Shutterfly 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

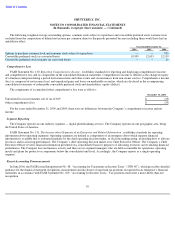

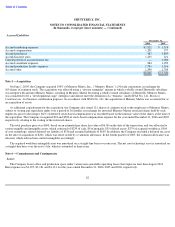

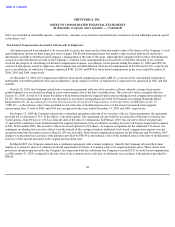

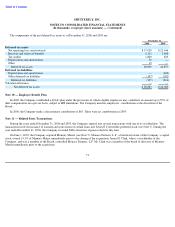

Property and Equipment

Property and equipment includes $6,502 and $7,050 of equipment and software under capital leases at December 31, 2006 and 2005,

respectively. Accumulated depreciation of assets under capital leases totaled $3,820 and $2,703 at December 31, 2006 and 2005, respectively.

Depreciation and amortization expense for the years ended December 31, 2006, 2005 and 2004 was $10,525, $6,246 and $3,769,

respectively.

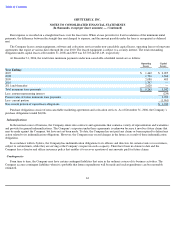

Intangible Assets

Amortization expense of intangibles for the years ended December 31, 2006, 2005 and 2004 was $222, $276 and $379, respectively.

Amortization of existing intangibles is estimated to be approximately $128 per year through 2017.

61

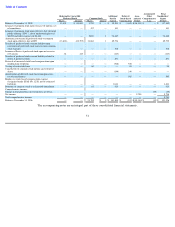

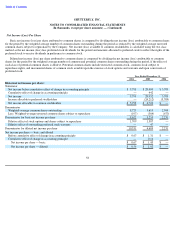

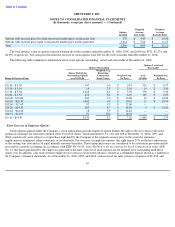

Note 4

—

Balance Sheet Components

December 31,

2006

2005

Computer and other equipment

$

41,880

$

25,658

Software

8,791

7,524

Leasehold improvements

4,903

3,189

Furniture and fixtures

1,348

990

56,922

37,361

Less: Accumulated depreciation and amortization

(26,003

)

(16,600

)

Net property and equipment

$

30,919

$

20,761

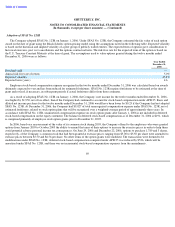

Accumulated

Gross

Amortization

Net

As of December 31, 2005

Purchased technology

$

2,030

$

(505

)

$

1,525

Acquired workforce

279

(186

)

93

$

2,309

$

(691

)

$

1,618

As of December 31, 2006

Purchased technology

$

2,030

$

(634

)

$

1,396

Acquired workforce

279

(279

)

—

$

2,309

$

(913

)

$

1,396