2008(1) Salons North America Hair Restoration Consolidated Unallocated International Corporate Centers (Dollars in thousands) Revenues: Service Product Royalties... -

Page 115

... reported in the international salon segment. For the Year Ended June 30, 2007 Salons North America International Hair Restoration Beauty Schools Centers (Dollars in thousands) Unallocated Corporate Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost... -

Page 116

... For the Year Ended June 30, 2006 Salons North America International Hair Restoration Beauty Schools Centers (Dollars in thousands) Unallocated Corporate Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and... -

Page 117

... safety and return-to-work programs over the recent years, as well as changes in state laws. Expense of $23.0 million ($19.6 million net of tax) was recorded in the third quarter ended March 31, 2007 related to our beauty school business, related to the Company's annual goodwill impairment analysis... -

Page 118

... the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to management, including the chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure... -

Page 119

..." of the Company's 2008 Proxy, and is incorporated herein by reference. The information required by Item 401 of Regulation S-K regarding the Company's executive officers is included under "Executive Officers" in Item 1 of this Annual Report on Form 10-K. Additionally, information regarding the... -

Page 120

... Long Term Incentive Plan. Information regarding the stock-based compensation plans is included in Notes 1 and 10 to the Consolidated Financial Statements. The Company's 2004 Long Term Incentive Plan (2004 Plan) provides for the issuance of a maximum of 2,500,000 shares of the Company's common stock... -

Page 121

.... 40142).) Regis Corporation Executive Retirement Savings Plan and Trust Agreement, dated March 1, 2007 between the Company and Fidelity Management Trust Company, as Trustee. (Incorporated by reference to Exhibit 10(c) of the Company's Report on Form 10-K filed on August 29, 2007, for the year ended... -

Page 122

... 26, 2003, between the Company and Information Leasing Corporation. (Incorporated by reference to Exhibit 10(ee) of the Company's Report on Form 10-K filed on September 10, 2004, for the year ended June 30, 2004.) 10(j) 10(k) 10(l) 10(m) 2004 Long Term Incentive Plan (Draft), dated August 4, 2002... -

Page 123

... Company's Report on Form 10-Q filed on February 7, 2008, for the quarter ended December 31, 2007.) Stock Purchase Agreement, dated January 17, 2008, between the Company, Cameron Capital Investments, Inc., Stephen Powell and Mackenzie Limited Partnership. Fourth Amended and Restated Credit Agreement... -

Page 124

...2002. Senior Executive Vice President, Chief Financial and Administrative Officer of the Company: Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (*) Management contract, compensatory plan or arrangement required to be filed as an exhibit to the Company's Report on Form 10... -

Page 125

... duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. REGIS CORPORATION By /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer By /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice... -

Page 126

... Disclosures About Market Risk Item 8. Financial Statements and Supplementary Data Management's Statement of Responsibility for Financial Statements and Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm REGIS CORPORATION CONSOLIDATED BALANCE... -

Page 127

... (this " Agreement ") is made and entered into as of January 17, 2008, by and among Regis Corporation (" Regis "), Trade Secret, Inc., a wholly-owned subsidiary of Regis (" Buyer "), Cameron Capital Investments Inc. (" Seller "), Cameron Capital Inc. (the " Company "), Stephen Powell (an officer of... -

Page 128

... and practices, business, training, marketing, promotional and sales plans and practices, cost, rate and pricing structures); (ii) identities of, individual requirements of, specific contractual arrangements with, and other confidential or proprietary information about, the Company's or any of its... -

Page 129

... Escrow Agreement " means the escrow agreement substantially in the form of Exhibit A attached hereto. " Escrow Amount " means an amount equal to $1,000,000. " ERISA " means the Employee Retirement Income Security Act of 1974, as amended. " Excluded Subsidiaries " means Cameron Capital Marketing Inc... -

Page 130

... agreements, plans and programs in place as of Closing), including legal disputes raised by them with respect to such severance, in the case of any such costs or expenses which are deductible for Tax purposes, multiplied by 0.6. " Headquarter Staff " means all employees or consultants of the Company... -

Page 131

... data, copyrightable works, non-public data and databases, financial and marketing plans and customer and supplier lists and information, (vii) all other intellectual property rights, and (viii) copies and tangible embodiments of any of the foregoing (in whatever form of medium). " Investment " as... -

Page 132

... Adverse Effect " means a material and adverse effect or development upon the business, operations, assets, liabilities, financial condition, operating results, cash flow or employee, customer or supplier relations of the Company and its Subsidiaries taken as a whole. " Notice of Disagreement " has... -

Page 133

... income, gross receipts, franchise, estimated, alternative minimum, add-on minimum, sales, use, transfer, registration, value added, excise, natural resources, severance, stamp, occupation, premium, windfall profit, environmental, customs, duties, real property, personal property, capital stock... -

Page 134

... by the party entitled to the benefit thereof on or prior to such date, on the second business day following satisfaction or waiver of such conditions (the " Closing Date "). (b) Closing Deliveries . At the Closing: (i) Buyer shall pay to Seller the Purchase Price, less the Escrow Amount, less the... -

Page 135

... (x) from the Escrow Funds (as defined in the Escrow Agreement) in the Escrow Account (as defined in the Escrow Agreement), and/or (y) by reducing annual fee payments for Phase II Services to CC Newco under the Consulting Agreement as provided therein, which shall be the sole sources of recourse of... -

Page 136

...the Preliminary Headquarter Cost Statement, Buyer shall notify Seller within such 30-day period and specify in reasonable detail the nature and dollar amount of any disagreement so asserted. During the twenty (20) days following delivery of such a notice, Buyer and Seller shall seek in good faith to... -

Page 137

... of the terms of share or option purchases, settlement of lease obligations and related obligations and/or finding successor or replacement tenants) in relation to the Pre-Closing Shutdown Liability, the Headquarter Severance and the settlement of any liabilities, costs or expenses relating to... -

Page 138

... instructed to deliver not more than forty-five (45) days following submission of such disputed matters). The fees and expenses of the Accounting Firm shall be shared equally between Buyer and Seller. (c) If, following finalization of the Closing Statement, the Excess Amount (other than with respect... -

Page 139

... and the option cancellations under any Option Cancellation Agreements entered into prior to Closing, in each case in exchange for the payments by CC1 or BeautyFirst, as applicable, to each such Person required under such agreements; provided , that Seller may direct Buyer to (and Buyer shall, if... -

Page 140

... Parties shall have terminated all agreements (if any) regarding voting, transfer or other arrangements related to the Shares or the Capital Stock of the Company or its Subsidiaries that are in effect prior to the Closing (in each case on terms and conditions satisfactory to Buyer), except that... -

Page 141

... Closing pursuant to the terms hereof or that Buyer reasonably requests prior to the Closing Date to effect the transactions contemplated hereby; and (k) The Company shall have reimbursed Regis for all legal costs and expenses for which Regis is entitled to reimbursement under the Credit Agreement... -

Page 142

... agreements and other documents required to be delivered by or on behalf of such party or any of its Subsidiaries under Article III above. 4.2 Maintenance of Business . The Company shall (and the Company shall cause its Subsidiaries to) (a) maintain their material assets in good operating condition... -

Page 143

... benefits to any officer or employee of the Company or its Subsidiaries, except for increases or bonuses made in the ordinary course of business consistent with past custom and practice, (iv) redeem, purchase or otherwise acquire directly or indirectly any of its issued and outstanding Capital Stock... -

Page 144

... times and during normal business hours, upon reasonable notice, to the Company's and its Subsidiaries' personnel and to business, financial, legal, tax, compensation and other data and information concerning the Company's and its Subsidiaries' affairs and operations. The Company shall provide... -

Page 145

...sponsored and managed by CCC or an Affiliate thereof, subject to the following terms: (i) the amount required to be funded by Regis prior to the first anniversary of Closing shall not exceed $7,500,000; (ii) such investment shall be made on customary market terms, no less favourable to Regis than to... -

Page 146

... Officers and Directors Schedule sets forth a list all of the officers and directors of the Company. 5.2 Capital Stock and Related Matters; Title to Shares . The entire authorized Capital Stock of the Company consists of 25,000 shares of common stock, par value $0.0001 per share (" Class A Shares... -

Page 147

... Sellers are subject; provided, that Seller makes no such representation as to whether change-ofcontrol consents are required under store leases or other contracts of the Company or its Subsidiaries (other than (i) a contractual obligation that would prohibit the sale of the Shares or completion of... -

Page 148

... the right to acquire any Capital Stock or any other security or interest in any other Person or has any obligation to make any Investment in any Person. The attached Officers and Directors Schedule sets forth a list all of the officers and directors of each of the Company's Subsidiaries. The copies... -

Page 149

... in the ordinary course of business; (d) declared, set aside or made any payment or distribution of cash or other property to any of its stockholders with respect to its Capital Stock or otherwise, or purchased, redeemed or otherwise acquired any Capital Stock or other equity securities (including... -

Page 150

... wage or salary increase to any employee or group of employees (except as required by pre-existing contracts described on the attached Contracts Schedule or in the ordinary course of business consistent with past practice), or made or granted any increase in any employee benefit plan or arrangement... -

Page 151

... other employee benefit plan or arrangement, or any collective bargaining agreement or any other contract with any labor union, or severance agreements, programs, policies or arrangements; (iv) contract relating to (A) loans to officers, directors or Affiliates (other than inter-company debt among... -

Page 152

... for the Company's and its Subsidiaries' own internal use for an aggregate fee, royalty or other consideration for any such software or group of related software licenses of no more than $50,000 annually; (xii) sales, distribution, manufacturing, supply or franchise agreement (A) which involves... -

Page 153

... its Subsidiaries or (y) embodied in any of the Company's or its Subsidiaries past or present products or services, and no current or former employee, consultant or contractor has any valid claim of ownership, in whole or part, to any such Intellectual Property Rights, or any valid right to use any... -

Page 154

... in and to the Intellectual Property Rights listed on the Intellectual Property Schedule and all of such Intellectual Property Rights shall be owned or available for use by the Company and its Subsidiaries on identical terms and conditions immediately after the Closing other than Intellectual... -

Page 155

..., bribes, kickback payments or other similar payments of cash or other consideration, including payments to customers or clients or employees of customers or clients for purposes of doing business with such Persons; provided, that Seller makes no representation as to whether the Company or its... -

Page 156

.... 5.17 Employee Benefit Plans. (a) The attached Employee Benefits Schedule sets forth an accurate and complete list of each "employee benefit plan" (as such term is defined in Section 3(3) of ERISA) and each other employee benefit plan, program or arrangement providing benefits to current or former... -

Page 157

... for limited continued medical benefit coverage required to be provided under Section 4980B of the Code or as required under applicable state law). (d) Except as set forth on the Employee Benefits Schedule under the heading "Profit Sharing Plans," neither the Company nor any of its Subsidiaries... -

Page 158

... other than the Directors and Officers' Insurance Policy of the Seller which currently applies to the Company and its Subsidiaries, shall, unless otherwise elected by Buyer, remain in full force and effect in accordance with its terms immediately following the Closing. Neither the Company nor any of... -

Page 159

...the time of payment or vesting of, or increase the amount of, or result in the forfeiture of compensation or benefits under any Plan. 5.21 Bank Accounts; Locations . The Bank Account Schedule to be delivered to Buyer at least 5 days prior to Closing will list, as of Closing, all of the Company's and... -

Page 160

... B Shares of the Capital Stock of the Company are held beneficially and of record by the Powell, free and clear of all Encumbrances. At the Closing, Powell shall sell to Buyer good and valid title to all of such 500 Shares, free and clear of all Encumbrances. 5.1.2 Authorization . This Agreement has... -

Page 161

... . under the laws of its State of formation. Mackenzie is a limited partnership duly formed, organized, validly existing and in good standing 5.2.2 Title to Shares . 500 Class B Shares of the Capital Stock of the Company are held beneficially and of record by Mackenzie, free and clear of all... -

Page 162

...into this Agreement and consummate the transactions contemplated hereby, Regis and the Buyer hereby represent and warrant to Seller that as of the date hereof and as of the Closing Date: 6.1.1 Organization and Power . Buyer is a corporation duly organized, validly existing and in good standing under... -

Page 163

... or covenants set forth in this Agreement or the Schedules hereto, which in the case of any material misrepresentation or material breach of warranty or covenant has not been cured or waived in writing within fifteen (15) days after written notification thereof by Seller to Regis and Buyer. For the... -

Page 164

... (Environmental and Safety Requirements) and Section 5.17 (Employee Benefit Plans) shall terminate on the seventh anniversary of the Closing Date; (c) the representations and warranties in Section 5.1 (Corporate Organization), Section 5.2 (Capital Stock and Related Matters; Title to Shares), Section... -

Page 165

...from Seller to an account designated by the applicable Buyer Party, as the case may be, within ten (10) days after the determination thereof Any such indemnification payments shall include interest at the Applicable Rate calculated on the basis of the actual number of days elapsed over 360, from the... -

Page 166

...pay the fees and expenses...applicable... provided ...Company, its Subsidiaries or any of its Affiliates as a partner, manager, trustee, director, officer, employee or agent of another entity (whether such claim is for judgments, damages, penalties, fines, costs, amounts paid in settlement, losses, expenses... -

Page 167

...from the Company or its Subsidiaries in respect of any payments required to be made by Seller pursuant to this Agreement. (g)... (Corporate Organization), Section 5.2 (Capital Stock and Related Matters; Title to Shares), Section...readjustment, assignment for the benefit of creditors, composition, ... -

Page 168

..., employees, customers and suppliers. After the Closing, Buyer may issue any such releases of information without the consent of any other party hereto. 8.5 Expenses. Except as otherwise provided herein, Regis and Buyer shall pay all of their own and all of their Affiliates' fees, costs and expenses... -

Page 169

...which Taxes relate to an event or transaction occurring before the Closing (other than, in each case, commodity or sales taxes in relation to current accounts payable and property, social security, unemployment, disability, payroll or employee or other withholding Taxes, in each case that are not in... -

Page 170

... expense, file all necessary Tax Returns and other documentation with respect to all such Taxes, fees and charges. (f) Tax-Sharing Agreements. All tax-sharing agreements or similar agreements with respect to or involving the Company and its Subsidiaries, if any, shall be terminated as of the Closing... -

Page 171

... Agreement shall be in writing and shall be deemed to have been given (i) when personally delivered or sent by telecopy (with hard copy to follow), (ii) one business day following the day when deposited with a reputable and established overnight express courier (charges prepaid), or (iii) five days... -

Page 172

... or therein. Any capitalized terms used in any Schedule or Exhibit attached hereto and not otherwise defined therein shall have the meanings set forth in this Agreement. Each defined term used in this Agreement shall have a comparable meaning when used in its plural or singular form. The use of... -

Page 173

...among Buyer, Hair Club Group, Inc. and Cameron Capital Corporation regarding hair therapy arrangements (collectively, the " Existing Agreements "). Furthermore, the parties hereto hereby consent to the sale and purchase of the Shares pursuant to the terms and conditions of this Agreement pursuant to... -

Page 174

... Steven K. Hudson Chairman and Secretary /s/ Stephen W. Powell Stephen W. Powell MACKENZIE LIMITED PARTNERSHIP By: Name: Title: /s/ Duncan Robinson Duncan Robinson Executive Vice President CAMERON CAPITAL CORPORATION By: Name: Title: 48 /s/ Steven K. Hudson Steven K. Hudson Chairman and Secretary -

Page 175

... Exhibit 10(z) STOCK PURCHASE AGREEMENT ARTICLE I CERTAIN DEFINITIONS ARTICLE II PURCHASE AND SALE OF THE SHARES ARTICLE III CONDITIONS TO CLOSING ARTICLE IV COVENANTS PRIOR TO CLOSING ARTICLE IV.1 ADDITIONAL COVENANTS ARTICLE V REPRESENTATIONS AND WARRANTIES CONCERNING THE COMPANY, ITS SUBSIDIARIES... -

Page 176

... Exhibit 10(aa) FOURTH AMENDED AND RESTATED CREDIT AGREEMENT Dated as of July 12, 2007 among REGIS CORPORATION, VARIOUS FINANCIAL INSTITUTIONS, JPMORGAN CHASE BANK, N.A. as Administrative Agent, Swing Line Lender and Issuer, BANK OF AMERICA, N.A., as Syndication Agent, and LASALLE BANK NATIONAL... -

Page 177

...10 Interest 2.11 Fees 2.12 Computation of Fees and Interest 2.13 Payments by the Company 2.14 Payments by the Lenders to the Administrative Agent 2.15 Sharing of Payments, Etc 2.16 Subsidiary Guaranty 2.17 Increase in Commitments; Additional Lenders ARTICLE III THE LETTERS OF CREDIT 3.01 The Letter... -

Page 178

i Page 3.07 Cash Collateral Pledge 3.08 Letter of Credit Fees 3.09 UCP; ISP ARTICLE IV TAXES, YIELD PROTECTION AND ILLEGALITY 4.01 Taxes 4.02 Illegality 4.03 Increased Costs and Reduction of Return 4.04 Funding Losses 4.05 Inability to Determine Rates 4.06 Reserves on Offshore Rate Loans 4.07 ... -

Page 179

... Disclosure ARTICLE VII AFFIRMATIVE COVENANTS 7.01 Financial Statements 7.02 Certificates; Other Information 7.03 Notices 7.04 Preservation of Existence, Etc 7.05 Maintenance of Property 7.06 Insurance 7.07 Payment of Obligations 7.08 Compliance with Laws 7.09 Compliance with ERISA 7.10 Inspection... -

Page 180

...Agreements iii 52 52 52 52 Page 8.10 8.11 8.12 8.13 8.14 8.15 8.16 8.17 ERISA Change in Business Accounting Changes Amendments to Charter Leverage Ratio Fixed Charge...Duties 10.05 Resignation by Administrative Agent 10.06 Independent Credit Decision 10.07 Notice of Default 10.08 Indemnification of... -

Page 181

11.02 Notices 11.03 No Waiver; Cumulative Remedies 11.04 Costs and Expenses 11.05 Company Indemnification 11.06 Marshalling; Payments Set Aside 11.07 Successors and Assigns iv 60 60 61 61 61 62 -

Page 182

... of Compliance Certificate Form of Assignment and Acceptance Form of Subsidiary Guaranty v 62 63 64 64 64 65 65 65 65 66 66 66 66 67 67 67 Pricing Schedule Existing Letters of Credit Commitments and Pro Rata Shares Financial Condition Environmental Matters Capitalization; Subsidiaries and Minority... -

Page 183

... loans to, and issue or participate in letters of credit for the account of, the Company on the terms and conditions set forth herein. NOW, THEREFORE, in consideration of the mutual agreements contained herein and for other good and valuable consideration, the receipt of which is hereby acknowledged... -

Page 184

... Lenders. " Agreement "-see the preamble. " Applicable Currency " means, as to any particular payment or Loan, Dollars or the Offshore Currency in which it is denominated or payable. " Applicable Facility Fee Percentage "-see Schedule 1.01(a) . " Applicable Margin "-see Schedule 1.01(a) . " Approved... -

Page 185

... commercial banks in Chicago, Illinois or New York, New York are authorized or required by law to close, and (a) with respect to disbursements and payments in Dollars, a day on which dealings are carried on in the applicable offshore Dollar interbank market and (b) with respect to disbursements and... -

Page 186

...course of business consistent with past practices having combined capital and surplus of not less than $100,000,000 whose short term securities are rated at least A-1 by Standard & Poor's Ratings Group, a division of The McGraw Hill Companies, Inc. (" S&P ") and P-1 by Moody's Investors Service, Inc... -

Page 187

..., or to maintain working capital or equity capital of the primary obligor or otherwise to maintain the net worth or solvency or any balance sheet item, level of income or financial condition of the primary obligor, (iii) to purchase property, securities or services primarily for the purpose... -

Page 188

... gains and losses upon the closing and abandonment of any non-franchised store locations) and interest and the amortization of intangibles of any kind, plus (ii) all taxes paid or accrued and unpaid on or measured by income, plus (iii) non-cash impairment charges arising in connection with any Joint... -

Page 189

... N.A., as administrative agent. " Existing Letters of Credit " means the outstanding letters of credit previously issued under the Existing Credit Agreement and set forth on Schedule 1.01(b) . " Federal Funds Rate " means, for any day, the weighted average (rounded upwards, if necessary, to the next... -

Page 190

... all obligations issued, undertaken or assumed as the deferred purchase price of property or services (other than trade payables entered into in the ordinary course of business on ordinary terms); (c) all reimbursement or payment obligations with respect to Surety Instruments and all L/C Obligations... -

Page 191

... as an Offshore Rate Loan, and ending on the date seven days or one, two, three or six months thereafter as selected by the Company in its Notice of Borrowing; provided that: (a) if any Interest Period would otherwise end on a day that is not a Business Day, that Interest Period shall be extended... -

Page 192

... accordance with its Pro Rata Share. " L/C Amendment Application " means an application form for amendment of outstanding letters of credit as shall at any time be in use by the applicable Issuer, as such Issuer shall request. " L/C Application " means an application form for issuances of letters of... -

Page 193

...and any contingent or other agreement to provide any of the foregoing, but not including the interest of a lessor under an operating lease. " Loan " means an extension of credit by a Lender to the Company under Article II or Article III in the form of a Revolving Loan, Swing Line Loan or L/C Advance... -

Page 194

... those currently provided on such page of such service, as determined by the Administrative Agent from time to time for purposes of providing quotations of interest rates applicable to dollar deposits in the London interbank market) at approximately 11:00 a.m. (London time), two Business Days prior... -

Page 195

... office of the Administrative Agent in immediately available funds in the London interbank market at approximately 11:00 a.m. (London time) two Business Days prior to the commencement of such Interest Period (or, in the case of an Offshore Rate Loan denominated in pounds sterling, on the first day... -

Page 196

...'s Affiliates. " Rental Expense " means, for any period, the sum of (a) all store rental payments, (b) all common area maintenance payments and (c) all real estate taxes paid by the Company and its Subsidiaries, in each case, with respect to non-franchised store locations. " Reportable Event " means... -

Page 197

...spot rate for the purchase by JPMorgan of such currency with another currency through its FX Trading Office at approximately 11:00 a.m. (London time) on the date two Business Days prior to the date as of which the foreign exchange computation is made. " Subsidiary " of a Person means any corporation... -

Page 198

... Code for the applicable plan year. " United States " and " U.S. " each means the United States of America. " Wholly-Owned " means any corporation, association, partnership, limited liability company, joint venture or other business entity in which (other than directors' qualifying shares or other... -

Page 199

...Rate. ARTICLE II THE CREDITS 2.01 Amounts and Terms of Commitments. Each Lender severally agrees, on the terms and conditions set forth herein, to make loans to the Company denominated in Dollars or in an Offshore Currency (each such loan, a " Revolving Loan ") from time to time on any Business Day... -

Page 200

...Date, which shall be a Business Day; (C) the Type of Loans comprising such Borrowing and in the case of an Offshore Rate Loan, the Applicable Currency; (D) with respect to Offshore Rate Loans, the duration of the Interest Period applicable to such Loans included in such notice; provided that if such... -

Page 201

... Loans, the duration of the requested Interest Period. (c) If upon the expiration of any Interest Period applicable to Offshore Rate Loans denominated in Dollars, the Company has failed to timely select a new Interest Period to be applicable to such Offshore Rate Loans, or if any Default or Event... -

Page 202

...thereafter bear interest at the Base Rate. (b) The Company may borrow under the Swing Line Commitment on any Business Day until the Termination Date; provided that the Company shall give the Swing Line Lender irrevocable written notice signed by a Responsible Officer or an authorized designee (which... -

Page 203

... be made available by the Swing Line Lender to the Company in immediately available funds at the office of the Swing Line Lender by 4:00 p.m. on the requested date of borrowing. The Company may, at any time and from time to time on any Business Day, prepay the Swing Line Loans, in whole or in part... -

Page 204

..., in the case of interest payments, to reflect the period of time during which such Lender's participating interest was outstanding and funded) and in the Applicable Currency; provided that in the event that such payment received by the Swing Line Lender is required to be returned, such Lender... -

Page 205

... to such request within two Business Days of receipt thereof and any failure to respond in such time period shall be deemed to be a rejection thereof. Each Lender may grant or accept such request in its sole discretion. The Administrative Agent will promptly notify the Company of the acceptance or... -

Page 206

... any action on the part of the Swing Line Lender. 2.08 Prepayments. (a) Subject to Section 4.04 , the Company may, at any time or from time to time, upon not less than four Business Days' irrevocable notice to the Administrative Agent in the case of Offshore Rate Loans, and not later than 12:00 noon... -

Page 207

... Company shall pay to the Administrative Agent for the account of each Lender a facility fee on the average daily amount of such Lender's Commitment (regardless of usage), computed on a quarterly basis in arrears on the last Business Day of each calendar quarter, equal to the Applicable Facility Fee... -

Page 208

... Agent later than 11:00 a.m. or later than the time specified by the Administrative Agent as provided in clause (i) above (in the case of Offshore Currency payments), shall be deemed to have been received on the following Business Day and any applicable interest or fee shall continue to accrue. 26 -

Page 209

...Company such amount, that Lender shall on the Business Day following such Borrowing Date make such amount available to the Administrative Agent, together with interest at the Federal Funds Rate, or, in the case of a payment in an Offshore Currency, the Overnight Rate, for each day during such period... -

Page 210

... the receipt by the Administrative Agent of an agreement in form and substance satisfactory to the Administrative Agent signed by the Company, by each Additional Lender and by each other Lender whose Commitment is to be increased, setting forth the new Commitments of such Lenders and setting forth... -

Page 211

... Rate Loans resulting from any Lender's funding of Loans previously funded by other Lenders. ARTICLE III THE LETTERS OF CREDIT 3.01 The Letter of Credit Subfacility. (a) On the terms and conditions set forth herein (i) each Issuer agrees, (A) from time to time on any Business Day, during the period... -

Page 212

... L/C Amendment Application from the Company and, if not, such Issuer will provide the Administrative Agent with a copy thereof. Unless the applicable Issuer has received notice on or before the Business Day immediately preceding the date such Issuer is to issue a requested Letter of Credit from the... -

Page 213

... a day in each such 12-month period to be agreed upon at the time such Letter of Credit is issued. Each such request for renewal of a Letter of Credit shall be made by facsimile, confirmed immediately in an original writing, in the form of an L/C Amendment Application, and shall specify in form and... -

Page 214

... consisting of Base Rate Loans to the Company in whole or in part, because of the Company's failure to satisfy the conditions set forth in Section 5.02 or for any other reason, the Company shall be deemed to have incurred from the applicable Issuer an L/C Borrowing in the Dollar Equivalent of the... -

Page 215

... Rate in effect from time to time. 3.05 Role of the Issuers. (a) Each Lender and the Company agree that, in paying any drawing under a Letter of Credit, the applicable Issuer shall not have any responsibility to obtain any document (other than any documents expressly required by the Letter of Credit... -

Page 216

... the Lenders a letter of credit fee with respect to the Letters of Credit equal to the Applicable Margin times the average daily maximum amount available to be drawn of the outstanding Letters of Credit, computed on a quarterly basis in arrears on the last Business Day of each calendar quarter based... -

Page 217

...date). (c) The Company shall pay to the applicable Issuer, for its sole account, from time to time on demand the normal issuance, presentation, amendment and other processing fees, and other standard costs and charges, of such Issuer relating to letters of credit as from time to time in effect. 3.09... -

Page 218

... the jurisdiction in which the Company is located, or any treaty to which such jurisdiction is a party, with respect to payments under this Agreement shall deliver to the Company (with a copy to the Administrative Agent), at the time or times prescribed by applicable law, such properly completed and... -

Page 219

...or such corporation's policies with respect to capital adequacy and such Lender's desired return on capital) determines that the amount of such capital is increased as a consequence of its Commitment, loans, credits or obligations under this Agreement, then, upon demand of such Lender to the Company... -

Page 220

... with Section 11.08 ; provided that the processing fee referenced in Section 11.08(a) shall not be required to be paid. 4.09 Survival. The agreements and obligations of the Company in this Article IV shall survive the payment of all other Obligations, and the Company will have no obligation to... -

Page 221

... the closing proceedings (provided that such estimate shall not thereafter preclude final settling of accounts between the Company and JPMorgan); including any such costs, fees and expenses arising under or referenced in Sections 2.11 and 11.04; (f) Certificate. A certificate signed by a Responsible... -

Page 222

...to which it is a party; (c) is duly qualified as a foreign corporation and is licensed and in good standing under the laws of each jurisdiction where its ownership, lease or operation of property or the conduct of its business requires such qualification or license; and (d) is in compliance with all... -

Page 223

... which would cause the loss of such qualification. The Company and each ERISA Affiliate has made all required contributions to any Plan subject to Section 412 of the Code, and no application for a funding waiver or an extension of any amortization period pursuant to Section 412 of the Code has been... -

Page 224

... business of purchasing or selling Margin Stock or extending credit for the purpose of purchasing or carrying Margin Stock. 6.09 Title to Properties. The Company and each Subsidiary have good record and marketable title in fee simple to, or valid leasehold interests in, all real property necessary... -

Page 225

... than those specifically disclosed in part (a) of Schedule 6.17 and has no equity investments in any other corporation or entity other than those specifically disclosed in part (b) of Schedule 6.17. 6.18 Insurance. The properties of the Company and its Subsidiaries are insured with financially sound... -

Page 226

...period commencing on the first day and ending on the last day of such fiscal quarter, and certified by a Responsible Officer as fairly presenting, in accordance with GAAP (subject to ordinary, good faith year-end audit adjustments), the financial position and the results of operations of the Company... -

Page 227

... all financial statements and regular, periodic or special reports (including Forms 10K, 10Q and 8K) that the Company or any Subsidiary may make to, or file with, the SEC; and (d) promptly, such additional information regarding the business, financial or corporate or other organizational affairs of... -

Page 228

...have a Material Adverse Effect. 7.05 Maintenance of Property. The Company shall maintain and preserve, and shall cause each Subsidiary to maintain and preserve, all its property which is used or useful in its business in good working order and condition, ordinary wear and tear excepted, and make all... -

Page 229

... accounts with their respective directors, officers, and independent public accountants, all at the expense of the Company and at such reasonable times during normal business hours and as often as may be reasonably desired, upon reasonable advance notice to the Company; provided that when an Event... -

Page 230

... Acquisitions and to pay certain fees and expenses related thereto, (b) for working capital, capital expenditures, stock repurchases and dividends and other general corporate purposes not in contravention of any Requirement of Law or of any Loan Document; provided that any stock of the Borrower... -

Page 231

... the value of the property subject thereto or interfere with the ordinary conduct of the businesses of the Company and its Subsidiaries; (h) Liens securing obligations in respect of Capital Leases on assets subject to such leases, provided that such Capital Leases are otherwise permitted hereunder... -

Page 232

... dispositions made by any Subsidiary to the Company; (d) dispositions made in connection with Investments permitted under Section 8.04 ; and (e) dispositions not otherwise permitted hereunder which are made for fair market value; provided that (i) at the time of any disposition, no Default or Event... -

Page 233

... Effective Date and set forth in Schedule 8.04 hereto; and (g) Investments in the form of repurchase of the Company's or any Subsidiary's capital stock or Indebtedness approved by the Company's board of directors (or the Subsidiary's equivalent managers or directors) that would not otherwise result... -

Page 234

..., so long as such Indebtedness is repaid concurrently with the making of the initial Credit Extensions hereunder; and (g) other Indebtedness incurred by the Company or any Subsidiary from time to time; provided that after giving effect to such Indebtedness, (i) Section 8.14 would not be violated... -

Page 235

... Company shall promptly execute and deliver at its expense (including Attorney Costs) an amendment to this Agreement in form and substance satisfactory to the Required Lenders evidencing the amendment of this Agreement to include such Additional Financial Covenants and Additional Defaults; provided... -

Page 236

... fails to perform or observe any other term or covenant contained in this Agreement or any other Loan Document, and such default shall continue unremedied for a period of 30 days after the earlier of (i) the date upon which any senior officer of the Company knew or reasonably should have known of... -

Page 237

... may be liable); or (iii) the Company or any ERISA Affiliate shall fail to pay when due, after the expiration of any applicable grace period, any installment payment with respect to its withdrawal liability under Section 4201 of ERISA under a Multiemployer Plan in an aggregate amount in excess of... -

Page 238

... in favor of the Company or such Subsidiary) and acknowledge that the Administrative Agent shall not be under any obligation to provide such information to them. With respect to its Loans and Letters of Credit, JPMorgan shall have the same rights and powers under this Agreement as any other Lender... -

Page 239

... made in or in connection with this Agreement, (ii) the contents of any certificate, report or other document delivered hereunder or in connection herewith, (iii) the performance or observance of any of the covenants, agreements or other terms or conditions set forth herein, (iv) the validity... -

Page 240

... in the payment of principal, interest and fees required to be paid to the Administrative Agent (or the Administrative Agent for the account of the Lenders), unless the Administrative Agent shall have received written notice from a Lender or the Company referring to this Agreement, describing such... -

Page 241

...written consent of each Lender directly affected thereby; provided that only the consent of the Required Lenders shall be necessary to amend the definition of "Default Rate" or to waive any obligation of the Company to pay interest at the Default Rate; (e) change any provision of this Section or the... -

Page 242