Shutterfly 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

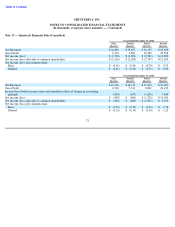

SHUTTERFLY, INC.

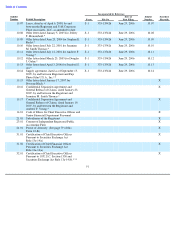

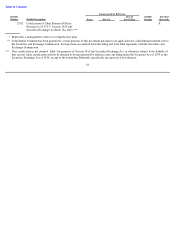

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

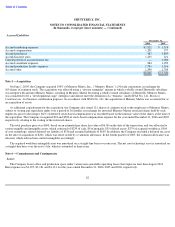

$123, was included in refundable deposits, respectively. Amounts so recorded are transferred into common stock and additional paid-in capital

as the shares vest.

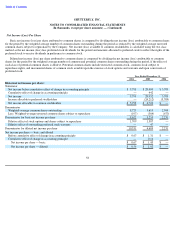

Stock-based Compensation Associated with Awards to Employees

All options granted were intended to be exercisable at a price per share not less than fair market value of the shares of the Company’

s stock

underlying those options on their respective dates of grant. The Board determined these fair market values in good faith based on the best

information available to the Board and Company’s management at the time of the grant. Although the Company believes these determinations

accurately reflect the historical value of the Company’s common stock, management has retroactively revised the valuation of its common

stock for the purpose of calculating stock-based compensation expense. Accordingly, in the periods ending December 31, 2004 and 2005 for

such stock and options issued to employees, the Company has recorded deferred stock-based compensation of $2,299 and $1,225, respectively,

net of cancellations, of which the Company amortized $565, $1,547 and $858 of stock-based compensation in the years ended December 31,

2006, 2005 and 2004, respectively.

At December 31, 2006, the Company had deferred stock-based compensation under APB 25, as shown in the consolidated statement of

redeemable convertible preferred stock and stockholders’ equity (deficit) of $191, of which $165 is expected to be amortized in 2007 and $26

in 2008.

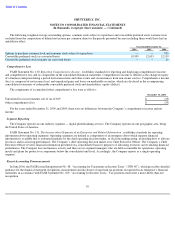

On July 28, 2004, the Company entered into a transition agreement with one of its executive officers whereby vesting of previously

granted options was accelerated resulting in a new measurement date at the date of modification. This executive officer resigned effective

January 31, 2005. A total of 316 shares would have been forfeited under the original option terms resulting in total compensation expense of

$1,145. The total compensation expense was measured in accordance with guidance provided by Financial Accounting Standards Board

Interpretation No. 44, Accounting for Certain Transactions Involving Stock Compensation, an Interpretation of APB Opinion No. 25

(“FIN 44”), as the intrinsic value of the modified award at the date of modification in excess of the amount measured at the original

measurement date. A total of $981 and $164 was recognized in the years ended December 31, 2004 and 2005, respectively.

On August 13, 2004 the Company entered into a transition agreement with one of its executive officers. Upon termination, the agreement

provided for acceleration of 25% of the officer’s unvested options. The agreement also provided for an extension of the time to exercise any

vested options, from 90 days to 270 days from the date of the officer’s termination. In February 2005, this executive officer resigned and

17 shares that would have been forfeited under the original option terms were accelerated, resulting in total stock-based compensation expense

of $65. In November 2005, this executive officer exercised options for 293 shares. As expense recognition for the additional 276 shares was

contingent on whether this executive officer took the benefit of the vesting extension, additional stock-based compensation expense was not

recognized until the November exercise when $1,035 was recorded. Stock-based compensation expense for the February and November 2005

charges was measured in accordance with guidance provided by FIN 44 as the intrinsic value of the modified award at the date of modification

in excess of the amount measured at the original measurement date.

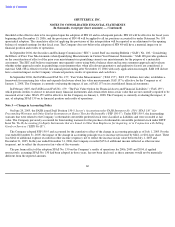

In March 2005, the Company entered into a settlement agreement with a former employee, whereby the Company allowed the former

employee to retain 65 shares of common stock and repurchased 29 shares of common stock at its original purchase price. These shares were

previously deemed repurchased by the Company. In connection with this settlement, the Company recorded $352 as stock-based compensation

as of December 31, 2004, computed at the fair value of the common stock at the date of settlement, in accordance with guidance provided by

FIN 44.

68