Shutterfly 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Not applicable.

Evaluation of Disclosure Controls and Procedures

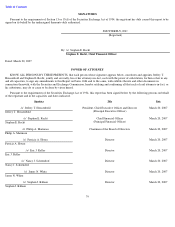

Our management, with the participation of our chief executive officer and chief financial officer, evaluated the

effectiveness of our disclosure controls and procedures as of the end of the period covered by this Annual Report on

Form 10-K. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the

Exchange Act, means controls and other procedures of a company that are designed to ensure that information

required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded,

processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure

controls and procedures include, without limitation, controls and procedures designed to ensure that information

required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated

and communicated to the Company’s management, including its principal executive and principal financial officers,

as appropriate to allow timely decisions regarding required disclosure. Based on the evaluation of our disclosure

controls and procedures as of December 31, 2006, our chief executive officer and chief financial officer concluded

that, as of such date, the Company’s disclosure controls and procedures were effective.

Remediation of Prior Material Weaknesses

As previously reported in our Registration Statement on Form S-1 (File No. 333-135426), as amended (the

“S-1”), in connection with the audit of our 2005 consolidated financial statements for the year ended and as of

December 31, 2005 and the review of our 2006 quarterly financial statements for the quarter ended June 30, 2006,

our independent registered public accounting firm identified three control deficiencies that represent material

weaknesses in our internal control over financial reporting.

The material weaknesses in our internal control over financial reporting were as follows:

We have implemented and will continue to implement changes to our processes to improve our internal control

over financial reporting. The following steps have been taken to remediate the conditions leading to the above stated

material weaknesses: (1) hiring a corporate controller, senior tax manager and additional experienced financial

personnel, (2) developing and implementing formal policies and procedures to manage and track the monthly

accounting close process, (3) modifying our website system controls to remove the capability of our customer

73

ITEM 9.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE.

ITEM 9A.

CONTROLS AND PROCEDURES.

• We did not maintain effective controls to ensure adequate analysis, documentation, reconciliation and review

of accounting records and supporting data. Specifically, we did not maintain effective controls to ensure that

accruals and accounts payable were completely and accurately recorded in the proper period. We believe this

occurred primarily because of insufficient management oversight and because several positions in our

accounting and finance organization were unfilled or were staffed by temporary personnel unfamiliar with our

policies and procedures. In addition, some personnel performing these functions did not have an appropriate

level of accounting knowledge, experience and training.

•

We did not maintain effective controls over the completeness and accuracy of revenue and deferred revenue to

prevent our personnel from reinstating expired prepaid print plans. Under our prepaid print plans, we offer

customers the opportunity to purchase in advance larger quantities of prints at a discounted price from our

current list price for prints. Our lack of controls resulted in the overstatement of revenue and understatement

of deferred revenue.

• We did not maintain effective controls over the accounting for income taxes, including the completeness and

accuracy of our deferred income tax assets and liabilities and the related provision for income taxes.

Specifically, we did not maintain effective controls to properly estimate and reconcile the change in our

deferred tax assets and liabilities in the calculation of our income tax provision or properly calculate the

applicable tax rate to be applied to income on an interim basis.