Shutterfly 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

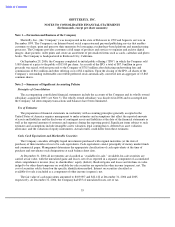

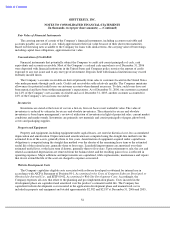

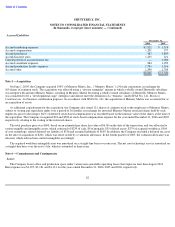

threshold at the effective date to be recognized upon the adoption of FIN 48 and in subsequent periods. FIN 48 will be effective for fiscal years

beginning after December 15, 2006, and the provisions of FIN 48 will be applied to all tax positions accounted for under Statement No. 109

upon initial adoption. The cumulative effect of applying the provisions of this interpretation will be reported as an adjustment to the opening

balance of retained earnings for that fiscal year. The Company does not believe the adoption of FIN 48 will have a material impact on its

financial position and results of operations.

In September 2006, the Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin (“SAB”) No. 108, “Considering

the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements.” SAB 108 provides guidance

on the consideration of effects of the prior year misstatements in quantifying current year misstatements for the purpose of a materiality

assessment. The SEC staff believes registrants must quantify errors using both a balance sheet and income statement approach and evaluate

whether either approach results in quantifying a misstatement that, when all relevant quantitative and qualitative factors are considered, is

material. SAB 108 is effective for the first annual period ending after November 15, 2006 with early application encouraged. SAB 108 did not

have a material impact on the Company’s financial position, results of operations and cash flows.

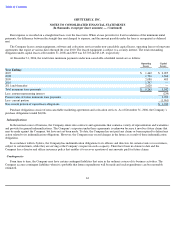

In September 2006, the FASB issued FAS No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 defines fair value, establishes a

framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 is effective for the Company as of

January 1, 2008. The Company is currently evaluating the impact, if any, of FAS 157 on its consolidated financial statements.

In February 2007, the FASB issued FAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (“FAS 159”)

which permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be

measured at fair value. SFAS 159 will be effective for the Company on January 1, 2008. The Company is currently evaluating the impact, if

any, of adopting SFAS 159 on its financial position and results of operations.

On June 29, 2005, the FASB issued Staff Position 150-5, Issuer’s Accounting under FASB Statement No. 150 (“SFAS 150”) for

Freestanding Warrants and Other Similar Instruments on Shares That Are Redeemable

(“FSP 150-5”). Under FSP 150-5, the freestanding

warrants that were related to the Company’s redeemable convertible preferred stock were classified as liabilities and were recorded at fair

value. The Company previously accounted for freestanding warrants for the purchase of redeemable convertible preferred stock under EITF

Issue No. 96-18, Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in Conjunction with Selling,

Goods or Services (“EITF 96-18”).

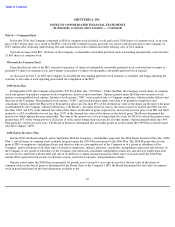

The Company adopted FSP 150-5 and accounted for the cumulative effect of the change in accounting principle as of July 1, 2005. For the

year ended December 31, 2005, the impact of the change in accounting principle was to increase net income by $442, or $0.14 per share. There

was $464 of additional expense recorded in other income (expense), net to reflect the increase in fair value between July 1, 2005 and

December 31, 2005. In the year ended December 31, 2006, the Company recorded $153 of additional income reflected as other income

(expense), net to reflect the decrease in fair value of the warrants.

The pro forma effect of the adoption SFAS No. 150 on the Company’s results of operations for 2006, 2005 and 2004, if applied

retroactively, assuming SFAS No. 150 had been adopted in those years, has not been disclosed, as these amounts would not be materially

different from the reported amounts.

60

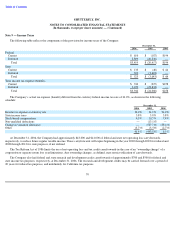

Note 3

—

Change in Accounting Policy