Shutterfly 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

32

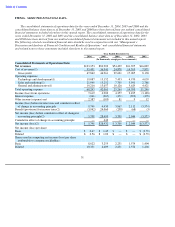

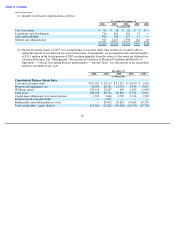

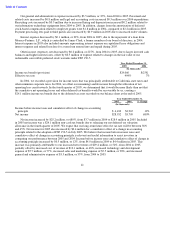

(1)

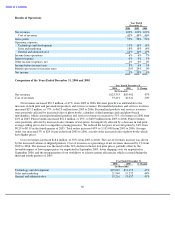

Includes stock

-

based compensation as follows:

Year Ended December 31,

2006

2005

2004

2003

2002

(In thousands)

Cost of revenues

$

96

$

28

$

21

$

3

$

—

Technology and development

736

826

263

32

—

Sales and marketing

521

239

117

11

—

General and administration

947

2,217

1,790

124

20

$

2,300

$

3,310

$

2,191

$

170

$

20

(2)

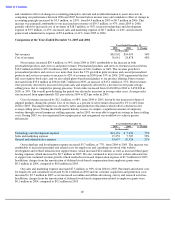

During the fourth quarter of 2005, we concluded that it was more likely than not that we would be able to

realize the benefit of our deferred tax assets in the future. Consequently, we recognized a non-cash tax benefit

of $24.1 million in the fourth quarter of 2005 resulting primarily from the release of the entire net deferred tax

valuation allowance. See “Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Critical Accounting Policies and Estimates — Income Taxes” for a discussion of the uncertainty

related to our deferred tax asset.

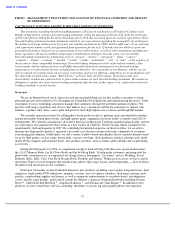

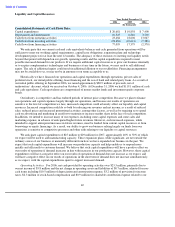

December 31,

2006

2005

2004

2003

2002

(In thousands)

Consolidated Balance Sheets Data:

Cash and cash equivalents

$

119,051

$

39,153

$

13,781

$

10,670

$

3,658

Property and equipment, net

30,919

20,761

11,723

5,140

3,617

Working capital

102,165

22,687

690

2,002

(1,050

)

Total assets

180,160

89,552

29,865

17,754

8,831

Capital lease obligations, less current portion

1,742

3,646

2,709

1,314

1,292

Preferred stock warrant liability

—

1,535

—

—

—

Redeemable convertible preferred stock

—

89,652

69,822

69,668

69,230

Total stockholders

’

equity (deficit)

151,326

(27,262

)

(59,568

)

(65,333

)

(67,752

)