Shutterfly 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

therefore taxable under federal and/or state laws. You are encouraged to seek advice from a personal tax advisor to determine the impact of

relocation income and new location taxes. If you voluntarily terminate your employment in the first year of employment you will be

responsible for reimbursing the Company a prorated portion of the relocation expenses.

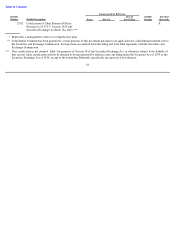

Temporary Housing Allowance

You will be reimbursed up to $4,000 per month for temporary housing in North Carolina for your first six (6) months of employment or until

you move into a new residence whichever is earlier. In order to be reimbursed for these costs, you must submit expenses no later than 30 days

after the expense. Due to the individual nature of this benefit, the housing allowance may be considered income and taxable under federal

and/or state laws. You are encouraged to seek advice from a personal tax advisor to determine the impact of relocation income and new

location taxes.

Benefits

As an employee, you will also be eligible to receive certain employee benefits including medical and dental coverage. The medical, dental and

vision coverage begin on your date of hire as an employee. Additionally, you are eligible to participate in the Fidelity 401k plan. The Company

reserves the right to revise or discontinue any or all of its benefit plans, at any time, in the Company’s sole discretion. Enclosed is some

information on the Company benefit plans.

Holidays

Shutterfly will observe twelve paid holidays in 2007. The holiday schedule may change at management’s discretion.

Change in Control Benefits

If the Company is subject to a Corporate Transaction (as defined in the Plan) whereas within the first six (6) months following such transaction

(1) you will no longer be SVP of Manufacturing, or (2) your role is materially diminished, then you shall be eligible to receive the following

enhanced severance benefits (“Change of Control Benefits”): (i) severance payments equal to six (6) months of your then-applicable base

salary, payable in accordance with the Company’

s standard payroll procedures; and (ii) the unvested portion of any outstanding options held by

you on the date of such Corporate Transaction shall vest for an additional one year period, and shall remain exercisable for the periods

specified in the relevant option agreements. Your eligibility for the foregoing Change of Control Benefits is conditioned on you having first

signed a release of claims in a form provided by the Company and returning all Company property. If the Company is subject to a Corporate

Transaction Change and you continue to report to the President, the severance and accelerated vesting will not be offered.

Paid Time Off

In order to allow you flexibility with your free time, the Company has a paid time off policy. You begin to accrue paid time off on your date of

hire. You will accrue fifteen (15) days of paid time off per year for your first three (3) years of employment, subject to the paid time off policy.