Shutterfly 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

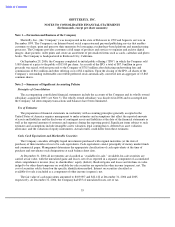

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

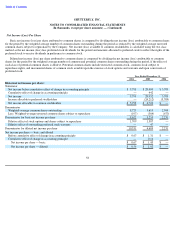

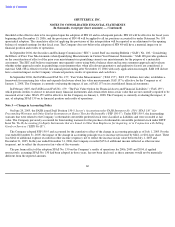

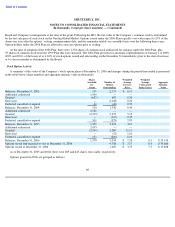

Net Income (Loss) Per Share

Basic net income (loss) per share attributed to common shares is computed by dividing the net income (loss) attributable to common shares

for the period by the weighted average number of common shares outstanding during the period as reduced by the weighted average unvested

common shares subject to repurchase by the Company. Net income (loss) available to common stockholders is calculated using the two class

method as the net income (loss) less preferred stock dividends for the period and amounts allocated to preferred stock to reflect the rights of the

preferred stock to receive dividends in preference to common stock.

Diluted net income (loss) per share attributed to common shares is computed by dividing the net income (loss) attributable to common

shares for the period by the weighted average number of common and potential common shares outstanding during the period, if the effect of

each class of potential common shares is dilutive. Potential common shares include restricted common stock, common stock subject to

repurchase rights, and incremental shares of common stock issuable upon the exercise of stock options and warrants and upon conversion of

preferred stock.

58

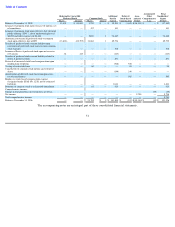

Year Ended December 31,

2006

2005

2004

Historical net income per share:

Numerator

Net income before cumulative effect of change in accounting principle

$

5,798

$

28,490

$

3,709

Cumulative effect of change in accounting principle

—

442

—

Net income

5,798

28,932

3,709

Income allocable to preferred stockholders

—

(

24,212

)

(3,709

)

Net income allocable to common stockholders

$

5,798

$

4,720

$

—

Denominator

Weighted

-

average common shares outstanding

8,729

3,619

2,904

Less: Weighted

-

average unvested common shares subject to repurchase

(107

)

(364

)

(673

)

Denominator for basic net income per share

8,622

3,255

2,231

Dilutive effect of stock options and shares subject to repurchase

1,709

1,307

—

Dilutive effect of outstanding preferred stock warrants

—

47

—

Denominator for diluted net income per share

10,331

4,609

2,231

Net income per share

—

basic and diluted

Before cumulative effect of change in accounting principle

$

0.67

$

1.31

$

—

Cumulative effect of change in accounting principle

—

0.14

—

Net income per share

—

basic

$

0.67

$

1.45

$

—

Net income per share

—

diluted

$

0.56

$

1.02

$

—